For me, investing in UK shares with a Stocks and Shares ISA and/or a Self-Invested Personal Pension (SIPP) is a no-brainer.

Data from money comparison website Moneyfacts shows why. Over the last 10 years, the average annual return on a Stocks and Shares ISA has been an impressive 9.64%. By comparison, the yearly average on Cash ISAs sits way back at 1.21%.

That’s not to say that savings accounts don’t play an important role. I personally use one to balance risk in my portfolio and to hold money for a rainy day. But the vast majority of my capital is tied up in shares, funds, and trusts.

This way, I think I have a much better chance of hitting my retirement goals.

A clear path

Let’s say someone invested £400 a month in a Stocks and Shares ISA and another £100 in a Cash ISA. If those rate of returns of the past decade remained unchanged, after 30 years our investor would have a portfolio of £880,996 to fund their retirement.

They could then use that money to buy an annuity, purchase dividend shares, or make a regular drawdown for a healthy passive income.

If they chose to put the full £500 monthly sum into a Cash ISA instead, they’d have made just £216,879 over the same timeframe to retire on. I doubt this would give them anywhere near the £43,100 that the Pension and Lifetime Savings Association (PLSA) says that single people need to retire on each year.

As I’ve already alluded to, investing in shares involves more danger than parking one’s cash in a savings account. However, by investing in a range of different stocks, individuals can reduce the risk they face while still targeting strong portfolio growth.

275 shares for a winning ISA

Stocks and Shares ISA holders can easily and cheaply build a diversified portfolio with an investment trust or exchange-traded fund (ETF). These pooled investments often hold dozens, or hundreds, or even thousands of assets to capture different investment opportunities and spread risk.

The JP Morgan American Investment Trust (LSE:JAM) is one such vehicle I think demands serious consideration. With an average annualised return of 14.48% since 2015, shareholder gains here have outstripped what the average Stocks and Shares ISA investor has enjoyed over that timeframe.

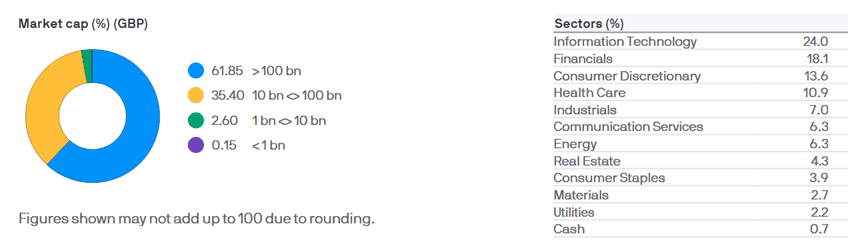

In total, this trust has holdings in 275 different US equities spread across both cyclical and defensive sectors. This gives it strength throughout the economic cycle. What’s more, around 93% of its capital is tied up in large-cap companies (those with market caps of £10bn and more), giving investors large exposure to robust, market-leading companies with cash-rich balance sheets.

Major holdings here include Microsoft, Amazon, Berkshire Hathaway, Nvidia, and Mastercard.

While reducing risk, this investment trust doesn’t eliminate danger entirely. For instance, returns here could disappoint looking ahead if economic conditions in the US worsen and/or global trade tensions worsen.

But, in my opinion, the long-term resilience of the US stock market means this trust still merits serious consideration from ISA investors.