Sainsbury‘s (LSE:SBRY) shares have been on a roller coaster over the last year. They’re up 11% after rising strongly since mid-April, but their performance still lags that of Tesco since mid-2024.

Shares of the FTSE 100 rival have risen 33% in value over the period.

However, after a solid trading update on Monday (2 July) — in which Sainsbury’s said sales continue to outperform the broader market — could we be about to see a turning point for the UK’s second-largest supermarket and its share price?

Price forecasts

Analysts with ratings on Sainsbury’s broadly expect the retailer’s share price to continue increasing at a fair clip. However, they’re not expecting it to rise at the sort of pace Tesco’s has been over the last year.

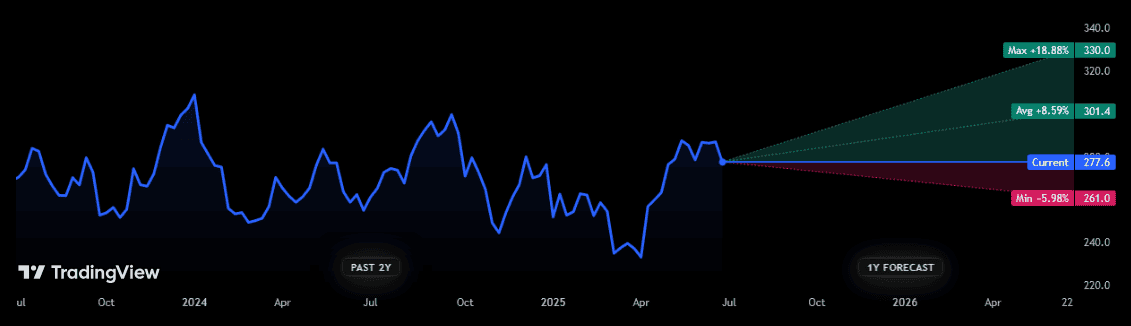

Sainsbury’s share price forecast

There are currently 11 brokers with ratings on Sainsbury’s today. And the consensus among them is for the Footsie stock to rise almost 9% from current levels of 277.6p.

As with most shares, there is a variety of opinions within this cluster. In this case, one especially bullish forecaster thinks the retailer will jump 19% from current levels. But on the other side of the fence, a bearish analyst reckons it will drop around 6%.

Dividend forecasts

In terms of dividends, analysts are (on the whole) similarly optimistic that things here will progress over the next 12 months and beyond.

They predict:

- An ordinary dividend of 14.1p per share in the 12 months to March 2026. That’s up 4% year on year.

- A full-year dividend of 15.1p in financial 2027, up 7%.

This is on top of the retailer’s plans to pay £250m out in special dividends later this year, following the sale of Sainsbury’s Bank last summer.

As with share price forecasts, dividend estimates are never set in stone. But I think there’s a good chance that the Sainsbury’s payout will be able to hit the City’s projections.

On the downside, dividend cover is just 1.5 times for the next two fiscal years. As an investor, I look for predicted dividends to be covered at least 2 times by anticipated earnings.

Yet the grocer’s strong financial foundations could give it room to pay those expected dividends, even if profits are blown off course. Its net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortisation) ratio was 2.5 times as of March.

That’s at the bottom of a target range of 2.4 to 3 times.

Time to buy Sainsbury’s?

Give recent trading momentum, I wouldn’t be surprised to see Sainsbury’s hit current share price and dividend estimates.

Like-for-like sales rose 4.9% in the 16 weeks to 21 June, it said yesterday. This meant its markets share was at the highest in a decade, with sales boosted by value initiatives like its ‘Aldi Price Match’ programme that covers 800 products.

While these numbers are solid, they’re not enough to convince me to invest. Sure, sales are impressive today, but profits figures weren’t released to allow investors to consider the impact of this heavy discounting on profits.

There’s a danger, too, that the retailer will have to continue slashing prices to keep growing sales at the expense of margins. The much-anticipated supermarket price war hasn’t broken out just yet but it’s likely only a matter of time.

And the pressure to cut price labels could be here to stay, too, as tough economic conditions hit consumer spending and discount chains expand. I’d rather find less risky UK shares to buy.