For whatever reason, I’ve never owned shares of Meta Platforms (NASDAQ: META) in my Stocks and Shares ISA. They’re up 750% in a decade, so this has been a massive missed opportunity.

Meta used to be known as Facebook, of course, and also owns Instagram. These two platforms are the advertisement cash cows, but it hasn’t done anything revolutionary with WhatsApp since it bought the messaging app 11 years ago.

That might be about to change, though. On 16 June, Meta announced that ads will finally be coming to the world’s most popular messaging app, which now has roughly 3bn monthly users.

The potential monetisation opportunity could be enormous. Given this, should I rush out to buy Meta stock right now? Here’s my take.

An AI giant

To be fair, I was already bullish on the stock before this announcement. The amount of customer data the firm has is mind-boggling, and this gives it a massive advantage in the age of AI. It can use the technology to both improve targeted ads and boost user engagement.

Just last week, in fact, a friend told me how scarily good Instagram’s ads have become. He says it’s like the algorithm knows what he wants before he does!

The company has confirmed that AI is indeed already delivering tangible benefits. In the six months to the end of March, improvements to its recommendation systems led to a 7% increase in time spent on Facebook, 6% more on Instagram, and 35% on Threads.

In Q1, revenue grew 16% year on year — or 19% at constant currency — to $42.3bn, while net profit totalled a cool $16.6bn (up 35%). An average of 3.43bn people used Meta’s apps daily, up 6%.

In recent days, the company announced it was investing $14.3bn to pursue artificial general intelligence (the holy grail of AI). When you generate as much cash as Meta does, I suppose you can give it a crack.

Overall, we are focused on building full general intelligence…The pace of progress across the industry and the opportunities ahead for us are staggering.

CEO Mark Zuckerberg, Meta Q1 2025 earnings call

Monetising WhatsApp

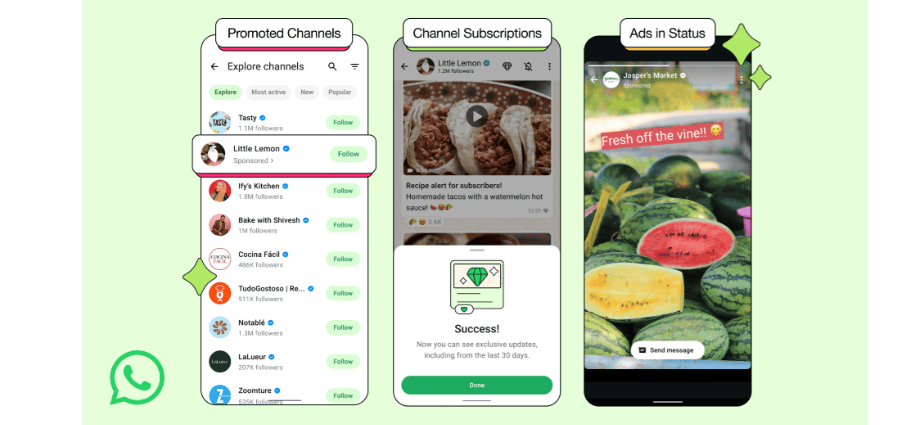

In WhatsApp, the company is introducing channel subscriptions, promoted channels, and ads in the “Updates” tab to help users find channels/products they’re interested in. They will be kept separate from personal conversations, thankfully.

Speaking as a regular WhatsApp user, I have mixed feelings. I already have products I’m interested in — as well as those I’m not — flying at me from all angles. Radio, email, YouTube, Netflix, and so on. I’m not too keen on signing up to see more on my daily messaging app.

Crucially though, Meta says personal messages will remain end-to-end encrypted and will not be used for ad targeting. Despite this, I think some WhatsApp users might fear that Facebook-style tracking is on the way, driving them to Telegram, Signal, or other alternatives. So this new feature is not totally risk-free, in my opinion.

Whether or not this moves the needle remains to be seen. But currently trading at 27 times forward earnings, I don’t think the stock is overvalued. Investors might therefore want to consider it today.

As for me, I’m going to put it on my watchlist as a potential candidate to buy on a dip.