I sold Greggs (LSE: GRG) stock earlier this year. However, it keeps flashing up as potentially great value (at just under £20) on Stock Screener. So is this a FTSE share for me to rebuy for my ISA? Let’s find out.

Strong brand

When I look at Greggs, I see a few things I like about the business. These are why I originally bought the shares.

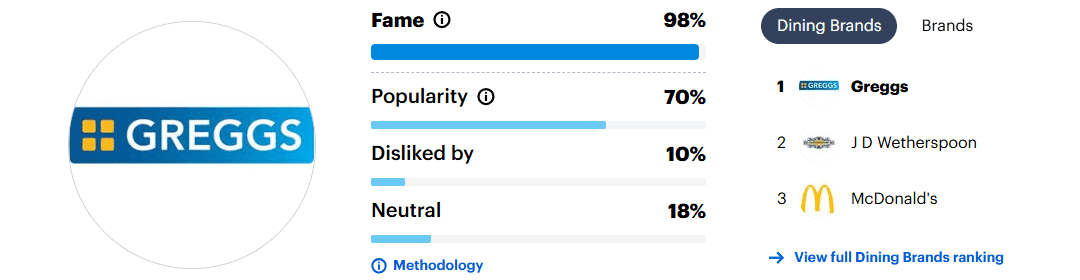

Firstly, Greggs has a unique brand. The bakery chain from Newcastle, which sells around 140m sausage rolls a year, is brilliant at tapping into British humour. I’ve seen people wearing Greggs-branded clothes for a laugh, and the company plays along, fully in on the joke.

According to YouGov BrandIndex rankings, Greggs is the most considered food-to-go brand for UK consumers and leads the way for value.

Of course, a strong brand doesn’t guarantee growth. Dr Martens and Burberry are two that are currently struggling.

However, there’s an underlying growth story at Greggs. It now has 2,638 shops, up from around 2,000 in 2020. It’s aiming to open between 140 and 150 more this year, as it moves towards its target of 3,000 locations.

Longer term, management sees scope for 4,500 shops. Needless to say, if it one day reaches that amount, sales will be significantly higher than the £2bn it notched up last year.

To grow the store count, Greggs is targeting more travel hubs, namely airports, train stations, retail parks, and petrol stations. It’s also opening later and growing its digital channels through partnerships with Just East and Uber Eats.

Finally, the stock looks good value at the moment. It’s trading for less than 14 times next year’s forecast earnings, while offering a well-supported 3.7% dividend yield.

Menu adaptation

So why did I sell the stock? There are a couple of main concerns I had.

The first was the National Insurance and Living Wage hikes that businesses are having to contend with. To offset this, the company’s been raising prices, which isn’t ideal when consumers are already under pressure.

But things might get worse. In May, HMRC data showed that the number of workers on company payrolls slumped by 109,000. That was the biggest monthly drop since the pandemic in 2020. It also seems increasingly likely that income taxes might go up next year.

Another nagging concern I have is the potential impact of GLP-1 weight-loss injections like Mounjaro and Wegovy. These make people feel fuller more quickly and can fundamentally alter eating habits.

Around a third of people in England and Wales are obese. To tackle this, the NHS is set to start a phased rollout of Mounjaro this month.

Interestingly, management’s now taking this threat seriously. CEO Roisin Currie has confirmed it’s “something on the horizon we are watching closely“. One response, she suggested, might be to serve up smaller portions, as well as offer more healthier options.

Apparently, many people on these weight-loss treatments are opting to eat leaner proteins, particularly chicken. So Greggs is planning to launch more chicken-based snacks to complement its chicken goujons and popcorn chicken bites.

I don’t think Greggs is in any fundamental danger. But given this GLP-1 uncertainty, and the depressing economic backdrop, I think there are better growth opportunities out there for my portfolio.