Unlike our American counterparts, many UK investors prefer to focus on stocks with high dividend yields — rather than those promising exceptional price growth.

This seems to be a particularly British trend, one that likely arises from the appeal of reliable and consistent income. Dividend-paying shares can provide a steady cash flow, which is attractive to retirees and income-focused investors who prioritise regular returns over capital appreciation.

In addition, high-yield stocks are often associated with established, financially stable companies, which may offer greater resilience during periods of market volatility. For many, this strategy is seen as a way to build passive income while potentially reinvesting dividends to maximise the long-term returns.

Calculating dividend returns

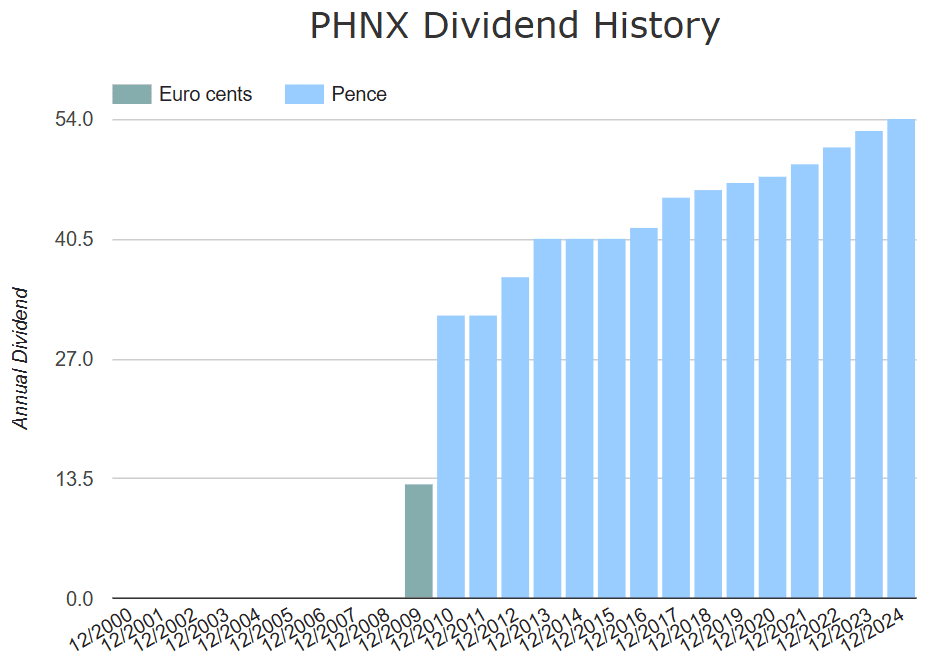

Calculating the returns from a dividend stock can be more complex than just adding the percentage of price performance. Take the UK insurance giant Phoenix Group (LSE: PHNX), for example.

One year ago, the shares were 487p each. With £10,000, an investor could have bought approximately 2,053 shares.

Had the investor bought the shares by 11 April 2024, they’d have qualified for the 2023 final year dividend of 26.65p per share, paid on 22 May 2024. That would have paid out £547.12 in dividends. By reinvesting those dividends, it would increase the holdings by 108 shares to 2,161 shares.

Having held the shares throughout the second half of the fiscal year, the investor would also receive the 2024 interim dividend of 26.65p per share, paid on 31 October 2024. That would equate to a further £575.99 — an extra 117 shares if reinvested.

The investor would now have a total of 2,278 shares, with the total dividends received over the year worth £1,123. Today, the Phoenix Group share price has increased by 19% to £5.78, so the shares would now be worth £13,178.

In total, a £10,000 investment one year ago would have returned around £3,178 — an eye-watering 31.7% return on investment!

This example reveals the compounding magic of reinvesting the dividends earned from high-yielding stocks.

A sustainable dividend yield?

Phoenix may have done well in the past year but as the saying goes, “past performance is no indication of future results“. Is it still a stock worth considering for its dividend yield in 2025?

While it offers notable value in regard to dividends, there are risks. Recent financial performance has been less than ideal, with the company posting a £1.12bn loss in 2024. This was largely due to operating expenses exceeding revenue by £661m.

But it still achieved a 31% increase in adjusted operating profit and cash flow of £1.4bn.

For now, the financial situation is somewhat sketchy and could potentially lead to a dividend cut if things don’t improve. That would largely negate the company’s value proposition, potentially prompting a sell-off and further losses.

Analysis of the stock is sombre, with the average 12-month price target eyeing an increase of only 8.6%. Yet dividends are forecast to continue growing steadily, reaching 55.7p this year and 57.3p next year.

While there are considerable concerns regarding the company’s financials, I think it’s still in a secure position. Barring another economic disaster, I think it has a good chance of recovery and is worth considering for dividend income.