I think Legal & General (LSE:LGEN) is one of the best FTSE 100 shares to consider for a large and passive income. It’s why I’ve made the financial services giant the largest single holding in my Self-Invested Personal Pension (SIPP).

Over the last decade, the company has raised dividends every year except for 2020. In response to the global pandemic, it froze the annual payout at 17.57p per share.

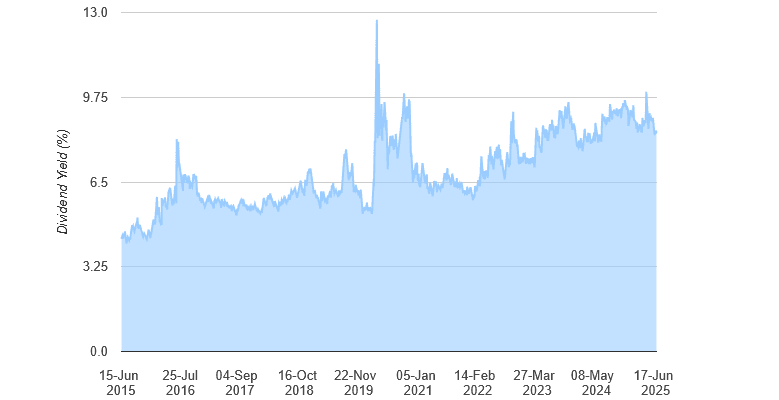

Dividends have risen strongly since then, culminating in last year’s 21.36p payout. It means that dividend yields have crept close to double-digit-percentage territory:

As a result, someone who bought £10,000 worth of Legal & General shares 10 years ago would have enjoyed a total passive income of £4,392.91 in that time. That’s based on cumulative dividends of 97.09p per share.

That’s a pretty tasty result, I’m sure you’d agree. But can the FTSE 100 firm continue delivering market-beating dividends? Here’s what City analysts think.

8.9% dividend yield

Past performance is not always a reliable guide to future returns. But the 14 brokers with ratings on Legal & General expect it to keep paying a growing and market-beating dividend during the next few years at least.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 21.82p | 2.1% | 8.6% |

| 2026 | 22.32p | 2.3% | 8.8% |

| 2027 | 22.76p | 2% | 8.9% |

As the table above shows, analysts expect dividends to grow at the pace the business forecast last year when it updated its payout policy.

This also means that dividend yields through to 2027 are more than double the Footsie’s long-term average of 3%-4%.

Yet, as we saw in 2020, there’s no guarantee that dividends will rise despite Legal & General’s best intentions and the bullishness of City analysts. And in the current economic climate, I’m mindful that earnings could underwhelm if consumer confidence weakens, impacting dividends in the process.

This is especially concerning given how thin dividend cover is at the company. Predicted cash rewards are covered between 1 times and 1.2 times by expected earnings, below the desired minimum of two times that provides a margin of safety.

So why are forecasters so bullish? It comes down to the firm’s impressive cash generation that gives it the strongest Solvency II coverage ratio in the sector. At 232%, Legal & General’s capital ratio was more than double the regulatory minimum as of the close of December.

Indeed, its robust financial foundations mean the company’s also planned a series of share buybacks through to 2027. With dividends and stock repurchases combined, it plans to return a total of £5bn to shareholders over the period.

A FTSE 100 ‘lifer’

Legal & General is a share I plan to hold for the rest of my life. It may experience some near-term turbulence, as we’ve seen during previous downturns. But over the long term, I expect it to deliver impressive capital gains and dividend income.

Demand for wealth management services, pensions, and other retirement products should rocket as global populations rapidly age. And Legal & General has incredible brand power and (as I’ve mentioned) substantial financial resources to fully capitalise on this opportunity. This is a UK blue-chip share I plan to never sell.