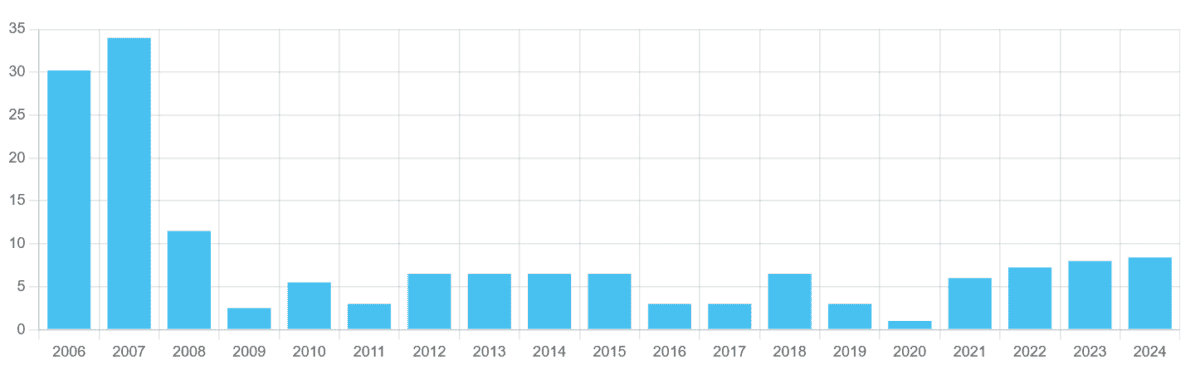

Banks are typically popular stocks for investors seeking a reliable passive income. Barclays (LSE:BARC) shares, however, have been largely disappointing for dividend chasers over the past decade.

Cash rewards at the FTSE 100 bank were cut and then frozen around the middle of the 2010s. This reflected efforts to mend its balance sheet and the costs of vast restructuring.

Barclays then reduced cash rewards around the time of the pandemic after the Bank of England called on banks to preserve capital.

Things have been better since then, however, with dividends rising steadily since 2022. This includes a solid 5% hike in 2024, to 8.4p per share.

But with economic storm clouds gathering, can the bank keep its progressive dividend policy going? And should investors consider buying Barclays shares today?

Mixed bag

Banks are highly sensitive to broader economic conditions. So with the US flirting with recession and its home UK market struggling for growth, Barclays faces a double whammy of sinking revenues and rising impairment charges.

Yet despite this threat, City analysts aren’t expecting Barclays to stop raising shareholder payouts. In fact, dividend growth is tipped to accelerate through to 2027, and even hit double-digit percentages in that time:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 9.15p | 8.9% | 3.1% |

| 2026 | 10.21p | 11.6% | 3.4% |

| 2027 | 11.82p | 15.8% | 4% |

Yet despite that expected growth, the yields on Barclays’ forecasted dividends aren’t half as impressive.

As the table shows, these are in and around the FTSE 100 long-term average of 3%-4%. And the yield for 2025 is also below the index’s forward average of around 3.7%.

Robust estimates

But unlike with many UK shares, current dividend forecasts are built on solid foundations, even factoring in current macroeconomic uncertainty.

For the next three years, dividends on Barclays shares are covered between 4.5 times and 5 times by expected earnings. Any reading of 2 times and above typically provides a wide margin of safety.

On top of this, the bank has a robust balance sheet it can use to support dividends even if profits significantly underwhelm. Its CET1 capital ratio, a measure of solvency, was 13.9% at the end of March, at the upper end of a targeted 13%-14%.

Are Barclays shares a buy?

Based on these figures, then, Barclays shares could be considered by some as a solid-if-unspectacular buy for dividends. Better-than-expected financials last week may have boosted investor appetite still further.

These showed income and pre-tax profits up 11% and 19%, respectively, in quarter one. This was thanks to strong trading at Barclays’ investment bank, where conditions may remain positive if financial market volatility persists.

However, last week’s update more worryingly also showed rising challenges at the firm’s core retail operations. Flagging “heightened uncertainty in the near-term macroeconomic outlook [and] especially in the US“, the bank booked £643m of bad loans in quarter one. This was up from £513m a year earlier.

Barclays also faces weaker loan demand as consumers across the UK and US scale back spending. Rising market competition poses a substantial danger too.

All this could significantly impact Barclays’ share price, I fear, and offset the benefit of those healthy dividends. So, on balance, I think investors should consider other UK shares for passive income.