The FTSE 100 currently trades at an average price-to-earnings (P/E) ratio of around 16. But I think investors should take a close look at a stock that’s trading at a much higher multiple.

Informa (LSE:INF) isn’t exactly a household name and its shares don’t exactly look cheap at first sight. But I think there’s a lot to like about the business from an investment perspective right now.

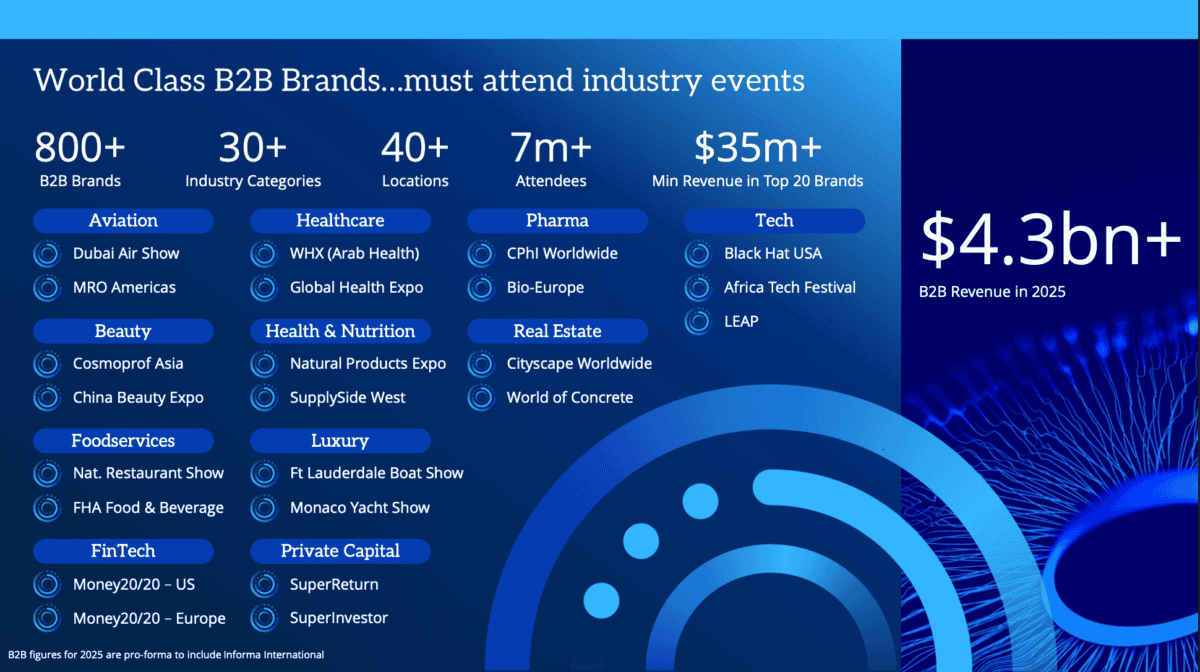

Trade shows

The largest part of Informa’s business is its events division. The company organises conferences and trade shows for various industries around the world.

From an investment perspective, there’s a lot to like about the business model. It avoids maintenance costs by leasing venues and it charges attendees before the event. Costs are then payed after.

Source: Informa 2024 Results

The firm’s events, such as Cannes Lions, are the biggest and best in the industry. This makes them important places for businesses to network, do business, and learn so attendance is crucial.

Informa’s strong assets create durable demand and its low overheads result in high cash flows. But there’s a particular reason I think the stock’s more attractive right now than it first seems.

Valuation

Officially, Informa shares trade at a P/E ratio of around 36, which makes it look like a strong business with a premium price tag. But I think a closer look reveals a somewhat different picture.

After several acquisitions over the last few years (including Ascential), the firm’s income statement has featured significant non-cash expenses. Officially, these have been weighing on net income.

In terms of cash however, things look much more positive. Informa’s free cash flow reached around £770m in 2024, which is just over 7% of the company’s market value.

The FTSE 100’s returning a lot of that cash to shareholders via dividends and share buybacks. And that makes me think the stock actually looks like pretty good value here.

Risks

I think Informa’s a quality operation with some very attractive properties. But there are some important risks that investors ought to pay attention to.

The biggest, in my view, is a potential trade war. This is arguably the main threat to the stock market as a whole at the moment, but it’s especially important for a company focused on global trade events.

A recession could cause businesses to cut back their spending and potentially weigh on Informa’s revenues. But to some extent, this is something that the company has seen before.

Demand fell away sharply during the Covid-19 pandemic as in-person events were suspended. But it rebounded strongly after, illustrating the long-term resilience of the company.

A stock to consider

A high P/E ratio and potential vulnerability to an economic downturn makes Informa shares look expensive. But I think the stock’s more attractive than it first seems.

Based on the cash the underlying business generates, the stock looks reasonably priced and the business has shown itself to be resilient over time. So I think it’s well worth considering.