Millions of us invest for passive income. However, most don’t know where to start. That’s especially the case for those of us without anything saved.

So where does an investor begin, especially with no nest egg at age 30? The answer, as ever, is deceptively simple. Start putting aside a portion of salary each month.

Even if the amount feels modest at first — perhaps £100 or £200, whatever is manageable — the key is consistency. By treating savings as a non-negotiable expense, akin to rent or council tax, a foundation’s created for a future portfolio that works independently.

Compounding magic

But here’s the real magic: compounding. This is the quiet force that transforms small, regular investments into substantial wealth over time. And that’s important. Because we need substantial wealth in order to earn a passive income.

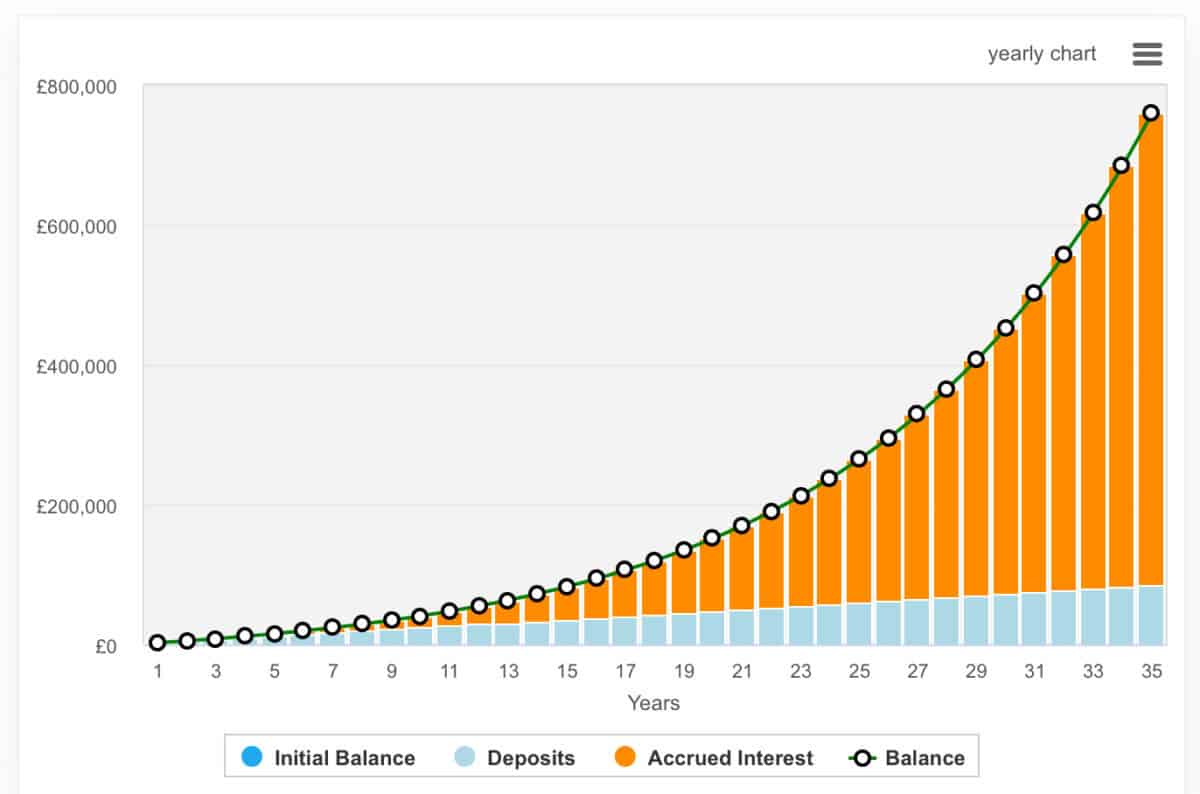

For example, if £200 is invested each month from age 30, and an average annual return of 5% is achieved, by age 65 the resulting pot could be well into six figures. However, more successful investors may be able to average double-digit returns over the period.

As we can see from the below chart, £200 a month could compound into nearly £800,000 with 10% annualised growth (which not everyone will be able to achieve).

The earlier the start, the more powerful compounding becomes. Consider two hypothetical investors: one begins at 30, the other waits until 40 but doubles the monthly contribution. Despite putting in more money, the late starter’s unlikely to catch up, simply because the early bird’s money has had more time to snowball.

Reinvesting dividends is another crucial lever. Rather than taking payouts as cash, dividends need to be ploughed back into holdings. This creates a virtuous cycle that accelerates growth.

