Thanks to its significant tax benefits, the Stocks and Shares ISA has proven an excellent way to help Britons build long-term wealth.

Research from Bowmore Financial Planning shows that ISA investors were protected from £9.4bn worth of tax liabilities in the 2024-2025 fiscal year alone. This covers Stocks and Shares ISAs alongside Lifetime ISAs and Cash ISAs.

These tax savings can be put to work in a portfolio too, helping deliver greater long-term investor returns through compounding. And thanks to changes down the years, investors have a vast range of securities they can choose to make this happen.

With access to thousands of shares, trusts and funds from the UK and overseas, individuals have the chance to pursue a multitude of investing strategies. Each of us have different investment goals and tolerances to risk, so having access to such choices allows us to customise our portfolio to suit our personal financial journey.

3 top ISA picks to consider

With this in mind, here are three great shares from the FTSE 100 I think would look good in a diversified portfolio. Covering growth, value and dividends, they’ve the potential to provide substantial capital gains over time along with a robust passive income.

The growth stock

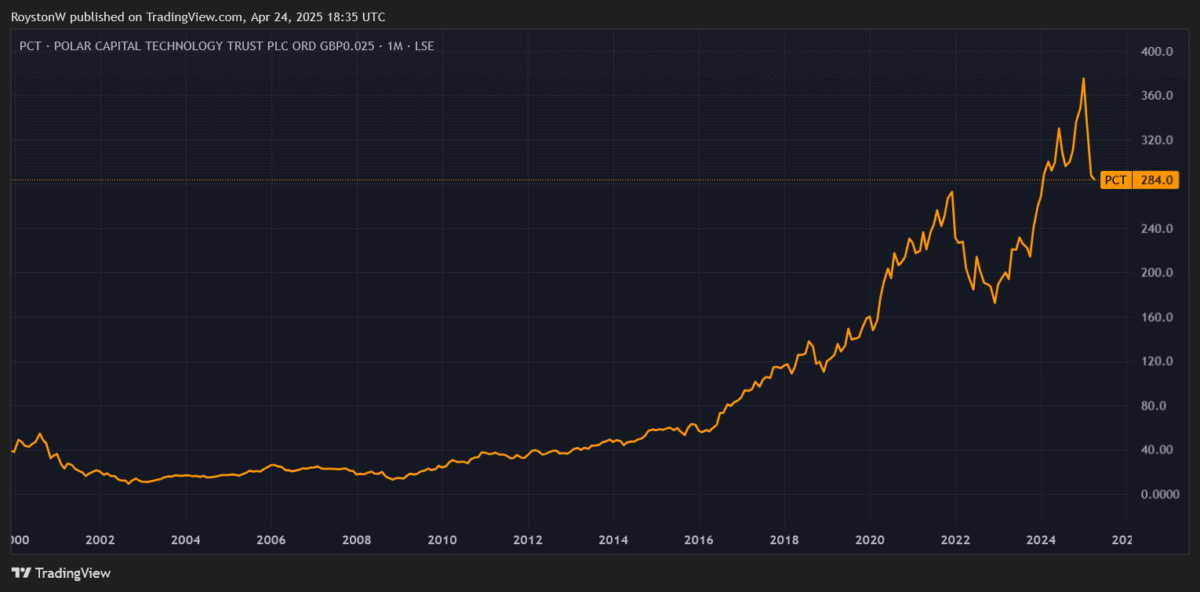

Polar Capital Technology Trust, which was launched in 1996, invests in a wide range of businesses. These include semiconductor manufacturers like Nvidia, software developers like Microsoft and consumer electronics makers like Apple.

As a consequence, it provides exposure to a multitude of fast-growing tech segments like artificial intelligence (AI), cloud computing, robotics and quantum computing. In total, it holds positions in 104 businesses worldwide, providing strength in depth.

During the last decade, Polar Capital Technology Trust’s provided a tasty average annual return of 17.4%. Be mindful that future performance could suffer if global trade tariffs continue climbing.

