The stock market’s managed to recover from its big decline after the US made its big tariff announcement on 2 April. But there’s still plenty for investors to keep an eye on.

Inflation, the Russia/Ukraine war, and the possibility of an artificial intelligence (AI) bubble bursting are all genuine concerns. But the biggest threat might be none of these.

The received view

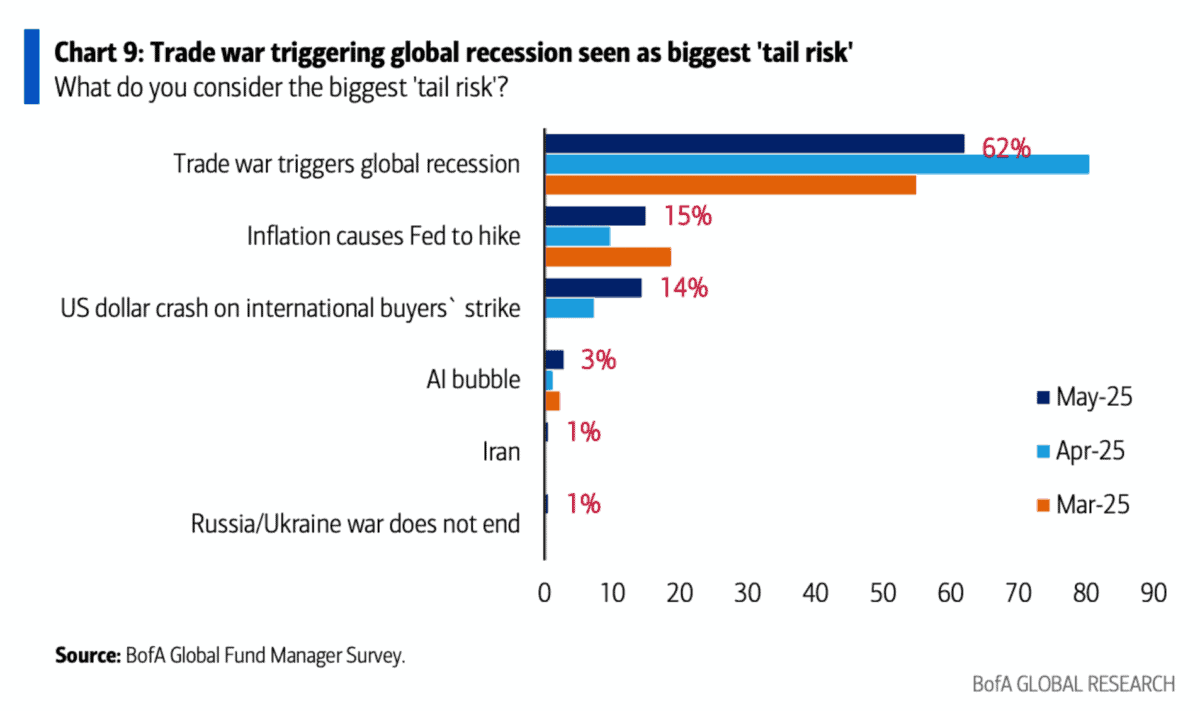

According to the latest Bank of America survey of fund managers, there’s one major risk that stands above the rest. It’s the possibility of a trade war triggering a global recession.

That seems reasonable to me. But it’s worth noting that the number of managers identifying this as the biggest threat in May is slightly lower than in April.

