Until recently, the stock market narrative was largely dominated by artificial intelligence (AI) and how it will transform multiple industries. Understandably, investors were keen to get exposure to the technology in their Stocks and Shares ISAs.

However, the market’s focus has now turned to tariffs. Consequently, a fair few AI-related stocks have pulled back by 25% or more. I think this presents long-term buying opportunities.

One under-the-radar growth stock that I’ve been considering is Cloudflare (NYSE: NET). The share price is down 37% in two months, giving the tech firm a market-cap of $37bn.

Improving internet security and performance

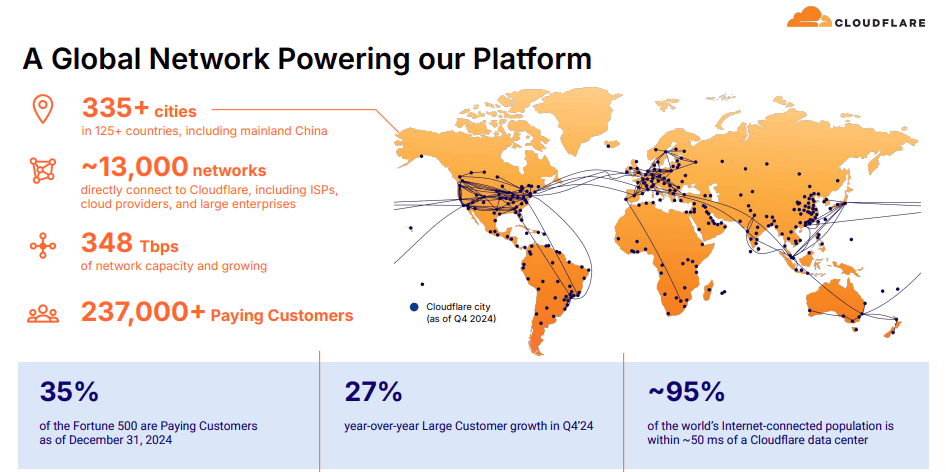

Cloudflare operates an edge computing network, with servers in more than 335 cities around the world. Put simply, it helps websites load faster while enhancing security.

So when you visit a website that uses Cloudflare (millions do), the request goes through its network, which then blocks harmful traffic (like hackers or bots) and speeds up content delivery.

Its network can reach approximately 95% of the world’s internet-connected population within 50 milliseconds, while blocking over 200bn cyber threats daily. Today, the company is providing critical digital infrastructure for nearly a quarter of all internet traffic!

Very strong growth

In 2024, Cloudflare’s revenue grew 29% year on year to $1.7bn. Customers spending more than $1m a year on its platform rose to 173, up 47%.

Operating cash flow surged 49% to $380.4m, while the free cash flow margin improved from 9% to 10%. However, Cloudflare remains unprofitable under standard accounting due to heavy investments and stock-based compensation.

Looking ahead, management expects the top line to grow 25% to around $2.1bn this year. And analysts forecast revenue will jump to $3.4bn by 2027, with profits growing strongly by then.

Meanwhile, the company has set an ambitious goal to reach $5bn in annual recurring revenue by 2028.

AI inference opportunity

Cloudflare is strategically positioning itself as a key player in AI inference with its Workers AI platform. This serverless solution enables developers to run machine learning models directly on Cloudflare’s global edge network, bringing AI capabilities closer to end-users.

Inference is where a trained AI model processes new data to generate outputs. The firm thinks more of these inference workloads will start moving to the edge.

Indeed, analysts at Bank of America recently said that Cloudflare is well-positioned to become “the leader in AI-as-a-service”. And they see revenue growing more like 30% annually over the next three years.

As such, the bank nearly tripled its share price target, from $60 to $160!

Very high valuation

Cloudflare isn’t optimised for profits yet, as it’s still focused on revenue growth. But even on this basis, the forward-looking price-to-sales ratio is currently around 18.

The risk with this hefty valuation is that Cloudflare’s future growth might fall short of expectations. Especially if the surge in AI agents and inference workloads doesn’t materialise as projected.

Foolish takeaway

With much of its global infrastructure now built out, Cloudflare’s free cash flow is projected to rise to around $546m by 2027, up from $167m last year. And it now has a significant growth opportunity with AI inference/agents.

I’m considering a starter investment here. But I will keep it small and look to build out my position on dips over time due to the steep valuation.