The last decade’s been a tale of two halves for Aviva (LSE:AV.) shares. Strategy issues, combined with challenges during the Covid-19 pandemic, pushed the FTSE 100 business to its cheapest since the Great Financial Crisis of 2020. Its lowest point came in March that year when it struck 203.23p per share.

But the share price has rebounded sharply from those troughs. Helped by a solid (if bumpy) economic recovery, not to mention a vast restructuring under chief executive Amanda Blanc from summer 2020, the financial services giant has bounced back and was more recently trading at 543.8p.

Sub-FTSE 100 returns

All of this means that someone who invested £10,000 in Aviva shares a decade ago would have seen the value of their investment rise to £10,442. That reflects a share price rise of 4.4% from 520.68p.

That’s a pretty mediocre return, I’m sure you’d agree. But when also considering dividends paid in that time, the picture changes a lot.

Dividends have totalled 240.2p per share in that time. When added to Aviva’s share price gains, someone who invested £10k a decade ago would now have £15,055 to show for it, reflecting a total shareholder return of 50.6%.

But I’m not done yet. I’m a big fan of Aviva shares — the company is a key plan in my own portfolio — yet the total return since spring 2015 still lags the 85.1% that the FTSE 100’s dished out in that time.

Can the financial services firm deliver a better return looking ahead?

Aviva forecasts

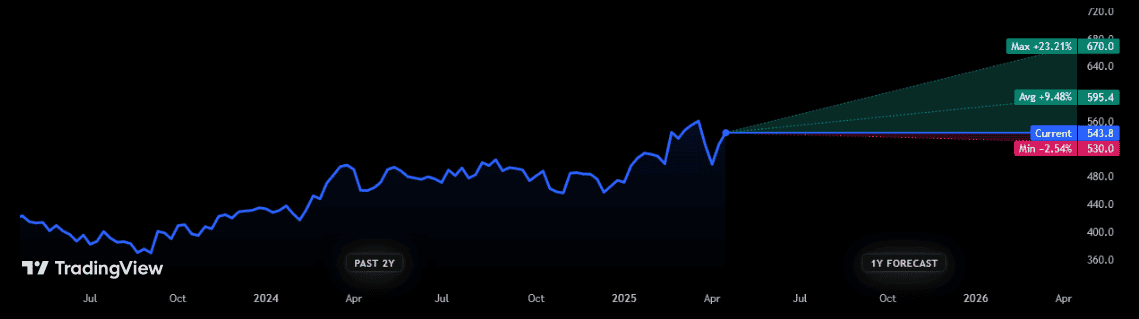

Sadly, broker forecasts for Aviva’s share price aren’t available for the next 10 years. However, they’re available for the coming 12 months. And they largely paint a positive outlook.

The 12 analysts with ratings on Aviva shares think prices will rise by close to double-digit percentages. One thinks they’ll appreciate by almost a quarter, though such positivity isn’t unanimous — one bearish broker thinks prices will backpeddle by low single digits.

It’s important to note that tough economic conditions could hinder such price gains looking ahead. Furthermore, intense competition could also limit future progress by hitting revenues and profit margins.

Yet I’m optimistic that Aviva could soar in value, both in 2025 and long beyond. Its growing focus on capital-light businesses — which recently saw it snap up Direct Line and AIG‘s life insurance business — should give earnings a significant shot in the arm.

A focus on protection, wealth and retirement products could also help lift Aviva’s share price, proving multiple ways for it to capitalise on demographic changes. Its bulk annuity business in particular offers substantial growth potential.

Dividend boost

This also means Aviva (in my view) looks in good shape to keep increasing dividends, providing a further substantial boost to shareholder returns.

Indeed, analysts think dividends will continue rising through to the end of next year at least. Aviva’s rock-solid balance sheet means current estimates look very much achievable as well (the Solvency II capital ratio here is 203%, latest financials show).

Between 2025 and 2027, the dividend yields on Aviva shares range from 7% to 8.1%. Both readings are subtantially above the 3.7% average for FTSE 100 shares.

While nothing’s guaranteed, I expect Aviva to deliver Footsie-beating returns over the next 10 years, making it worth serious consideration.