I’ve been loudly banging the drum for Duolingo (NASDAQ: DUOL) all year long. And putting my money where my mouth is, I’ve bought this growth stock twice in my ISA since the start of 2025.

Recently, the Duolingo share price hit a 52-week high after surging 21.6% in one day (2 May). This took the year-to-date return to 52%.

Here’s why the stock’s been on fire, and why I think it will head even higher in the years ahead.

C’est magnifique!

Launched in 2012, Duolingo is the world’s leading language learning app, offering a ‘freemium’ model alongside two paid subscription tiers. Its mission is “to develop the best education in the world and make it universally available“.

The stock’s spike to a record high last week came after the firm released fantastic Q1 results. Revenue jumped 38% year on year to $231m, beating analysts’ estimates for $223m.

Daily active users surged 49% to 46.6m, as it added more daily users than ever. Monthly active users increased 33% to 130.2m, while paid subscribers rose 40% to 10.3m.

Adjusted EBITDA advanced 27% to $62.8m and free cash flow totalled $103m. Earnings per share (EPS) of $0.72 breezed past analyst expectations of $0.52.

Management raised its full-year revenue guidance to $987m-$996m, which would represent around 33% growth.

Theoretical risk becomes real

Now, the stock isn’t without risk. Back in December, I wrote: “One risk here is the emergence of an AI-powered competitor offering advanced features for free that Duolingo currently charges for.”

Lo and behold, it looks likely we have one in the shape of Google Translate. Various reports say that the tech giant is planning to launch an AI-powered practice mode. So this risk isn’t theoretical anymore.

That said, not everything Google touches turns to gold. Its attempt at a social media platform to compete with Facebook — called Google+ — never caught on. Meanwhile, its music streaming service — YouTube Music — hasn’t stopped Spotify’s impressive growth trajectory.

Nevertheless, it’s something I’ll be monitoring moving forward.

AI-powered growth

One thing I like about Duolingo is that it’s aggressively leaning into generative AI. Its Max subscription tier, which includes AI-powered conversation practice sessions, is attracting more learners to sign up.

And last week, the company launched 148 new language courses, doubling its offering overnight. For context, it took 12 years for mainly humans to create 100 courses, but just 12 months for AI to produce 148.

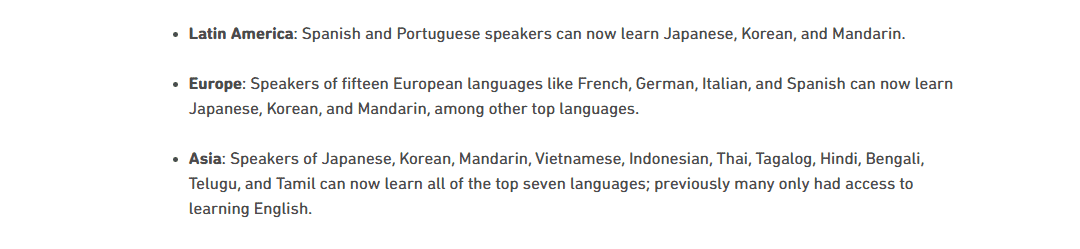

Moreover, this significantly enhances the market opportunity for Asian users to learn popular European languages and vice-versa:

Growing optionality

After its surge, the stock’s trading at around 22 times this year’s expected sales. That’s far from cheap, even if Duolingo beats this forecast.

However, its courses extend beyond languages to maths and music, while the firm’s about to launch a chess course. So the overall opportunity’s expanding.

Following the results, Morgan Stanley’s Nathan Feather said: “Duolingo’s unique, gamified approach to learning allows it to combine the mobile gaming and language learning markets for a $220bn total addressable market. With sub-1% share, it is heavily underpenetrated.“

While I think the stock’s worth considering for long-term investors, the high valuation cannot be ignored. Therefore, it might be worth thinking about building out a full position on dips over time.