Palantir (NASDAQ:PLTR) stock’s up an impressive 38% over the past month. That means a £10,000 investment a month ago would now be worth around £13,600 — that’s factoring in the appreciation of the pound.

So why’s the stock up so notably and is it still an investment worth considering?

What’s happened at Palantir?

Palantir’s surge has several causes, each building on a rebound from a lower base set after the announcement of new US trade policy. Initially, Palantir’s shares dropped sharply as investors digested the potential impact of trade tensions on the tech sector.

However, sentiment shifted as the US and China agreed to a 90-day tariff pause, sparking a broad tech rally and helping Palantir recover lost ground.

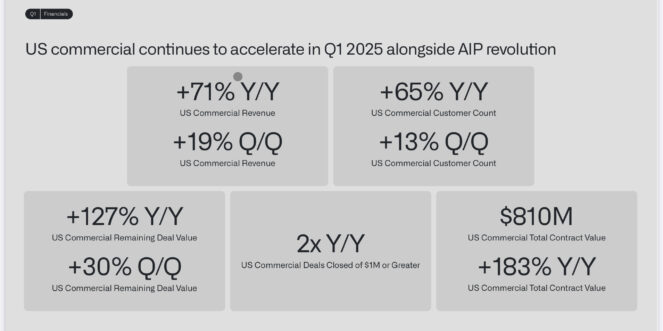

More fundamentally, optimism’s been fuelled by its Q1 results. Revenue jumped 39% year on year to $884m. US revenue was up 55% and commercial revenue leapt 71%.

While these figures only met or modestly exceeded expectations, they reinforced the company’s narrative of strong artificial intelligence (AI)-driven growth and expanding enterprise adoption, particularly in the North American commercial sector. The company also raised its full-year revenue guidance, adding further confidence.

Additionally, the political backdrop has played a role. The Republican administration could increase federal spending on national security and immigration — areas where Palantir’s well positioned.

Analyst upgrades, including a significant price target hike from Bank of America, have also stoked bullish sentiment. Despite concerns about Palantir’s lofty valuation, the combination of policy support, impressive execution, and market optimism around AI has driven the stock’s sharp rebound.

Too richly valued for me

I always love seeing a stock surge. It’s interesting and it’s an opportunity. But I’m wondering if the growth forecast might already be priced in here.

Palantir’s current valuation certainly gives pause. The stock trades at a towering price-to-earnings (P/E) ratio of 312 for 2024. Even looking ahead, consensus estimates suggest the P/E will remain staggeringly high. It trades at 220 times in 2025, 175 in 2026, 134 in 2027, and 86 by 2028.

While these numbers do show a steady decline as earnings are expected to rise, they’re well above the broader tech sector average and even most AI peers. What’s more, the recent quarterly results were in line with estimates. A big earnings beat it was not.

This raises the question of whether investors are paying too much today for future growth that’s already widely anticipated. The price-to-earnings-to-growth (PEG) certainly suggests that investors are overpaying.

And while Palantir’s business is clearly expanding and its AI-driven narrative is compelling, at these valuations the margin for error’s slim. Any disappointment in execution or a shift in market sentiment could see the shares come under pressure.

For long-term believers, the stock’s premium might be justified by its unique government contracts and commercial momentum. But for value-focused investors, the current price could be a reason for caution. I’m in the latter camp for now.