I don’t usually take risks when picking stocks for my passive income portfolio. I prefer the safety of reliable FTSE 100 dividend stocks with long payment track records.

However, in the run-up to Christmas, I noticed an opportunity in a mid-sized £337m company that might benefit from the holidays: Card Factory (LSE: CARD). The stock isn’t in the FTSE 250 yet but I think it’s well on its way to joining the mid-cap index.

Festive cheer

As the name suggests, the company sells personalised cards, party accessories and gifts, including balloons, napkins, wedding decor, mugs, chocolates, glassware — you name it.

When I bought the stock at around 79p per share, it was down 44% from its 52-week high, sporting a decent 3.2% dividend yield. Since then, not only has the share price increased 20% but it’s also boosted its dividends, bringing the yield up to 5%.

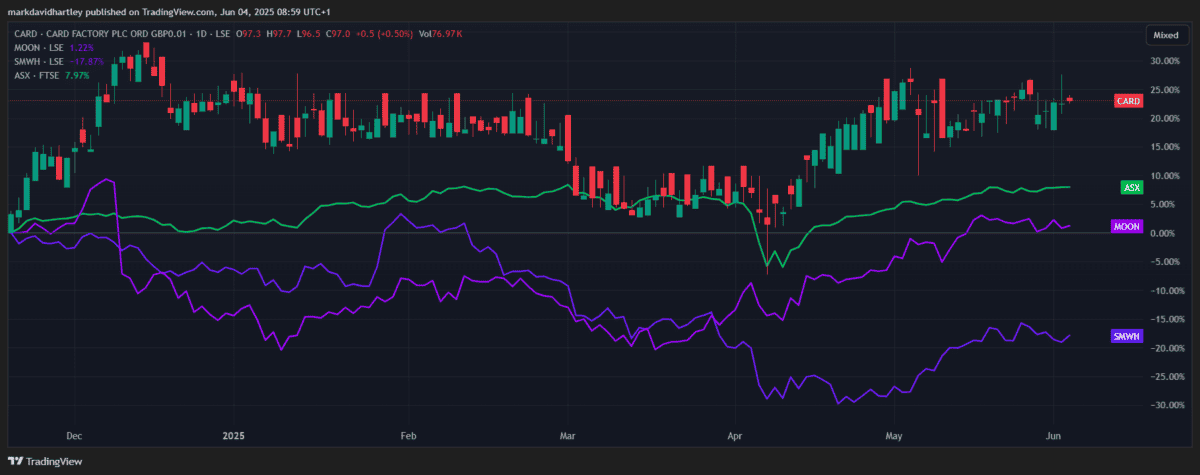

Looking at the price comparison above, I can see that the FTSE All-Share has increased 8% in the same period, with Card Factory’s closest rival Moonpig up 4%. WH Smith, a fellow producer of cards and gifts, is down 18%.

And this isn’t once-off growth. Over a five-year period, the price has almost doubled from 50p a share, representing annualised growth of 14% a year.

Still good value?

With that kind of growth, I’d expect the stock to be overvalued. Yet I was surprised to find it has a forward price-to-earnings (P/E) ratio of only 6. That suggests the current price near £1 still looks cheap when considering the expected earnings.

And it’s not just the P/E — it has a low price-to-sales (P/S) ratio of 0.62 and a decent price-to-cash-flow (P/CF) ratio of 4. These are all strong signs of a stock selling at less than its intrinsic value.

So what’s the catch?

As always, if it looks too good to be true, it’s worth digging deeper. Here’s a closer look at the possible risks that investors should consider in regards to Card Factory.

While the company’s valuation metrics look good, its financials aren’t so great. While revenue’s grown steadily, earnings have weakened slightly, falling from £49.5m in 2023 to £47.8m in 2024, bringing its margin down to 8.8%.

This is likely impacted by cost inflation, especially for paper, energy and international shipping. Any sudden spike in input costs or further currency headwinds from a weaker pound could squeeze profitability. This is risky as its balance sheet still carries a notable debt burden from the pandemic years.

With over 1,000 stores, it’s sensitive to rising retail rents and could suffer losses if high street footfall declines.

Worth considering

Although there are challenges ahead, Card Factory’s in a far stronger position than it was a few years ago. With an excellent valuation and growing dividends, it’s an attractive stock for both value and income investors.

So while there are risks to be aware of, I think it’s still worth considering as part of a diversified income portfolio.