The value share

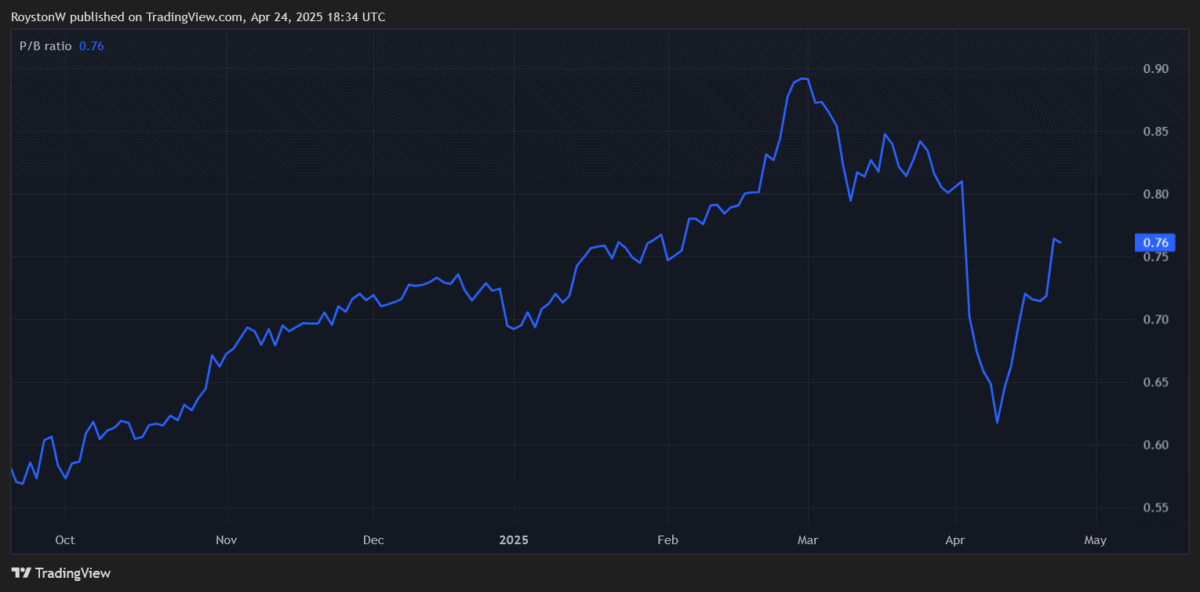

Standard Chartered generates the lion’s share of its profits from Asia. This means returns could underwhelm in China’s heavyweight economy remain challenging.

Yet I believe this scenario is more than baked into the bank’s rock-bottom valuation. Its price-to-book (P/B) ratio sits below 1, indicating that the firm trades at a discount to the value of its assets.

StanChart also boasts a price-to-earnings (P/E) multiple of 7.7 times, and a sub-1 price-to-earnings growth (PEG) ratio of 0.6.

Over the long term, I think earnings could soar as the firm’s emerging markets rapidly grow.

The dividend stock

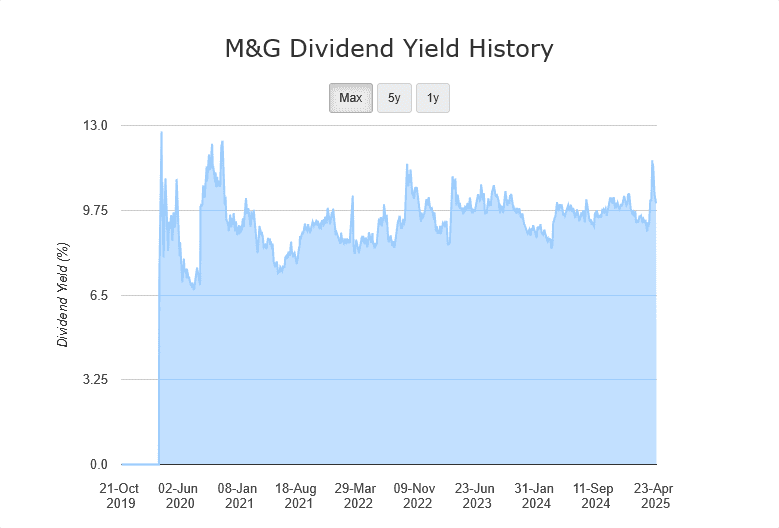

At 10.2%, financial services provider M&G (LSE:MNG) currently has the largest dividend yield on the FTSE 100. But unlike many high-yielding shares, I think the policy of paying large shareholder rewards over time is very sustainable.

As the chart shows, M&G has a strong record of offering above-average yields.

The business is an impressive generator of cash and as of December, its Solvency II capital ratio was 223%, up 200 basis points year on year. This puts it in good shape to pay more Footsie-beating dividends in the near term, at least.

On the other hand, intense market competition could threaten profits and dividends further down the line. But I’m optimistic that M&G’s robust brand power could help it keep thriving in a growing marketplace.