The BP (LSE:BP.) share price is now (7 May) 32% below its 52-week high. A falling oil price, concerns over how Trump’s tariffs might impact global energy demand, and an internal debate on how ‘green’ the group should be, have all played their part in knocking over £25bn off the group’s stock market valuation.

To compound matters, its 2025 first quarter earnings fell short of analysts’ expectations. If that wasn’t enough to spook investors, the group also reported an unexpected jump in net debt of $3.97bn (17%), compared to the end of 2024.

Not all bad

But despite its present problems, I think its shares offer good value at the moment.

That’s why, in common with activist investor Elliott Investment Management (EIM), I recently took a stake in BP. Admittedly, my position’s much smaller than its 5%, which was disclosed to the market in April.

It’s reported that EIM founder Paul Singer wants BP to significantly cut its costs. According to the Financial Times, he believes it’s possible to increase free cash flow by 40%. To achieve this, he wants to see $5bn of additional (over and above those already planned) annual cost savings.

Indeed, the group does appear to be bloated. Reuters claims that the energy giant’s operating expenses as a proportion of EBITDA (earnings before interest, tax, depreciation and amortisation) have increased from 70% in 2019, to 113% in 2024.

To my surprise, BP now employs more people than Shell, its much larger FTSE 100 rival.

Ethical investors look away now

EIM also wants to see a slower transition to renewable energy.

In February, BP told investors that it was cutting capital expenditure in its ‘clean’ energy division. It also abandoned its previous commitment to reduce oil and gas production by 20-30% by the end of the decade.

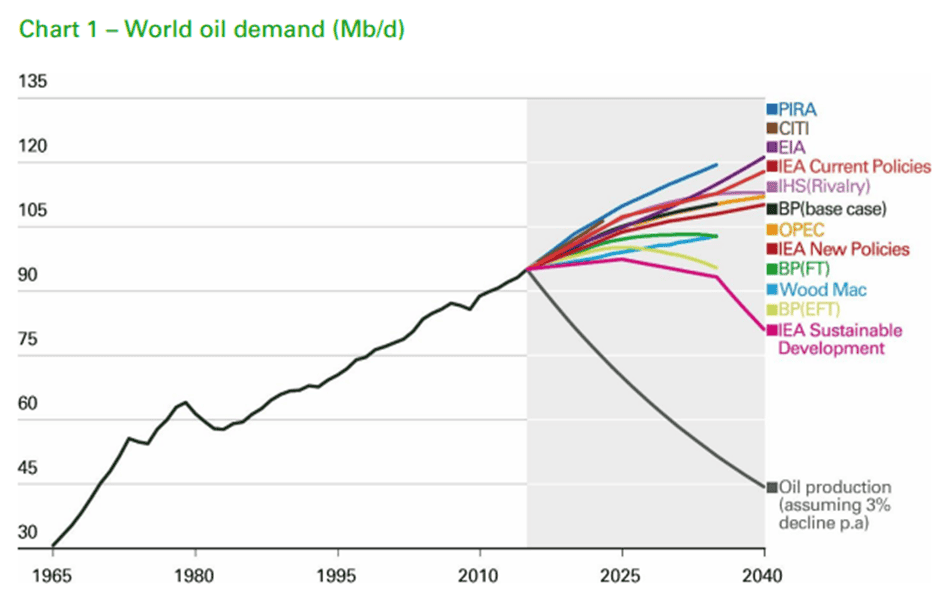

This reflects the reality that, despite the move to net zero, global demand for oil and gas continues to rise. And most economists expect this trend to continue for many more years.

Patience is key

It takes time for cost savings to be implemented, especially in complex groups operating across multiple jurisdictions.

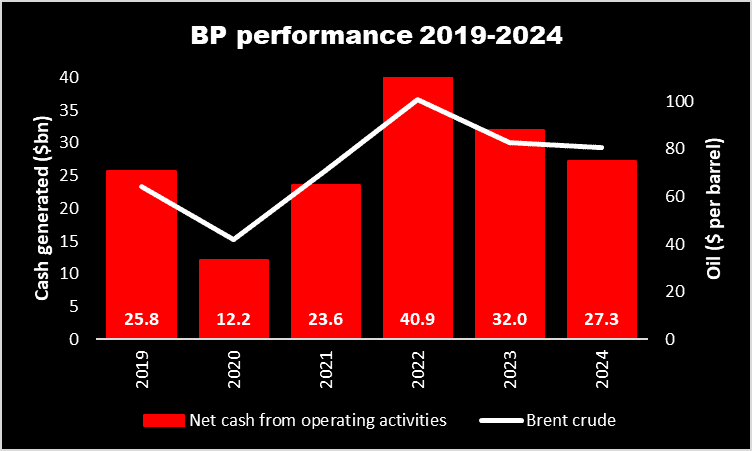

Therefore, in the short term, I think BP’s results will be more heavily influenced by the price of oil. According to its own analysis, a $1 movement in Brent crude has a $340m impact on earnings.

But oil prices are impossible to predict accurately.That’s why I’m expecting some short-term price volatility. It’s one of the risks associated with the sector.

And until the effects of BP’s planned changes become visible in its financial performance, I’ll take comfort from the generous dividend on offer.

Although BP halved its payout in the second quarter of 2020, it’s been steadily increasing it since. In cash terms, it’s now 23.8% lower than before the 50% cut. And in part due to its disappointing share price performance, it’s now in the top 10 of FTSE 100 dividend payers, with a yield of 6.8%.

At this stage, it’s unclear how much influence EIM will have on the strategic decisions made by the oil giant. But in February, BP’s directors acknowledged that the group’s performance needed to improve. With changes underway, and EIM acting as a powerful observer, I’m optimistic this will happen, although I accept it might take some time.