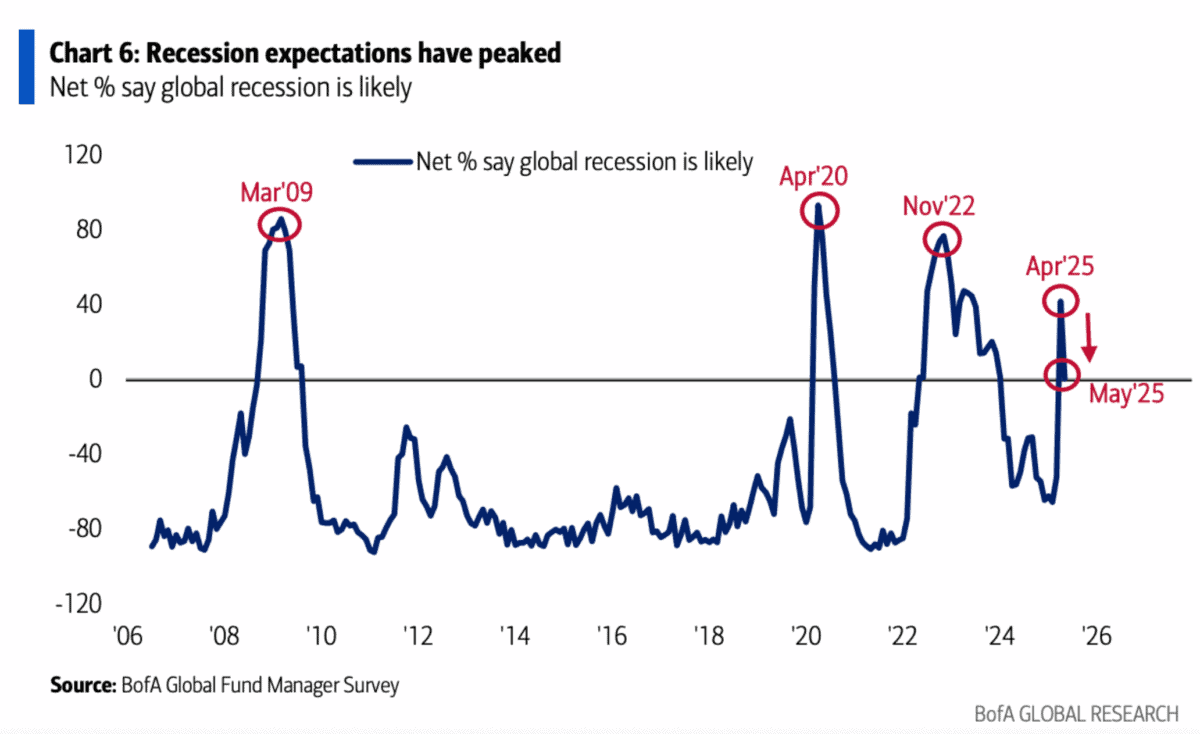

More generally, expectations of a recession seem to be declining. And since the survey, the prospect of lower tariffs between the US and China are likely to have reduced the risk further.

Given this, it’s probably fair to say that the perceived recession risk is subsiding. But I’m wary about dismissing the possibility of an economic slowdown for a couple of reasons.

Recession risks

One is that recessions generally show up when people are least expecting them. When people are on the lookout for signs of a slowdown, things tend not to go that way.

Another is the volatile nature of trade policy at the moment. If the last couple of months have shown investors anything, it’s that things can turn around very quickly – in either direction.

As a result, I think the time to consider getting a portfolio ready for an economic slowdown is now. By the time the stock market sees it coming, there might not be time to do anything.

With my own investing, the way I plan for a recession is by maintaining a diversified portfolio. And that includes some businesses I expect to do well even in an economic slowdown.

Resilient investments

Strictly, I think Rentokil Initial (LSE:RTO) is classified as an industrial stock rather than a defensive one. But demand for its products is relatively acyclical – pests don’t show up less in a recession.

Despite this, it also looks as though the company has clear scope for growth. It’s currently working through an integration process after an acquisition that I expect to boost profits in the long run.

The CEO’s recently announced his intention to retire, which I see as a surprise given where the company is right now. With the firm in transition, a change in leadership creates a risk for investors.

Rentokil’s long-term strengths though, are hard to dispute – it has a strong position in an industry that’s growing and isn’t cyclical. Recession or not, I think that’s a powerful combination.

Foolish takeaway

Fund managers have started to shift their portfolios away from defensive stocks in the last month. But I think the key to investing well is trying to find opportunities when others are looking elsewhere.

Part of this involves getting ready for a recession when investors are starting to go off the idea that one’s on the way. And that’s why Rentokil is on my list of stocks to consider buying at the moment.