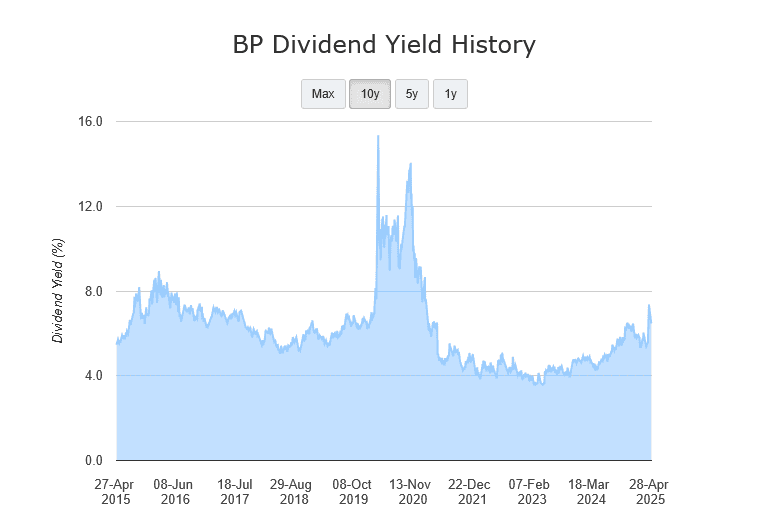

A volatile oil price has created a similarly choppy setting for energy sector profits. But as with many of the world’s oil majors, the dividends on BP (LSE:BP.) shares have continued flowing.

Thanks to its enormous cash flows, dividends from the FTSE 100 company have long outstripped what the broader index has provided in the last decade. That’s even accounting for swingeing payout cuts, and especially around the time of the pandemic:

When economic downturns soften energy demand, the dividend for oil stocks have been known to topple, as BP’s recent record shows. And this remains a risk going forwards as trade wars intensify.

The good news is that City analysts expect cash rewards to continue rising over the next few years. But how realistic are these forecasts, and should I consider buying BP shares today?

7%+ dividend yields

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 24.43p | 1% | 6.9% |

| 2026 | 25.52p | 4.5% | 7.3% |

| 2027 | 26.91p | 5.4% | 7.7% |

As you can see, dividends are tipped to rise modestly this year before growth really takes off from 2026. This — combined with recent weakness in the BP share price — means yields sit around 7% and above for the next few years.

But while these projections are impressive, I believe they stand on extremely shaky foundations. Firstly, predicted dividends through the period aren’t especially well covered by estimated earnings.

This is especially dangerous for economically sensitive shares like oil stocks, as we’ve seen with BP before.

As an investor, I’m seeking a reading of 2 times and above for a wide margin of safety. Unfortunately, dividend cover here sits at 1.6 and 1.7 times for 2025 and 2026, respectively. This improves to 1.8 times for 2027 but is still on the thin side.

Debt climbs

Dividend cover isn’t the be-all-and-end-all when considering a share’s dividend prospects, however. A strong balance sheet can still help businesses see out temporary profits problems and pay great dividends.

Yet BP doesn’t have the solid financial foundations that could help it ride out oil market weakness. Underlying replacement cost profit dropped to $1.4bn from $2.7bn in the first quarter, data last week showed. This in turn prompted net debt to soar $3bn over the 12 months to March, to $27bn.

In an alarming signal of its stressed balance sheet, BP said it would repurchase ‘just’ $750m worth of shares this quarter. That’s down from the $1.75bn it previously bought.

On the plus side, the business has targeted $3bn-$4bn worth of asset sales, along with further cost cutting to mend its finances. But this may end up hardly making a dent if oil prices continue sinking.

Are BP shares a buy?

And the chances of further crude price weakness are substantial, in my opinion. Growing recessionary risks in the US and China pose a substantial threat to energy demand. At the same time, production from both OPEC+ and non-cartel nations is ratcheting higher, putting Brent crude values under a severe squeeze.

This bodes badly for BP’s dividends and share price in the near term. And the company’s outlook over a longer time horizon is plagued with uncertainty, too, as the popularity of renewable energy takes off.

Plans to raise oil production could lift the business if energy prices recover. But on balance, I think investors should consider giving BP shares a wide berth.