Bonds have long been a cornerstone for investors seeking steady, predictable passive income. But with yields at multi-year highs, the bond market is now offering a rare chance to lock in attractive returns with relatively low risk. This combination is drawing new attention from UK investors.

How do bonds work?

A bond is essentially a loan an investor makes to a government or corporation. In exchange for the money, the issuer promises to pay the bond holder regular interest (known as the coupon) and to return the original investment (the principal) when the bond matures. Bonds are considered fixed-income investments because they typically pay a set interest rate over their life, making them a popular choice for those seeking reliable income streams.

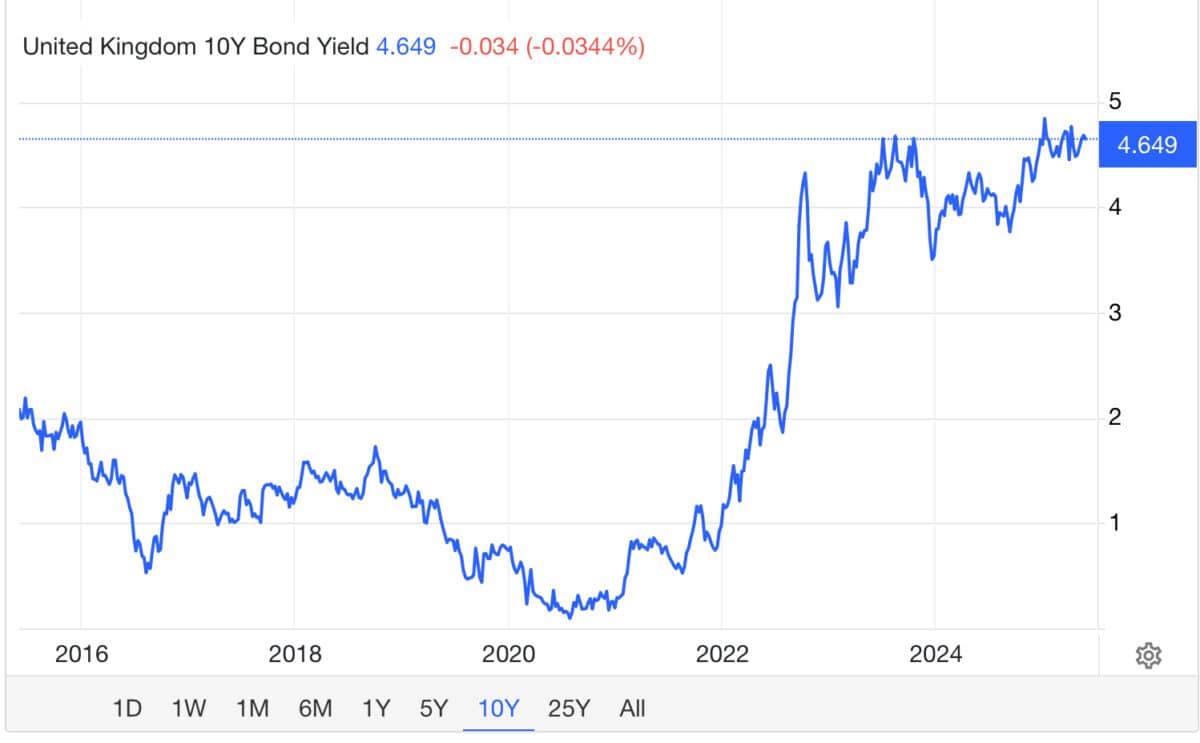

The appeal of bonds for passive income is straightforward, especially now. For example, UK government bonds (gilts) are currently offering yields not seen in over a decade. The 10-year gilt yield stands at around 4.65%, while the 30-year yield is just over 5.4%.

This means that if someone were to invest £10,000 in a 10-year gilt, they could expect to receive £470 per year in interest — more than double what they would have earned five years ago. The only significant risk is if the UK government were to default on its obligations. However, this is widely considered extremely unlikely, making gilts far less risky than most stocks.

Looking overseas

Across the Atlantic, US Treasury bonds are also offering attractive yields. The 10-year US Treasury yield is currently about 4.46%, and the 30-year yield is just under 5%. These rates are historically high for such safe assets. This higher-than-usual yield reflects near-term economic uncertainty and Trump’s plans for potentially unfunded tax cuts. But it also offers investors a rare window to lock in high passive income for years to come.

For those willing to look further afield, some overseas bonds offer even higher yields, especially in emerging markets or countries facing economic challenges. While these can provide eye-catching income, they also come with increased risk, including currency fluctuations and the potential for default. For example, the South African 10-year bond yields over 10%.

Alternative exposure

Bond investing might not be for everyone. And thankfully lots of stocks offer exposure to the bond market. One of the best known is Berkshire Hathaway (NYSE:BRK.B) which offers partial bond market exposure due to its massive holdings in US Treasury bills, which provide steady interest income and stability.

Berkshire now holds over $300bn in US Treasurys — accounting for nearly 5% of the entire market for short-term government debt. While Berkshire is a conglomerate, its defensive cash position, debt holdings, and diversified business operations help buffer against market volatility, offering shareholders indirect benefits from bond market returns.

However, this Warren Buffett company is not a direct substitute for bond funds, as most of its value comes from operating businesses and a concentrated equity portfolio, not fixed-income assets.

And while the company has performed well in recent years, there’s going to be some uncertainty for this US-focused business going forward. It’s a stock I own and recently bought more of, but I appreciate that Trump’s policy may cause some volatility. Also, it doesn’t pay a dividend, so there’s no yield — just growth, hopefully.