It’s impossible to know which growth stocks are going to massively outperform the UK market. That said, there are some I certainly wish I’d bought for my Stocks and Shares ISA three years ago.

Here are two of them.

SpaceX-fuelled growth

Filtronic (LSE: FTC) has been on fire in 2025 – it’s up 105%. Over three years, it’s rocketed by 1,367%!

Speaking of rockets, Filtronic signed a strategic partnership with SpaceX in 2024 to supply radio-frequency modules for the US firm’s satellite internet constellation (Starlink).

This relationship has gone from strength to strength, and earlier this month Filtronic received a follow-on order from SpaceX worth $32.5m (£24m). This was the largest deal in value so far, and it’s expected to be fulfilled in FY26 (which has just started).

Consequently, management is confident it “will exceed current revenue expectations” for this fiscal year. That previous expectation was for roughly £52m, up from £16.3m in FY2023.

Meanwhile, Filtronic says it’s continuing to invest in its technology roadmap to capitalise on “the sizeable market opportunity”.

This opportunity does look large. With SpaceX continuing to deploy more satellites, additional ground infrastructure will be needed, thereby presumably driving further demand for the Filtronic’s modules.

Additionally, there should be growth opportunities in the defence market, to which Filtronic supplies components for military communication and radar systems. Customers include BAE Systems.

What could go wrong? Well, the importance of the SpaceX partnership can’t be overstated. It already made up the bulk of the firm’s sales prior to this latest order. In other words, there’s now significant customer concentration risk.

The stock also looks pricey. According to the latest forecasts, the forward price-to-earnings (P/E) ratio is nearly 54. So investors today are having to cough up to invest in this SpaceX-related growth story.

Fintech disruptor

A second UK stock I wish I’d bought earlier is Wise (LSE: WISE). It’s up 43% in the past 12 months and 173% over three years.

Wise is a global fintech firm that specialises in low-cost international money transfers. Its fees are dramatically lower than those of traditional banks and it continues to attract consumers and business.

For the year ended 31 March, it moved £145.2bn across borders for 15.6m people and businesses, a 23% year-on-year increase. Roughly 65% of transactions were completed in under 20 seconds!

Revenue jumped 15% to £1.2bn, while underlying pre-tax profit climbed 17% to £282m. That was equivalent to an underlying pre-tax margin of 21%. Earnings per share rose 18% to 40.4p.

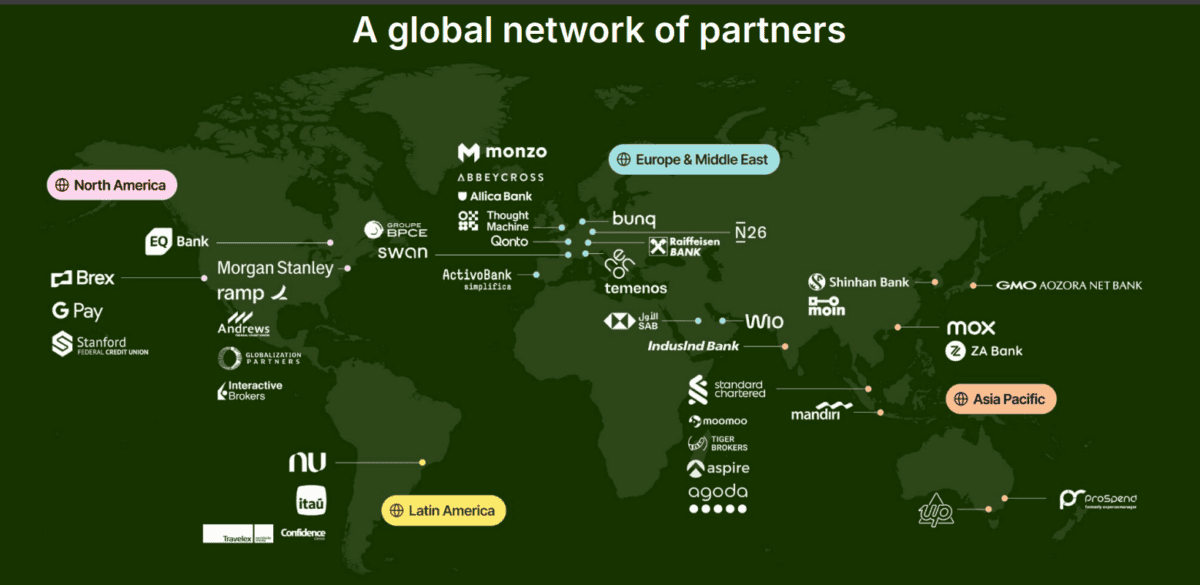

Meanwhile, Wise expanded its global reach by connecting to new domestic payment systems in the Philippines, Japan, and Brazil. And it signed major new partnerships with Morgan Stanley, Standard Chartered, and Nubank.

I’d say the biggest risk is the uncertain economic backdrop. Were a global recession to occur, cross-border activity could quickly slow down.

Interestingly though, Wise is now the 11th-largest holding for FTSE 100 investment trust Scottish Mortgage. It says: “Multiple growth avenues are open to Wise…these opportunities give Wise the ability to grow many times from its current base.”

Looking ahead, the firm sees a $32trn market for its infrastructure. So the long-term growth opportunity remains very large indeed.

Of the two stocks here, I prefer Wise. It’s trading at 28.3 times forward earnings, and I think it’s well worth considering.