Since January 1, 2025, BAE Systems (LSE: BA) has gained a substantial 69% following a surge in global defense spending. An investor who sunk their £20,000 allowance into BAE shares at the start of the year would have £33,800 today. That’s an eye-watering profit of £13,800!

Plus, if invested via a Stocks and Shares ISA, they would avoid any tax levied on the capital gains.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

With talk of the UK government making changes to ISA allowances, Brits are scrambling to fill their quota. Reports indicate a record £14bn has flowed into ISAs over the past month after fears the £20k allowance may be reduced.

What’s driving BAE’s growth?

BAE’s latest numbers are looking good. The defence giant reported a 14% increase in sales for 2024, reaching £28.3bn, and operating profit up 4% to £2.7bn. Free cash flow for the year reached £2.5bn, helping to support the company’s £357m injection into it’s self-funded R&D programme.

It benefits from several major contract wins, including the £3.95bn AUKUS submarine programme and a $2.5bn deal in Sweden and Denmark. It now has a massive order backlog worth nearly £80bn, ensuring revenues for years to come.

A key growth driver that kicked off the performance boost was last year’s acquisition of Ball Aerospace for $5.5bn. The move not only enhanced BAE’s presence in the US but also gave it exposure to the growing demand for space-based defense technologies.

Overall, the performance is a clear sign of strong operational efficiency backed by unwavering demand and solid management.

What does H2 hold?

The first half of 2025 seems to be shaping up very well for BAE — but all that could change in the second half.

The company faces several risks, including its heavy reliance on government defence spending, which is vulnerable to political shifts and budget cuts. Large contracts can suffer from cost overruns and delays, while strict regulatory and compliance requirements pose legal and reputational risks.

On top of that, global operations carry the risk of currency fluctuations and the fast pace of technological change demands continual R&D investment to stay competitive. With the share price near record highs, any setback could trigger a sharp market reaction.

Valuation

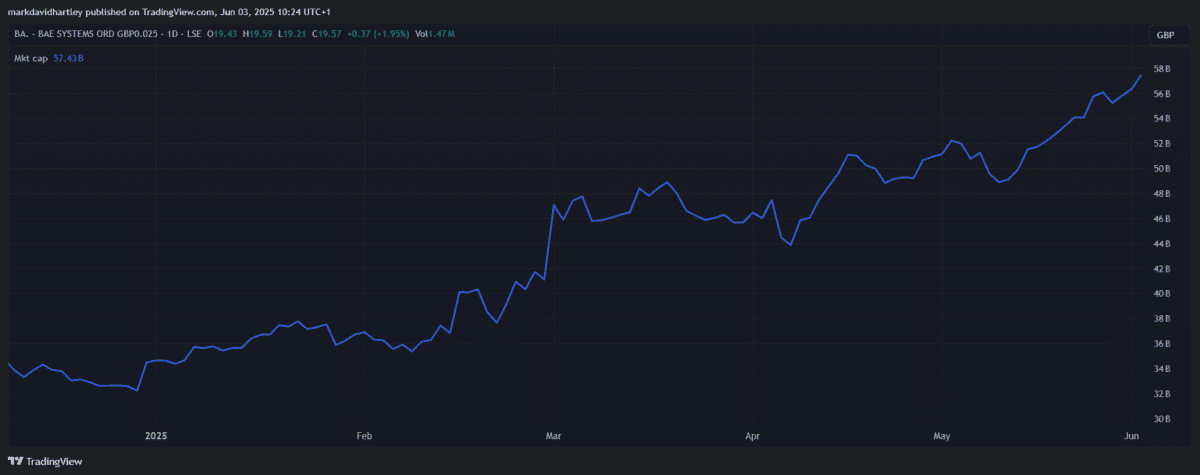

As of early June 2025, BAE’s market capitalisation stands at approximately £57.5bn, reflecting growth of nearly 40% over the past year.

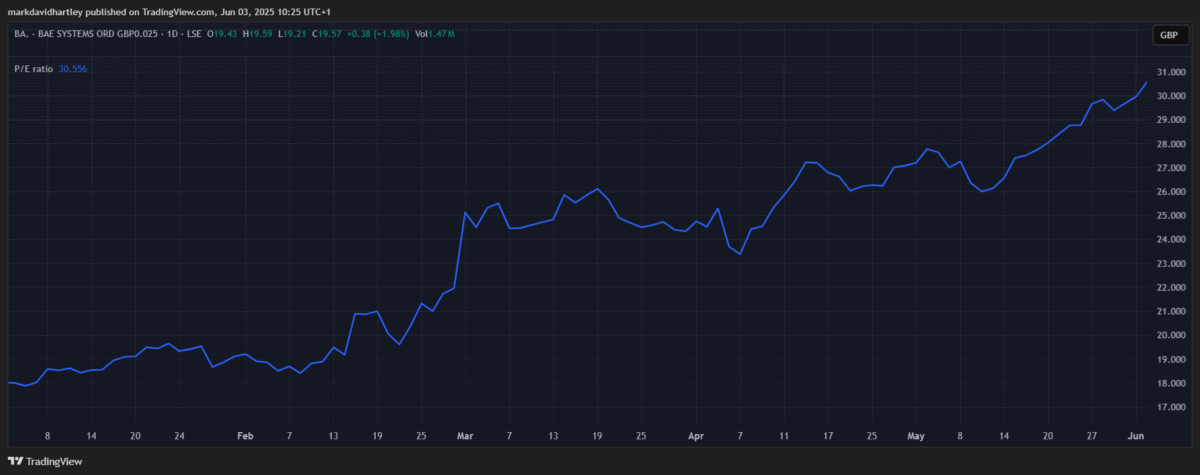

At the same time, it’s price-to-earnings (P/E) ratio has risen to above 30. This suggests the current share price could be overvalued and may struggle to make notable gains in the short term.

This is reflected by price forecasts, which on average expect a 4.75% loss in the coming 12 months. Still, the majority of analysts think the stock is a Buy, probably considering its long-term prospects.

Eagle-eyed investors might eye a better entry point in the coming six months, but it’s unlikely to make a big difference. For those looking for a solid defence stock to add to their portfolio, I think BAE is still well worth considering.

The cyclical nature of defence spending might prompt brief slumps, but in the long run, it’s a company that – in my opinion — isn’t going away. That’s why I plan to keep holding my shares well into retirement.