Building a reliable stream of passive income is no easy feat — trust me, I know! I’ve tried everything from drop-shipping and affiliate marketing to ebooks and selling photographs.

But every now and then, an opportunity comes along that could be a game-changer.

A market crash might not sound like an opportunity, but many investors — including Warren Buffett — have used such events to their advantage. Experienced investors know to trust the market to recover even when all seems lost.

Rather than focus on their losses, they see discount prices and capitalise on the moment. In the long run, this ability to strike while the iron is hot usually pays off.

The chance of a stock market crash in 2025 is lessening as the initial fears around US trade tariffs subside. But the possibility isn’t ruled out just yet. In the event of a crash, here’s how investors could benefit — particularly in the UK, where many FTSE 100 companies offer reliable dividends.

Soaring dividend yields

A stock’s dividend yield is calculated as: dividend yield = annual dividend per share ÷ share price.

So, if share prices fall and the company maintains its dividend payout, the yield goes up.

Example:

- If a stock pays a £1 dividend and trades at £20, its yield is 5%.

- If the price drops to £10 in a crash, but the £1 dividend stays the same, the yield doubles to 10%.

During downturns, high-quality dividend-paying companies (especially in sectors like utilities, healthcare, and consumer staples) often become available at a discount. So investors with a long-term view can lock in higher yields for years to come, reinvest the dividends at lower prices, and compound the returns faster.

A cautious approach

The above strategy may sound simple but the trick to success is picking the right stocks. It’s important to focus on resilient companies with strong balance sheets, stable earnings, and histories of consistent dividend growth.

One example to consider is the gas and electricity network operator National Grid (LSE: NG.).

With the share price up 12% already this year, the yield has fallen to a moderate 5%. However, back in May last year, when the price was down 20%, the yield rose to nearly 7%. A larger price dip could push the yield as high as 8% or 9%, making the stock especially attractive for income-seeking investors.

The utilities provider has paid consistent dividends for decades and operates under long-term regulatory frameworks, which provide predictable cash flows. That means payments are typically well-covered by earnings and supported by a strong investment-grade credit rating.

At the same time, regulations can also limit profits — for example, if the government legislates for lower energy prices. Last year, the company had to cut dividends for the first time in 20 years to support upgrade work. If cash flows don’t improve, it may have to make further cuts.

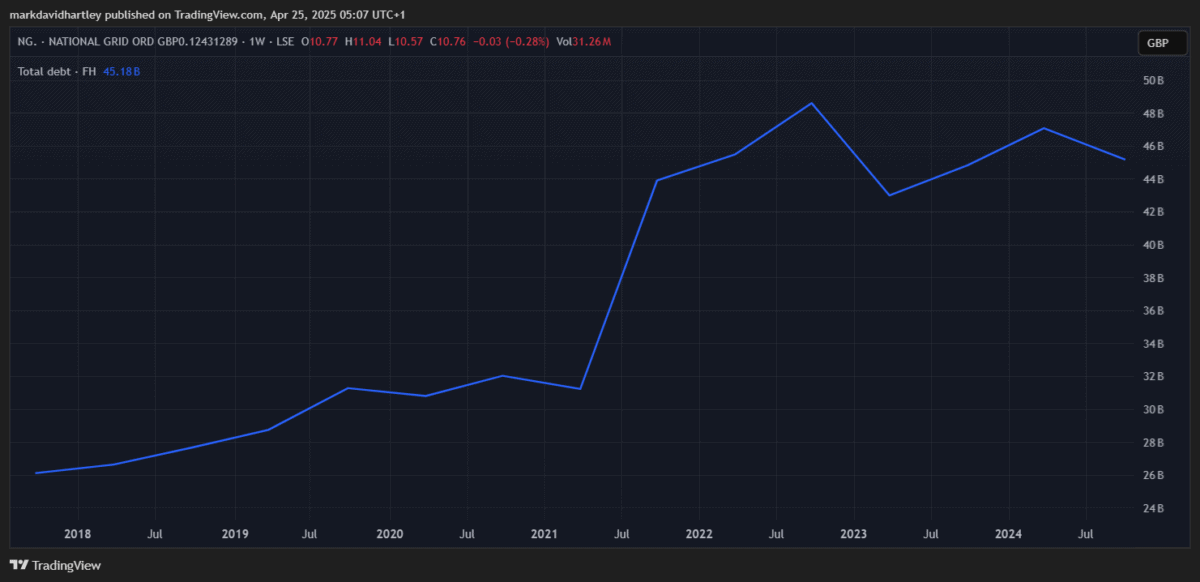

Rising interest rates or a move back into a high-inflation environment are also threats — particularly considering how much debt National Grid carries.

Still, National Grid is worth considering for long-term investors seeking reliable income and low-volatility exposure — especially when purchased at a discount.