Searching for the best dividend shares to buy next month? Here are three I think deserve a closer look, each of which have dividend yields above 10%.

A FTSE 100 heavyweight

Sellers of discretionary financial products like asset manager M&G (LSE:MNG) are vulnerable during economic downturns. With trade tariffs threatening economic growth, this FTSE 100 firm could be in for a tough time.

Yet a strong balance sheet means this should have little impact on near-term dividends at least, in my view. The dividend yield for this year is 10.5%, supported by the company’s Solvency II ratio of 223%. Only Legal & General, whose own capital ratio is 232%, has stronger financial foundations among UK-listed financial services providers.

What’s more, while weakening consumer demand as the economy cools is a large risk, M&G’s ongoing cost-cutting could help insulate the bottom line from fresh pressures. The FTSE firm expects to grow operating profit at an average annual rate of 5% or more during the three years to 2027.

Look East

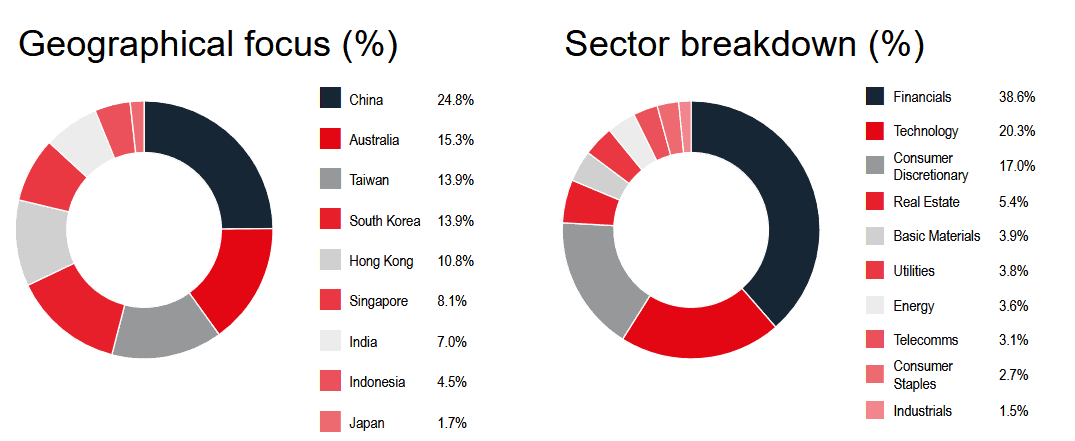

Henderson Far East Income‘s (LSE:HFEL) an investment trust to consider that I feel could provide protection due to its spread of investments. Its capital is effectively spread across 71 different companies spanning different territories and industries, including classic defensive sectors such as utilities, real estate and consumer staples.

It has exposure to cyclical shares and so is vulnerable during economic downturns. But as mentioned, the risk tends to be shared across a much larger range of companies, which can reduce the impact of any volatility on shareholder returns.

This helps insulate total returns in the event of company-, sector- or region-specific threats, and a smoother return over the long term. This resilience has allowed it to raise annual dividends every year since it came into being in 2006.

For this year, Henderson Far East Income’s dividend yield is a mighty 12.2%. Investors need to be aware that its ongoing charge of 1.08% is higher than many other investment trusts. But I think this premium could be worth it.

Another solid dividend share

NextEnergy Solar Income‘s (LSE:NESF) another investment trust I feel investors should consider today. And not just because its 12.3% dividend yield also makes it one of the more potentially lucrative dividend shares currently around.

As the name implies, this financial vehicle invests in renewable assets. And so earnings (and consequently dividends) remain stable at all points of the cycle. In the case of this particular operator, most of its contracts are also inflation linked, providing profits with protection against rising costs.

That’s not to say that businesses like this are totally without risk. Power generation from renewable energy sources is notoriously volatile due to unpredictable weather conditions. However, NextEnergy Solar Income’s sought to soften this threat by siting around 15% of its assets outside the UK, and spreading the rest across the length and breadth of the country.

I think it’s worth a close look from investors seeking a reliable passive income.