Diageo (LSE:DGE) has been one of the FTSE 100’s top passive income stocks, but the company has been struggling recently. The most recent results, however, are very positive — at least at first sight.

Organic sales growth in the most recent quarter came in strong. But there’s still a lot of uncertainty ahead for the company, especially in the short term.

Results

Diageo reported overall organic sales growth of just under 6%, which is very good. Importantly, there were also positive results in geographies that have been struggling recently.

The US is the company’s largest market, accounting for around 39% of total revenues in 2024. And organic growth across the Atlantic came in just over 6%.

Another area of recent weakness has been Latin America and the Caribbean, where inflation has been weighing on sales. But that part of the business put up impressive growth numbers.

Organic sales growth in the region reached 28.5%. That’s compared with a very weak set of results a year ago, but it’s an encouraging sign for investors.

Given this, there’s a natural question of why the stock hasn’t responded more positively. The share price climbed less than 3% after the announcement.

The answer is that a lot of the growth is due to distributors ordering in advance of increased tariff costs. So to some extent, the results are the result of timing, rather than increased demand.

Outlook

CEO Debra Crew called out that the results are partly a function of distributors stocking up. And there are clear signs of this elsewhere for investors to pay attention to going forward.

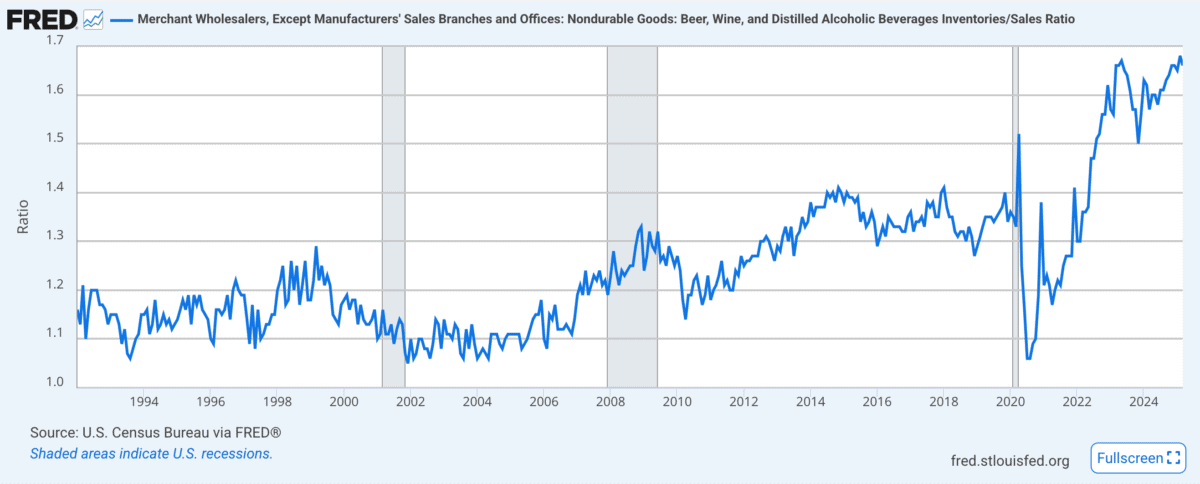

Given Diageo’s strength across the Atlantic, one important data point is inventory levels at US wholesalers. And the US Census Bureau measures these as a proportion of sales.

Source: St. Louis Fed

The latest update isn’t a good sign for the FTSE 100 firm. The ratio of inventories to sales has been rising recently and is now at some of its highest levels for decades.

As mentioned, rising inventory levels can be explained in terms of moves to pre-empt tariffs. However, they can also be a sign of weakening consumer demand, which is a bigger issue for shareholders to consider.

That makes me wary about the next six months or so for Diageo. The balance between supply and demand shifting is a risk for any firm and it’s clearly happening with alcohol in the US right now.

With one quarter of its financial year to go, the company reiterated its operating profit guidance for the full year. The big question for investors is what the longer term looks like.

Acceleration

While I’m not reading too much into the company’s recent growth, I still think is a top passive income stock. That’s why it remains on my list of shares to consider buying.

Over the long term, the question is whether a global shift towards premium spirits can offset declines in alcohol overall. But that won’t be fully answered by any three-month results.

The latest update, however, is a positive sign. And the next big event for income investors to pay attention to is in August, when the firm provides an update on its Accelerate programme.