Above all, patience is the greatest ally. The urge to tinker or chase fads can be ignored. Time and compounding do the heavy lifting.

Where to invest?

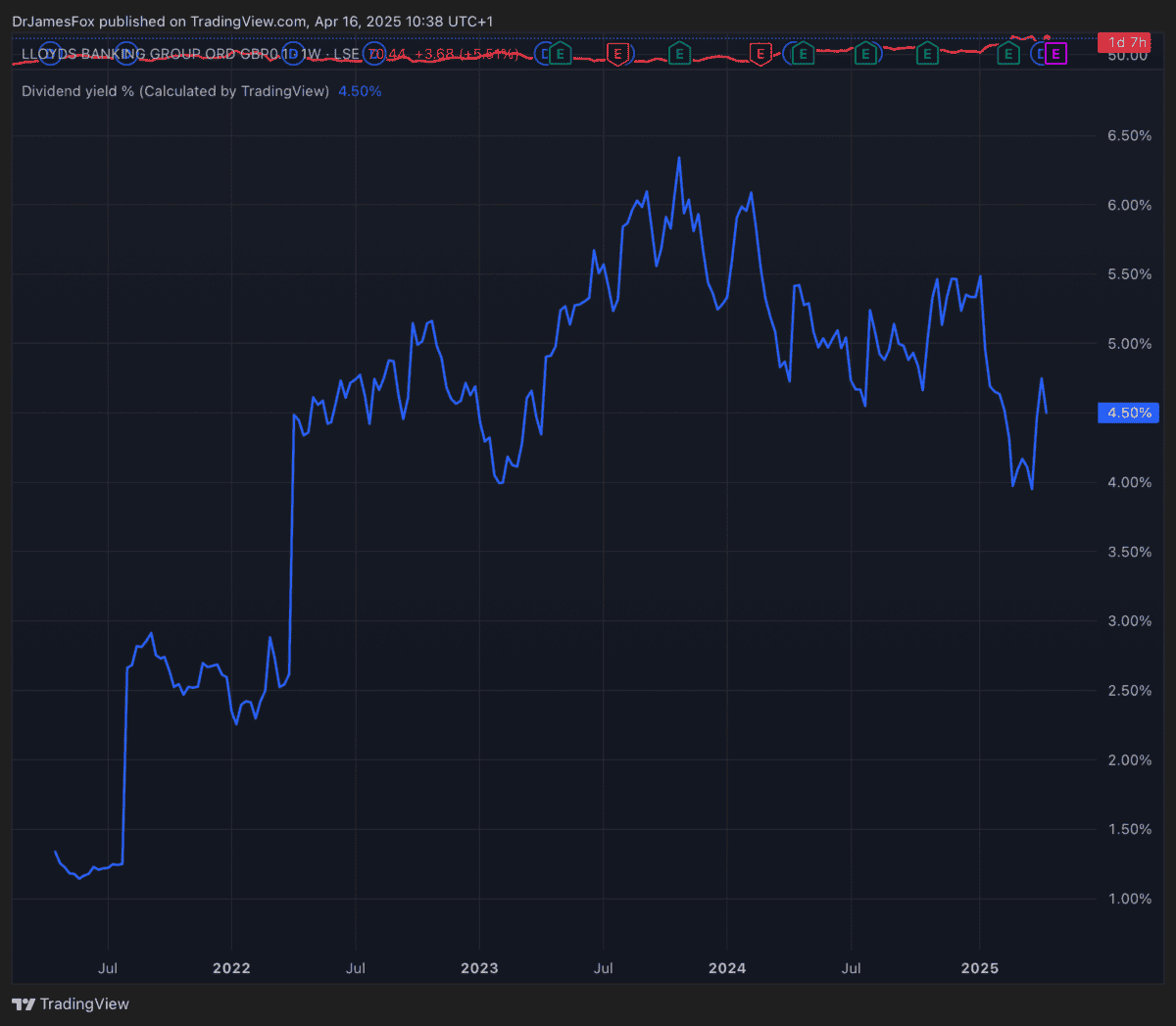

Let’s be practical and not assume a 10% return. One option that could be considered as part of a diverse portfolio over the next 35 years is Lloyds (LSE:LLOY). The British lender offers a blend of income and value for investors seeking exposure to the banking sector. Despite recent volatility, including the motor finance mis-selling probe, Lloyds is resilient with strong capital buffers and a progressive dividend policy.

Looking ahead, Lloyds’ forward earnings are forecast to improve. Earnings per share (EPS) are projected at 6.5p in 2025, rising to 8.85p in 2026 and 10.68p in 2027.

