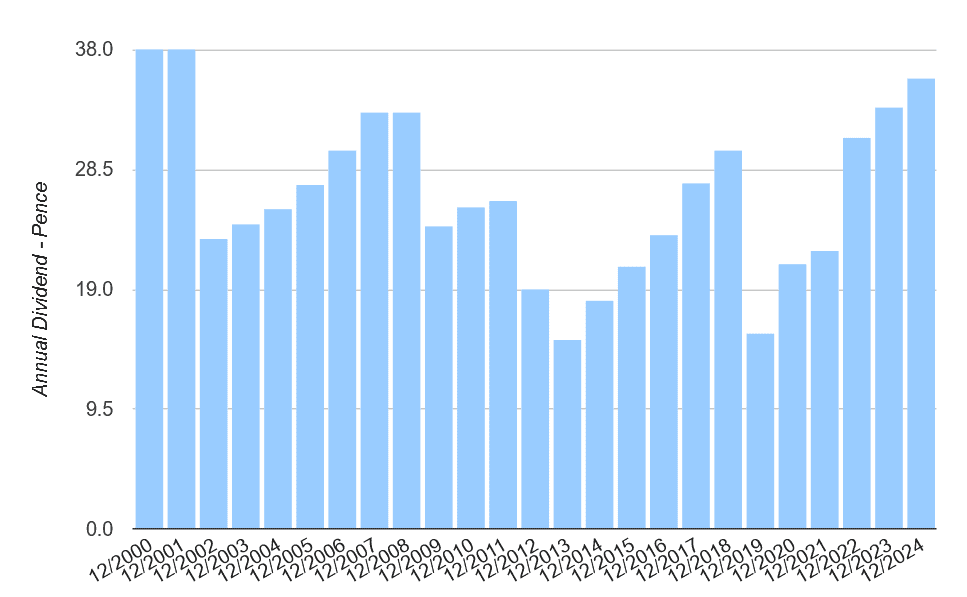

Aviva (LSE:AV.) has proved to be one of Britain’s most lucrative passive income shares in recent years. Since rebasing the dividend in 2013, the FTSE 100 company has raised shareholder payments every year, except for 2019, when the pandemic struck.

With asset sales aiding its balance sheet recovery, dividends have generally risen strongly since the mid-2010s, including a 7% hike in 2024 to 35.7p. What’s more, the firm’s dividend yields have regularly beaten the Footsie’s long-term average of 3%-4% over the period.

But with global economic uncertainty growing, can the financial services giant keep its dividend momentum going? And should investors consider buying Aviva shares today?

Robust forecasts

Despite the threat of weaker consumer spending in Aviva’s markets, City analysts are expecting its earnings to rise by triple-digit percentages in 2025, and by double-digits in the following two years.

This, in turn, leads to forecasts of further robust dividend growth over the period:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 37.87p | 6.1% | 6.4% |

| 2026 | 40.65p | 7.3% | 6.9% |

| 2027 | 43.78p | 7.7% | 7.4% |

For this year, shareholder payouts are tipped to rise at a greater rate than the 1.5%-2% that’s predicted for the broader FTSE 100 index. What’s more, the pace of growth is expected to accelerate in 2026 and again in 2027.

You’ll also notice that yields improve by around a percentage point over the period. For 2027, too, the dividend yield is around double the more recent FTSE forward average.

Yet, it’s critical to remember that dividends are never guaranteed, and that broker forecasts are never set in stone. And based on dividend coverage, there’s a danger that the passive income from Aviva shares may disappoint.

For the next three years, predicted payouts are covered between 1.3 times and 1.4 times by expected earnings. These figures fall way short of the figure of two and above that typically provide good security.

Strong dividend cover is especially important for cyclical shares like Aviva during uncertain times. However, I’m still optimistic the business will have the strength to pay those projected dividends, even if profits undershoot forecasts.

As of March, the company’s Solvency II ratio was 201%, more than double the regulatory requirement. And its strategy of focusing on capital-light businesses will help it to maintain robust financial foundations.

More than half (56%) of operating profit came from such operations in the first quarter. This will move to 70% if its planned acquisition of Direct Line goes ahead.

Is it a buy?

Investing in Aviva isn’t without risk, as the tough economic environment could have consequences for the dividend and/or the share price. But on balance, I think the potential benefits of owning the stock outweigh the possible dangers.

I certainly believe it could prove a lucrative stock to own over the long term. Demographic changes across its UK, Irish, and Canadian markets may supercharge demand for its retirement, protection, and wealth products.

Given those huge dividend yields and undemanding price-to-earnings (P/E) ratio of 11.3 times, I think it’s a great FTSE bargain to consider.