It goes without saying that Warren Buffett’s investing prowess has long been the subject of financial discourse. His market wisdom and dedication to long-term investing and financial discipline are second to none. But now the 94-year-old legend has finally announced his retirement and will be stepping down as CEO of Berkshire Hathaway at the end of 2025.

As investors reflect on his unprecedented career, attention turns not just to his legacy — but stocks today that may echo his most successful picks. Over his lifetime, he transformed a struggling textile company into a $1.2trn conglomerate, powered by smart capital allocation and a deep understanding of business fundamentals.

Let’s take a look at the stocks that cemented his legacy and one that could mimic that success going forward.

Warren Buffett’s best investments

Known as the ‘Oracle of Omaha’, Buffett’s simple strategy of buying high-quality shares and holding them ‘forever’ is admired by many investors. The companies he chooses are typically those with durable competitive advantages, or ‘economic moats’.

One of his most famous and enduring stock picks is Coca-Cola. Berkshire purchased $1.3bn worth of shares in 1988 — a stake that today is worth over $25bn. This comes due to its consistent dividends and global brand strength — two characteristics that exemplify Buffett’s investment philosophy.

Earlier in his career, he also made a fortune with American Express, buying during a crisis when others were selling. This contrarian mindset of focusing on fundamentals over market fear has consistently defined his success.

So what lesser-known stock today could be the next Buffett-style win?

Coffee culture

Dutch Bros (NASDAQ: BROS) is a fast-growing American coffee chain that could eventually grow to echo classic investments like Coca-Cola. With a cult-like customer base and a vibrant, youth-driven brand, the company is rapidly expanding across the US. Its drive-thru model, energetic culture, and consistent demand create the kind of consumer loyalty that could fuel decades of success.

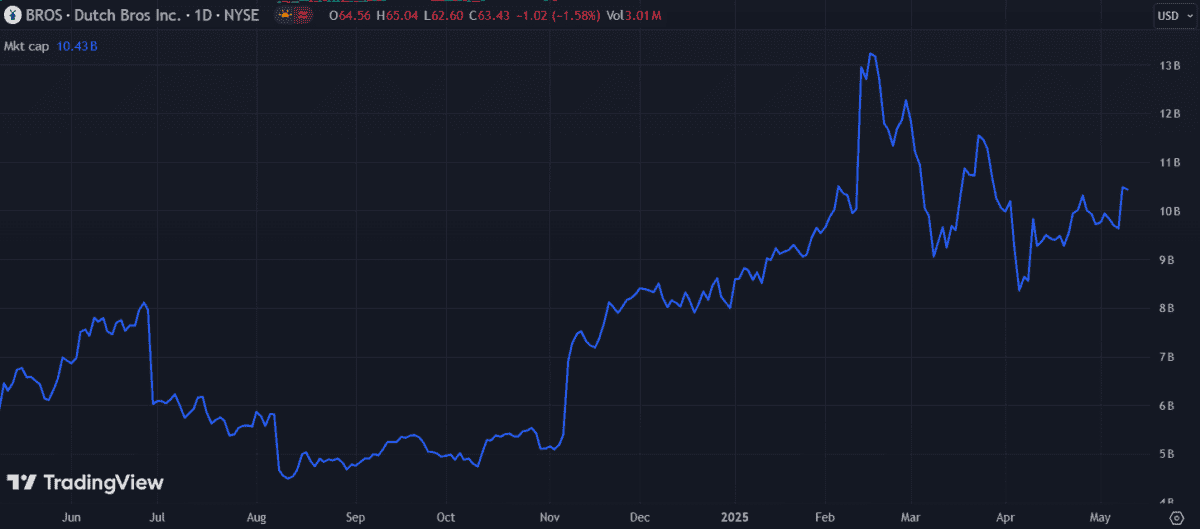

While it’s still relatively small in US terms, its market cap of $10.37bn has almost doubled in the past year.

In 2024, it reported a 32.6% revenue increase to $1.28bn. And its 2025 first-quarter results, posted last week, show no slowdown. The results revealed a 29.1% increase in revenue to $355.2m, with net income climbing 38.6% to $22.5m.

The strong performance prompted an 8.8% price jump, helping to boost its 2025 year-to-date growth to 13%. While down since February, its trailing price-to-earnings (P/E) ratio is still an eye-watering 164. If upcoming earnings fail to impress, this could lead to a notable price drop.

Expansion plans

With just over 1,000 stores currently, Dutch Bros estimates a total addressable market covering 7,000 locations. This expansion potential, paired with strong unit economics and founder-led leadership, makes it a compelling long-term investment option with slow and sustainable growth prospects.

Like Coca-Cola, it markets a high-margin, attractive product with emotional appeal. Sure, competition in the coffee space is intense, but the brand’s differentiation and scalability give it the characteristics of a high-quality, compoundable stock. That said, there still remains a high chance of market share loss if it fails to execute its expansion strategy effectively.

Overall, I think Dutch Bros is an early-stage gem that’s well worth considering — particularly for fans of Warren Buffett’s long-term investing approach.