As such, the forward price-to-earnings (P/E) ratio’s expected to decline from 10.9 times in 2025 to 8 times in 2026 and 6.6 times in 2027. Dividends are also set to grow, with forecasts of 3.44p per share in 2025, 4.07p in 2026, and 4.64p in 2027, translating to yields between 4.9% and 6.6%.

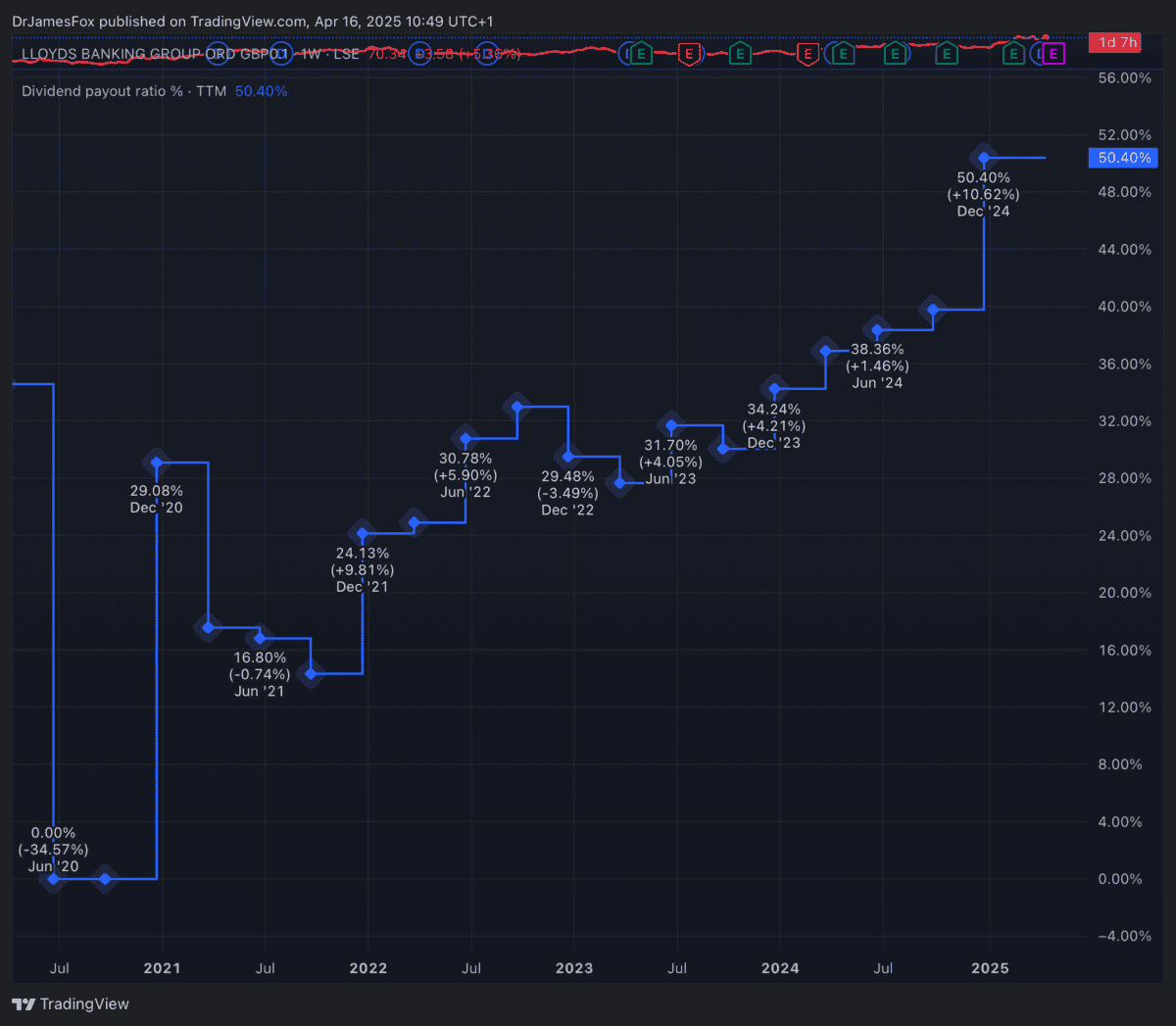

What’s more, the payout ratio remain sustainable.

Risks persist, of course. The UK economy could face a slowdown because of US tariffs, and this really isn’t good for banks, which typically reflect the health of the economy. However, it’s still an interesting proposition. Personally, I’m just holding on to my Lloyds shares, rather than buying more, due to concentration risk.