The Stocks and Shares ISA is an incredible vehicle for investing. No capital gains tax, no income tax. It’s something that almost every investing Briton will attempt to use. And it’s simple to set up. Almost every major brokerage in the UK provides access to an ISA wrapper.

I’m led to believe that the average size of a Stocks and Shares ISA in the UK is £8,737. That’s probably not a life-changing amount of money for most people. And that’s certainly not going to provide enough income for someone to live on.

So, how can an investor turn this ordinary ISA into something much larger?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Simple steps

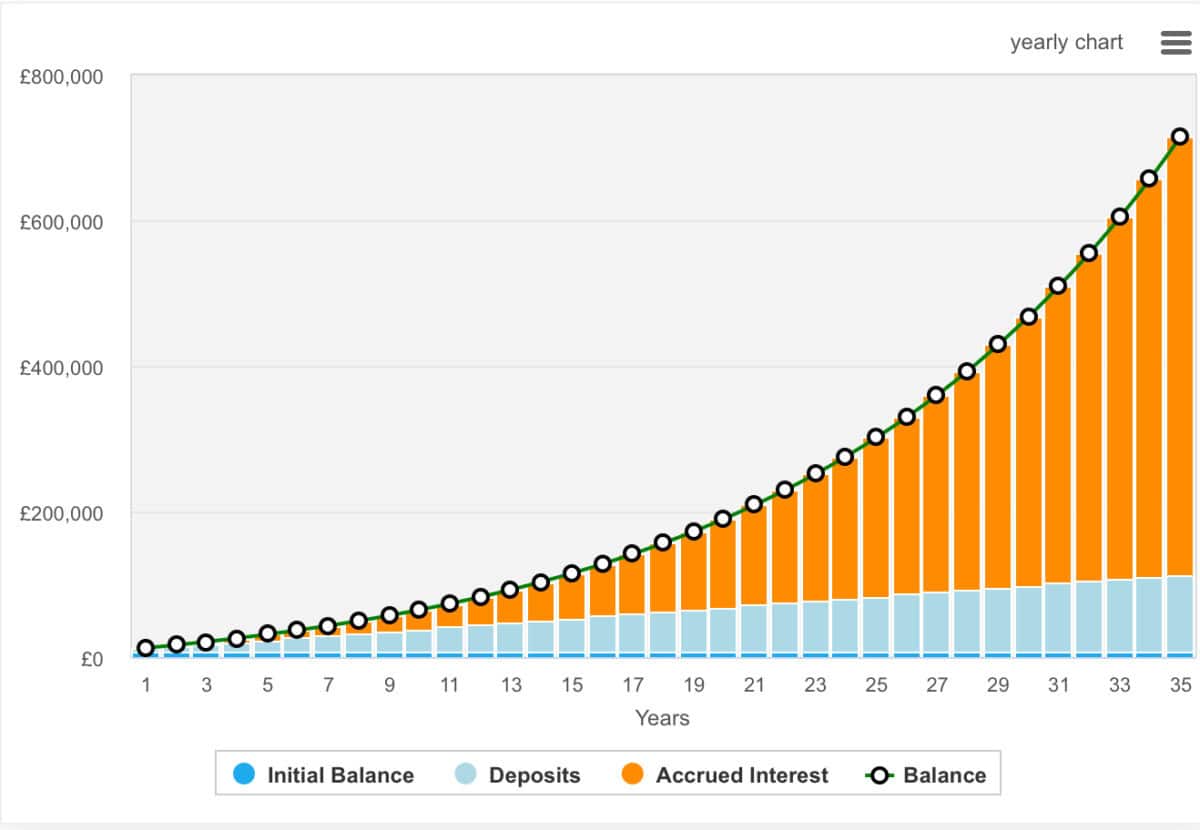

To transform an ordinary Stocks and Shares ISA into a much larger pot, the first step is to consistently make use of the annual ISA allowance. For the 2025/26 tax year, this allowance is £20,000, and using as much of it as possible each year can dramatically accelerate the growth of investments. Regular contributions, even if they start small, can add up significantly over time thanks to the power of compounding returns.

Another key strategy is to focus on long-term investing. Stocks and Shares ISAs are designed for longer time horizons — typically five years or more — which increases the chances of seeing positive returns compared to cash savings. By staying invested and avoiding the temptation to make withdrawals or react to short-term market volatility, investments have the best chance to grow through both share price appreciation and reinvested dividends.

Finally, reinvesting dividends can supercharge an ISA’s growth. Many companies pay dividends to shareholders, and by choosing to reinvest these payouts rather than withdrawing them, investors can benefit from compounding. Over time, reinvested dividends can make a substantial difference. This approach, combined with regular contributions and a long-term mindset, can help turn an average ISA into a much larger nest egg.

Here’s an example of how things can add up. The below assumes £250 of monthly contributions and an average 8% growth rate.

Stocks for the job

If an investor already has a relatively diversified portfolio, including index trackers, funds, or maybe even just a good variety of stocks, they may wish to consider a stock like Jet2 (LSE:JET2). Why Jet2? Well, I believe it’s one of the most undervalued and overlooked stocks on the British market.

The firm currently trades with a net cash adjusted price-to-earnings (P/E) ratio of just one. In other words, when we subtract net cash from the market cap, all that’s left is one year of earnings. That’s truly exceptional.

Of course, the company isn’t perfect. Its fleet is a little older than some of its peers and the autumn Budget will add around £25m in costs. This will have to be absorbed or passed onto customers.

However, its steady fleet transformation and expansion planning over the next decade are certainly intriguing. Coupled with its super low valuation compared with peers, I’ve been adding this one to my portfolio.