Looking for the greatest, cheap FTSE 250 shares to buy right now? Here are three quality bargains to consider.

Hochschild Mining

The precious metals price surge has lifted Hochschild Mining (LSE:HOC) shares through the roof in recent times. But investors can still get good value from the gold and silver producer today.

City analysts think annual earnings here will soar 104% year on year in 2025. That leaves it trading on a price-to-earnings (P/E) ratio of 10.4 times. On top of this, Hochschild’s corresponding price-to-earnings growth (PEG) ratio is 0.1. Any reading below 1 indicates that a stock is undervalued.

The FTSE 250 miner owns a handful of assets across South America, which leaves profits at group level less sensitive to isolated operational problems. Costs remain a wide scale issue however and in January, Hochschild hiked its cost forecasts for the year.

Yet despite these pressures, I believe gold and silver’s continued bull run makes the mining giant an attractive share to think about.

Supermarket Income REIT

Investors seeking protection from an escalating trade war have piled into Supermarket Income REIT (LSE:SUPR) shares in recent weeks. The trust’s focus on the ultra-stable food market, combined with its focus on the UK, make it a natural safe haven as global trading rules face a potential earthquake.

Yet despite these price gains, the real estate investment trust (REIT) still offers excellent value right now. It trades at a meaty 12.4% discount to its estimated net asset value (NAV) per share.

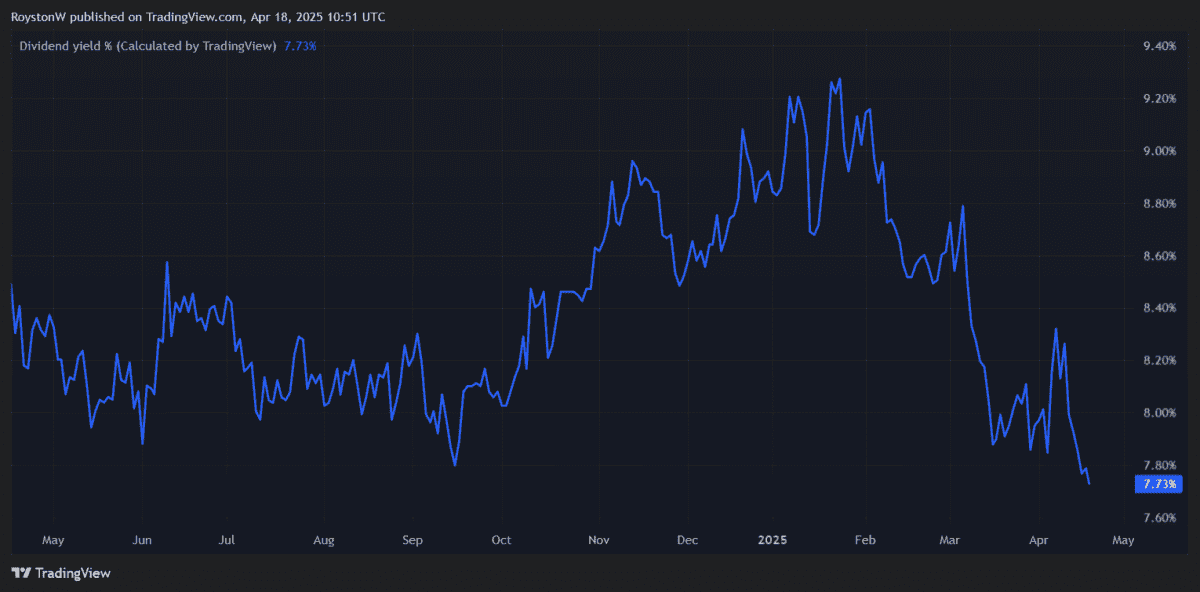

The trust also continues to offer market-smashing dividend yields. Approaching 8%, its forward reading makes mincemeat of the 3.7% average for FTSE 250 shares.

Supermarket Income — which rents properties out to retail giants such as Tesco, Sainsbury’s and Carrefour — offers distinct advantages to dividend chasers. In exchange for tax perks, at least 90% of its annual rental profits have to be paid out to shareholders.

Be mindful when considering this one that overall returns could be impacted by interest rate changes that hit NAVs and drive up borrowing costs.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Crest Nicholson

With the UK economy spluttering, a sustained recover for housebuilders like Crest Nicholson (LSE:CRST) is by no means guaranteed. And that’s not the only threat, as a potential trade war could fuel inflation and drive up housebuyer costs through higher interest rates.

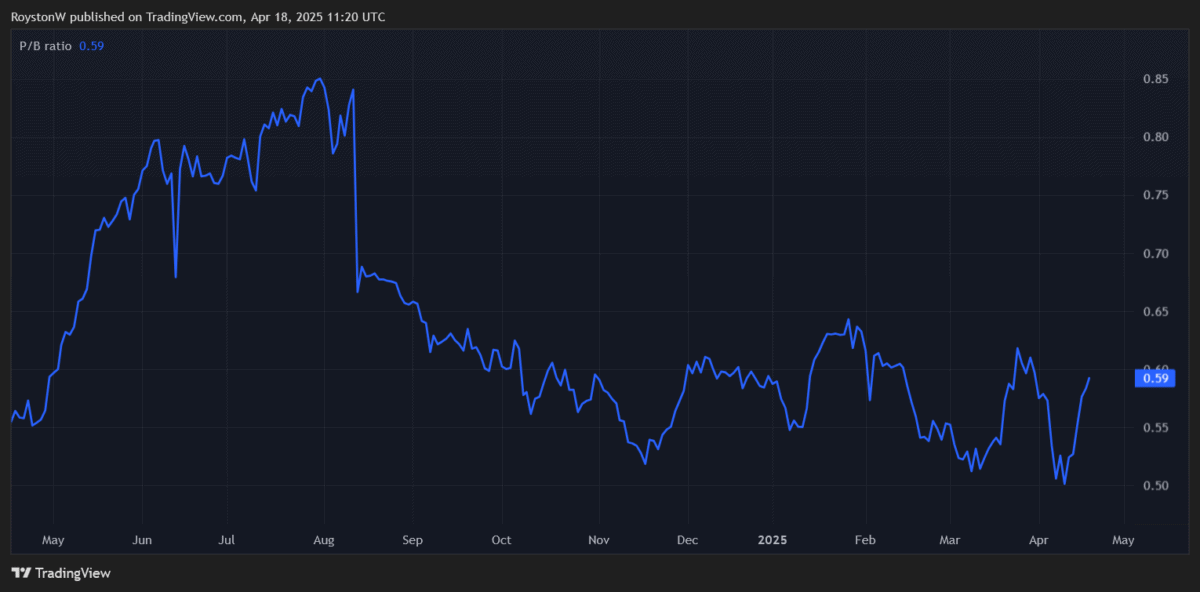

However, I think this threat’s baked into many of these companies’ low valuations. With this particular FTSE 250 operator, its shares trade on a price-to-book (P/B) ratio below 1, which implies a discount relative to the value of the firm’s assets.

Potential investors here should also be encouraged by the resilience of the housing market despite tough economic conditions. Crest Nicholson’s own open market sales rate (excluding bulk purchases) was 0.61 in the 10 weeks to 14 March, up from 0.5 a year earlier.

Housebuilders like this could be great long-term investments to research too, as Britain’s soaring population drives demand for new homes.