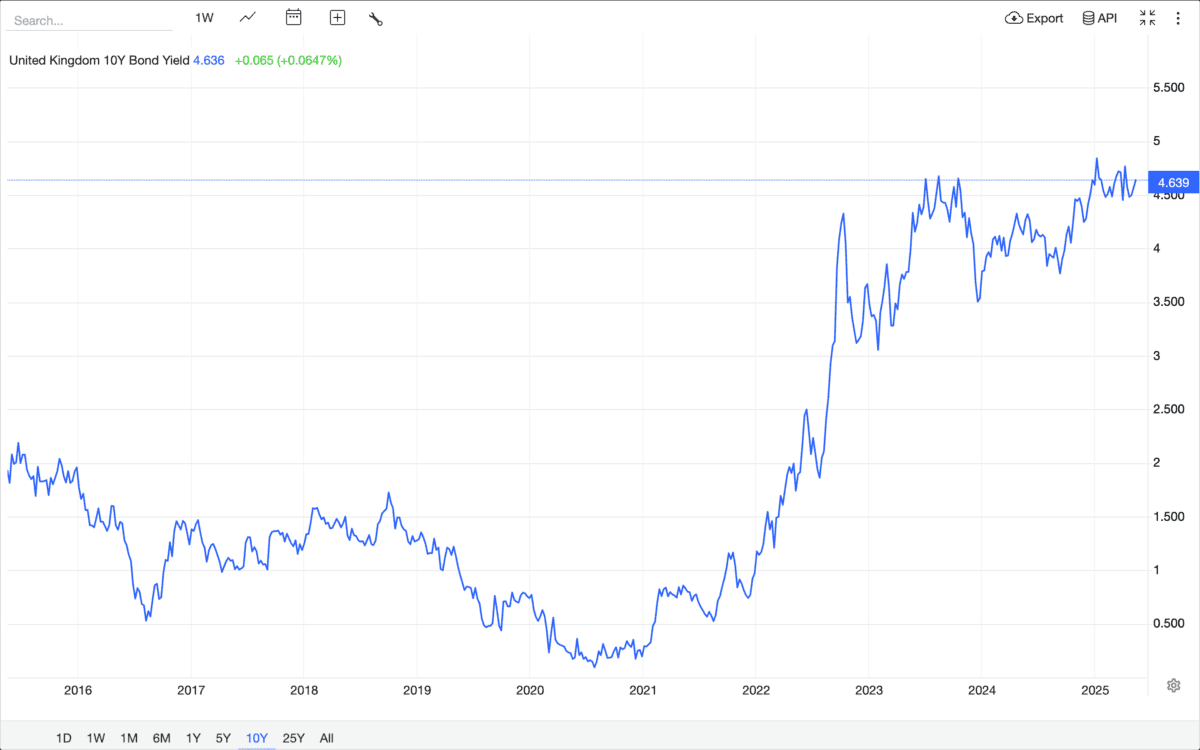

When it comes to passive income, UK investors have a choice. And with 10-year government bonds offering a yield of more than 4.6%, bonds are looking pretty attractive right now.

That represents a 10-year high and it’s something to be taken seriously. But I think investors can do even better in the stock market.

Bond market

Whatever the asset class, investing well is about being greedy when others are fearful. And the current state of the bond market suggests to me that there’s some fear around at the moment.

A 4.6% yield means someone who invests £10,000 in UK gilts can expect to receive £460 each year until 2035. Five years ago, the same investment would have returned around £200 per year.

Source: Trading Economics

With a bond, the only way investors don’t get their expected return is if the UK government defaults on its obligations. And that makes them much less risky than any stock investment.

In short, gilts right now offer an unusually high yield with a relatively low risk. And that’s something passive income investors should pay attention to when thinking about opportunities.

Stocks

UK gilts haven’t been this attractive for more than a decade. And while I’m sticking to the stock market for investment opportunities, this is something I’m taking account of.

I’m looking further ahead than the next 10 years, but the situation is even more stark with the 30-year bond. The current yield is just under 5.5% – again, the highest it’s been in a decade.

Source: Trading Economics

In the context of my own investing, that means I shouldn’t be looking at shares where I don’t expect to make at least 5.5% per year over the next 30 years. And that’s a fairly high bar.

There are, however, a few stocks that I think might well make the grade. One of these is FTSE 250 housebuilder Vistry (LSE:VTY).

Shareholder returns

Vistry looks like an odd choice for passive income investors. The firm has recently suspended its dividend and there’s an ongoing investigation from the Competition and Markets Authority.

Neither of those is something I look for in a stock to consider. But the share price has fallen so much that I think there’s a good chance it could do better than 5.5% per year going forward.

For one thing, there’s an ongoing share buyback programme. At current levels that by itself is equivalent to around 6.25% of Vistry’s current market value.

The dividend was suspended earlier this year following some accounting irregularities. But I think these might be short-term in nature and shouldn’t derail the distribution for too long.

Income opportunities

Bonds are unusually attractive from a long-term passive income perspective. Despite this, I still think I can find better opportunities for my portfolio in the stock market at the moment.

Vistry doesn’t look like the most promising investment at the moment, but it’s well worth a closer look. I think its partnerships business has some excellent long-term prospects.

It’s fair to say there are some short-term risks and opportunities. But I’m seriously considering it for my Stocks and Shares ISA as potential opportunity to do better than a 30-year bond.