During the pandemic, the Ocado Group (LSE:OCDO) share price peaked at nearly £30. With many people housebound, the online retailer benefitted from an increase in internet shopping and additional demand for home deliveries. On Friday (27 June), I could buy one of the group’s shares for £2.28.

However despite this, the group appears to retain the support of its largest shareholders. It’s believed that over 60% of its stock is owned by city institutions, some of which have held positions since the group’s IPO in 2010.

Unfortunate timing?

But having looked at Ocado’s recent stock exchange announcements, I’m reminded of a famous Volkswagen TV commercial from 1985.

The car giant ran an advertising campaign featuring a forlorn-looking man leaving a casino in the early hours of the morning. Unfortunately for him, he’d just put “a million on black” when the roulette wheel came up red. And to make matters worse, he had earlier “moved into gold just as the clever money moved out”. The underlying message was that despite this unlucky individual’s woes, he was able to rely on his nice car.

And in some respects, this has happened to Ocado. With effect from April, the group’s relinquished control of its joint venture with Marks & Spencer, just as it’s starting to do better. Although it retains a 50% shareholding, the decision demonstrates that it doesn’t see selling groceries as its core business.

But unlike the man from the Volkswagen advert, it’s not yet in a position to rely on the other parts of its business.

Looking good

According to Kantar, during the 12 weeks to 15 June, Ocado Retail was the fastest-growing grocer in Great Britain. With a 12.2% increase in sales, it now has a 1.9% market share.

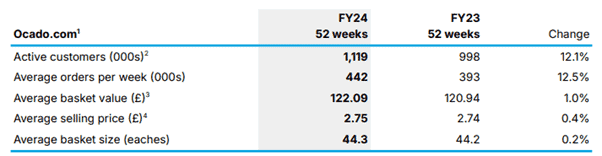

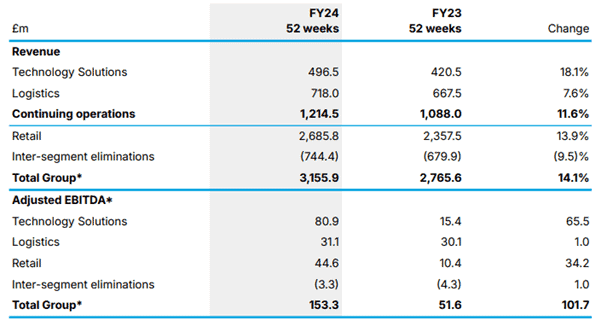

And during the 52 weeks ended 1 December 2024 (FY24), it improved each of its key performance indicators compared to FY23.

Looking ahead, 10% revenue growth is expected in FY25. And analysts are expecting a doubling of adjusted EBITDA (earnings before interest, tax, depreciation and amortisation).

Clever solutions

But the group believes its future lies in licensing its technology to others. It now has 13 global partnerships and its most recent trading update said it’s likely to open another seven customer fulfilment centres (warehouses) over the next three years.

And if it can grow, its share price should respond positively. Investors tend to be more patient with tech stocks and, generally speaking, they attract a higher earnings multiple than, for example, grocery retailers.

My view

But I still don’t want to invest. The group remains loss-making at a post-tax level. Its FY24 adjusted loss before tax was £374m.

And it continues to burn cash. From 2020-2024, it’s seen an underlying operating cash outflow of over £2.5bn. The group expects to be cash flow positive during FY26 but it doesn’t disclose when its bottom line will move into the black.

And while I acknowledge that the group has some impressive technology, it’s likely to be several years (at the earliest) before its Solutions and Logistics divisions become profitable.

To be honest, because of these issues, I don’t think Ocado shares can be relied upon to do better over the next five years than they have done over the past five. In short, they’re not for me.