Looking for the best growth shares to consider in the coming days? Here’s one of my favourites.

Growth at a good price

Gold prices have hit fresh highs each month so far in 2025. I think there’s a good chance of fresh peaks in May, making gold producers attractive stocks to potentially buy.

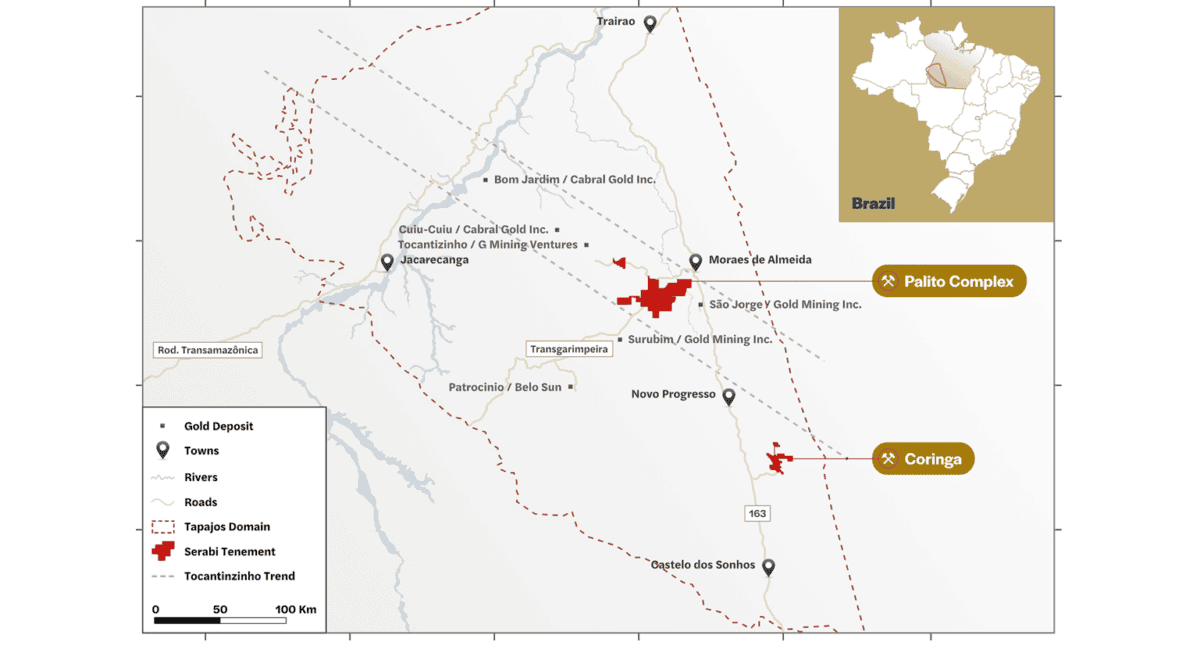

Of the several UK gold shares to choose from, Serabi Gold‘s (LSE:SRB) one of my favourite because of its stunning value. City analysts expect earnings to soar 88% in 2025, driven by lofty gold prices and steps to increase output. This leaves the Brazilian miner trading on a price-to-earnings (P/E) ratio of 3.2 times.

This also means Serabi shares trade on a price-to-earnings growth (PEG) ratio below 0.1. A reminder that any sub-1 reading indicates a share is undervalued relative to expected profits.

Bull run

The sensitivity of gold stocks’ profits to metal prices can be a blessing or a curse. So while Serabi’s price is soaring at the moment, it’s important to remember that a downswing in bullion values could pull it back to earth with a bang.

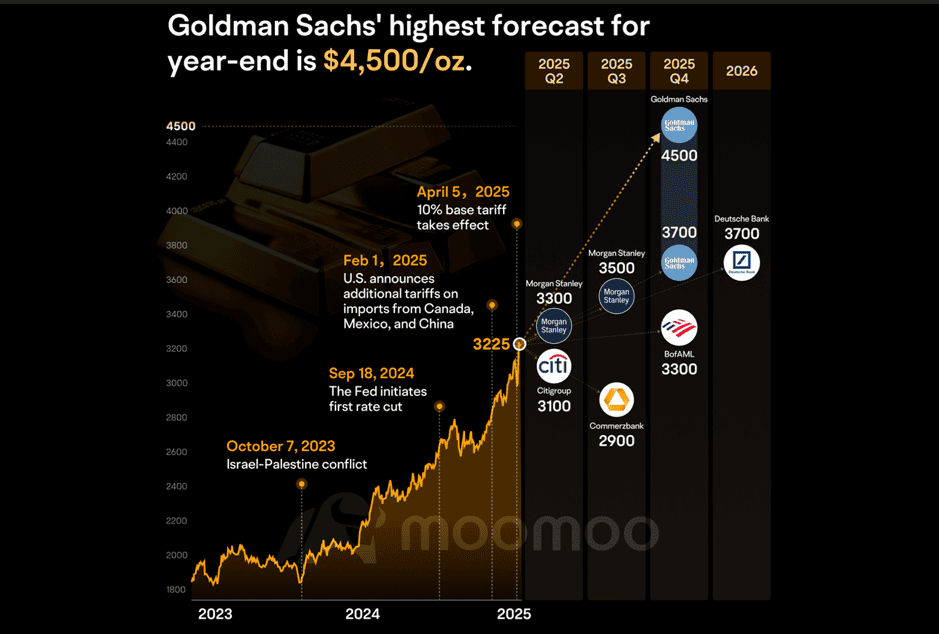

That said, I’m optimistic that gold can continue ploughing new territory in the weeks and months ahead. My optimism is shared by several major banks too, a flavour of which are shown in the graph above.

Escalating trade wars, global interest rate cuts, a plunging US dollar, and growing geopolitical uncertainty all remain potential drivers for the yellow metal, which is two-and-a-half years into its current bull run. Planned production ramp-ups could leave Serabi well placed to capitalise on this too, if output ramps up to expected levels.

Production growth

Chief executive Michael Hodgson this month told podcast Company Interviews that business plans is on course to produce around 45,000 ounces in 2025, up from 37,520 ounces last year.

As Serabi develops its Coringa asset and works to expand its resource base, Hodgson said he expects group output to head still higher. Over the next few years, group production is tipped to hit:

- 60,000 ounces in 2026

- 70,000-75,000 ounces in 2027

- Up to 100,000 ounces by 2028

It’s important to remember however, that metals mining is a complex and unpredictable business. Even companies with solid track records like Serabi can suffer setbacks at the development and production phases that depress profits and by extension the share price.

A gold-plated bargain?

Furthermore, miners who operate in single territories like this are more exposed to both political and exchange rate risks than producers that operate in multiple regions. At the moment, Brazil is a favourable place for Serabi to do business on both fronts, though things can change.

However, it’s my belief that these risks are reflected in this specific miner’s rock-bottom valuation. As a leveraged way to capitalise on the soaring gold price, I think it’s a highly attractive growth stock to consider today.