Since April 2024, the Hikma Pharmaceuticals (LSE:HIK) share price has risen 5%, matching the performance of the FTSE 100. And based on dividends declared over the same period, the stock’s presently yielding 3.2%. The average for the Footsie as a whole is 3.5%. On these measures, the manufacturer of generic, branded and in-licensed medicines, could be described as the ‘most average’ on the index.

And in my opinion, there’s nothing wrong with that. If these figures were maintained for a period of 30 years, a £10,000 investment made today — with dividends reinvested — would grow to £111,191.

An uncertain world

But investors appear jittery about the impact of President Trump’s approach to tariffs. In particular, the pharmaceutical industry is nervous.

For example, during February, compared to 12 months earlier, Ireland’s medical exports to the United States increased by 145.7%, as manufacturers rushed to get products into the country ahead of any possible announcements concerning additional import taxes.

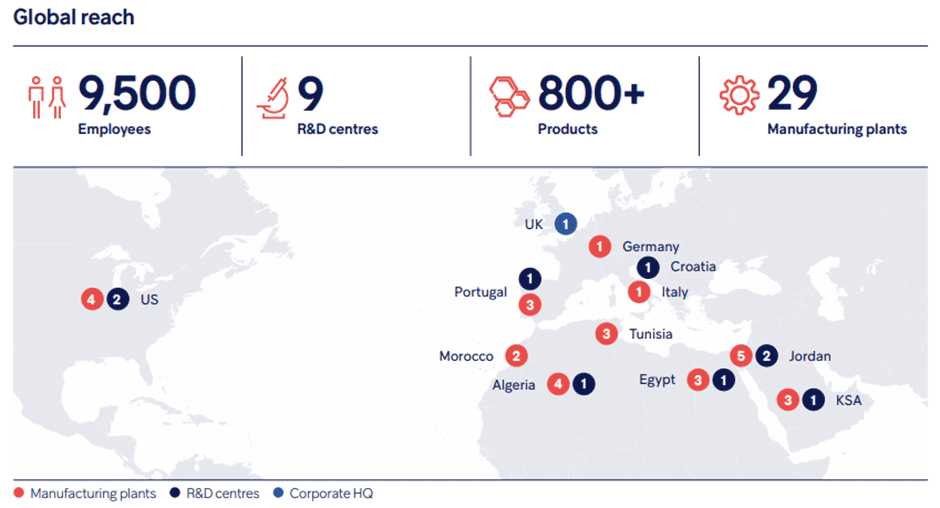

In 2024, sales by Hikma Pharmaceuticals to America accounted for 60% of revenue, which could make it vulnerable. Fortunately for shareholders, the company has four manufacturing plants — as well as two research and development facilities — inside the country so it should fare better than some of its rivals.

A solid financial performance

Recently, the group reported a decent set of results for 2024. Compared to the previous year, core revenue was 10% higher and core operating profit increased by 2%.

Underlying earnings per share went up by one cent to $2.24. This means the shares trade on a very reasonable 11 times historical earnings. Compare this to, for example, AstraZeneca. Its stock is approximately 50% more expensive.

The company also has a good track record in growing its dividend. In cash terms, its 2024 payout is 60% higher than it was in 2020. In fact, the average annual increase over this period has been 12.5%. Of course, dividends can fluctuate from one period to the next.

Pros and cons

But medical research is expensive. The company plans to increase the proportion of its revenue spent on R&D to 6%-7%, as it seeks to build on its existing portfolio of 800 products. However, there’s no guarantee that this investment will yield the desired results.

Inflation is also putting pressure on the group’s margin.

In addition, its business is relatively concentrated in a small number of countries. This could be a problem if any of them experienced an economic slowdown. Its three biggest markets — the US, Saudi Arabia and Algeria — contributed over 75% to revenue in 2024.

However, ill-health is big business — the global industry’s expected to be worth $2.3trn by 2028. And by focusing on generic and in-licensed (acquired from other companies) products, it’s able to under-cut those selling branded pharmaceuticals.

Due to the turbulent times in which we live, it’s difficult to know who the winners and losers will be during President Trump’s remaining time in office. As Robert Kiyosaki, the businessman and author, once wrote: “A financial crisis is a great time for professional investors and a horrible time for average ones”.

However, despite the current uncertainty, I think Hikma Pharmaceuticals –- the most average of FTSE 100 stocks – could be one for long-term investors to take a look at.