There have been some bumps along the way, including the global pandemic and recent turbulence in China’s economy. Yet HSBC‘s (LSE:HSBA) large (and growing) Asian operation has seen its shares rise sharply over the last decade.

At 879.3p per share, the FTSE 100 bank has risen 44.6% in value since mid-2015 when it traded at 608.2p. It means a £10,000 investment back then would now be worth £14,467.

Adding in dividend income, and the total return becomes even more impressive. HSBC’s delivered total dividends of 346.5p per share during the past decade. So our £10k lump sum in its shares at the start of the period would have delivered a total return of £20,165, or 101.7%.

However, past performance isn’t always a reliable guide to future returns. So what can we expect from this point? And should investors consider buying HSBC shares?

Forecasts

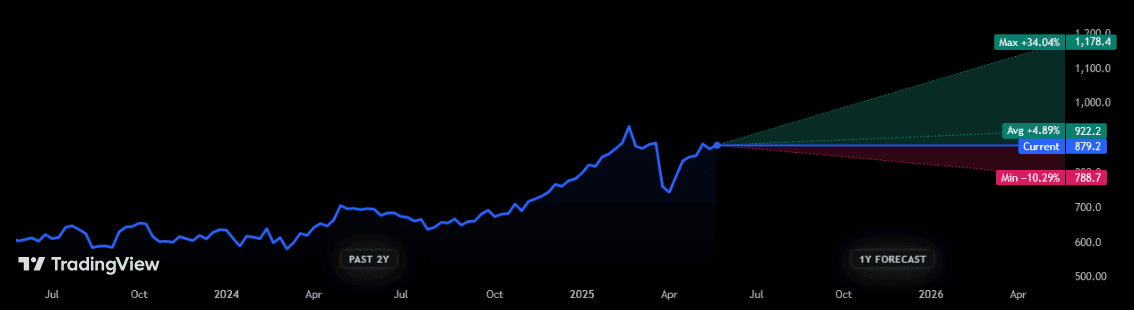

Unfortunately, brokers’ price forecasts don’t stretch all the way out to 2035. However, they do cover the next 12 months, and, by and large, they’re pretty bullish.

The consensus among the 17 analysts offering estimates is that HSBC will rise by mid-single percentages over the period. However, it’s always worth remembering that forecasts can often miss their targets.

Valuation

It’s therefore also worth considering the valuation that HSBC’s share price currently commands. Signs that the bank is undervalued could leave scope for further gains, while increases could be limited if it looks overpriced.

Based on predicted earnings, the bank looks attractively cheap at current prices. Its price-to-earnings (P/E) ratio is 8.8 times, below the five-year average of 9.8 times.

Its price-to-book (P/B) ratio’s less impressive from an historical perspective though. At 1.2 times today, this sits above the five-year average of 0.8.

Finally, let’s look at HSBC’s value based on dividend yield. At 5.6%, its forward dividend yield current beats an average of 5.2% for the last five years. But it’s also worth remembering that, like other UK banks, it was forced to suspend dividends at the height of the pandemic in 2020.

On balance, I’d say HSBC looks fairly valued, although that doesn’t give a clear indication as to whether more price gains could be in the offing.

Should investors buy the bank?

My overall view is that HSBC shares could continue climbing, making them worth consideration right now.

That’s not to say the banking giant doesn’t carry notable risks. Economic conditions in China remain tough, as illustrated by disappointing retail sales and factory data in April. And things could get tougher as trade tariffs come into effect.

But over the longer term, the bank still has significant growth opportunities to exploit. Rapid population growth and the booming middle class in Asia should continue to drive financial services demand.

Analysts at McKinsey & Company, for instance, expect personal financial assets in Asia’s wealth management sector to hit $81trn by 2027. With its enormous brand power and ongoing expansion in wealth management, HSBC’s well placed to harness this growth.

As it’s also stepping up expansion in the booming Indian marketplace, I expect the bank to continue soaring in value as profits lift off.