Nvidia stock has been charging higher in recent weeks. Indeed, since plummeting to a 52-week low in early April, it’s rocketed 43%!

However, one that’s up even more is CoreWeave (NASDAQ: CRWV), whose shares have increased by 109% in May. It partly has Nvidia to thank for that, as recent regulatory filings show that the AI chip juggernaut raised its existing stake in CoreWeave just after its IPO in March.

Should I buy any CoreWeave shares for my ISA? Let’s take a closer look.

Sizzling-hot growth

Founded in 2017, CoreWeave is a cloud computing company that provides infrastructure for AI and machine learning workloads. It offers on-demand access to powerful GPU hardware (mainly Nvidia’s), enabling organisations to train AI models and process large datasets.

In other words, its data centres are purpose-built for AI, which companies rent access to.

The company is no minnow, as it was valued at $23bn at its IPO. Its market cap has since shot up to $41.5bn. This means CoreWeave is already more highly valued than FTSE 100 blue-chips like Tesco and Standard Chartered, despite being less than a decade old.

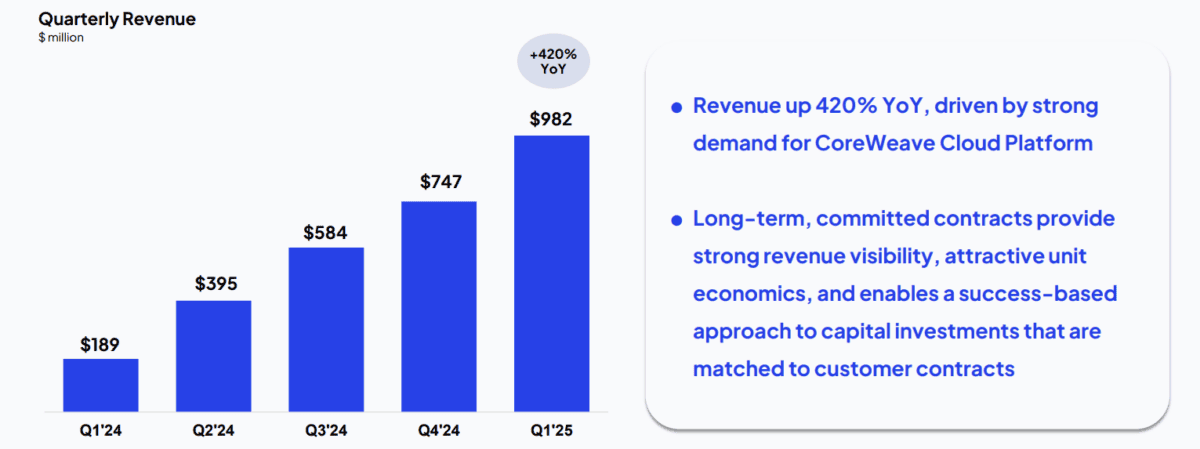

As it only went public in late March, the Q1 report CoreWeave dropped on 14 May was its first as a public company. Growth was outstanding, with revenue skyrocketing 420% year on year to $982m. That was well above market expectations for $860m.

Back in March, the company signed a five-year contract worth $11.9bn with ChatGPT maker OpenAI to provide it with AI infrastructure. As part of the deal, OpenAI also took a stake in CoreWeave.

With this $11.9bn in the bag, the firm’s revenue backlog jumped to $25.9bn at the end of March. And management now anticipates annual revenue of $4.9bn to $5.1bn, up from previous expectations of approximately $4.6bn.

Looking ahead, Wall Street sees revenue topping $16bn by 2027!

High customer concentration

A risk here is potential overreliance on a key customer, namely Microsoft. Last year, the software giant was responsible for a whopping 62% of CoreWeave’s revenue. While the firm plans to diversify its customer base, any slowdown in AI spending from Microsoft might significantly impact growth.

Also, CoreWeave plans to spend $20bn-$23bn this year in order to meet growing AI infrastructure demand from OpenAI and Microsoft.

Understandably, it’s still not profitable, and the adjusted net loss for Q1 was $149m. Given the capital-intensive nature of building out AI data centres, profits might not materialise for a while.

Should I buy CoreWeave stock?

The fact that Nvidia has been adding to its stake is a strong endorsement of CoreWeave’s cloud infrastructure platform. Blue-chip customers like Microsoft and OpenAI add significant weight to the bull case.

Weighing things up, this looks like a top-notch AI company with a long potential runway of growth ahead of it. However, the stock is trading at 15 times sales, which is pretty pricey.

As a rule of thumb, I don’t invest so soon after an IPO, no matter how glittering and exciting it is. I wait until the company finds its feet, making sure quarterly growth targets are hit. Then, once I’ve learned more about the firm, I wait for a dip that I think looks attractive.

Therefore, I’ll just keep CoreWeave stock on my watchlist for now.