I’m looking for the best bargains to buy following recent share price turbulence. After doing some initial research, it seems that Aston Martin Lagonda‘s (LSE:AML) share price may warrant a close look.

At 61.3p per share, the FTSE 250 stock’s dropped more than a quarter in value over the past month, and 61.6% over a one-year horizon.

Aston’s not tipped to generate any profits over the next couple of years. So the price-to-earnings (P/E) ratio doesn’t give us an idea about whether its shares offer decent value for money.

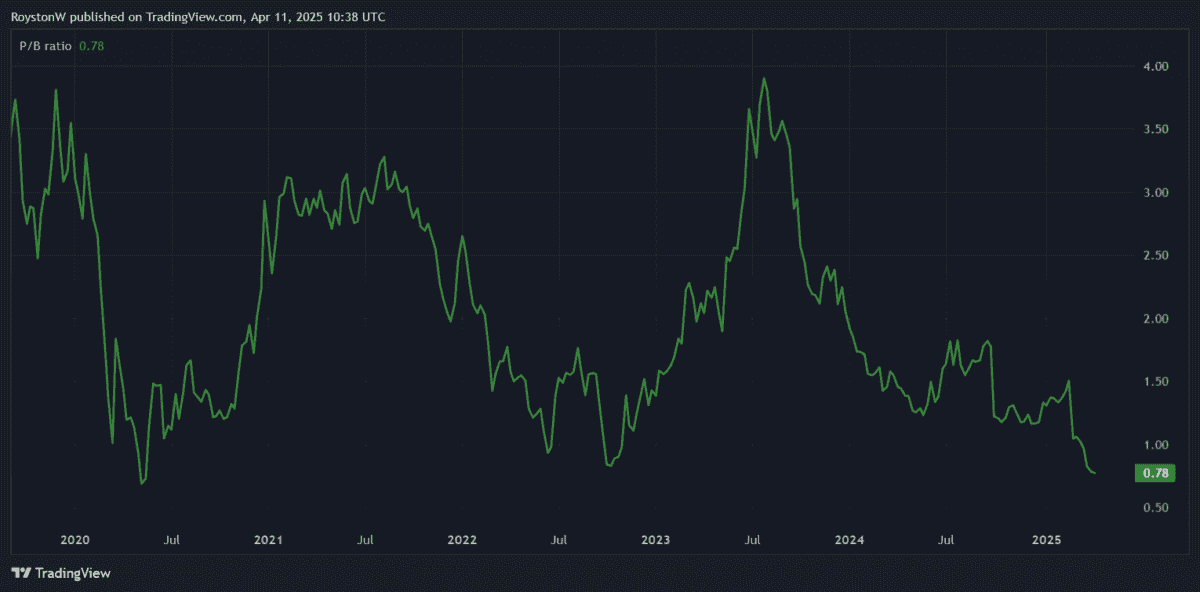

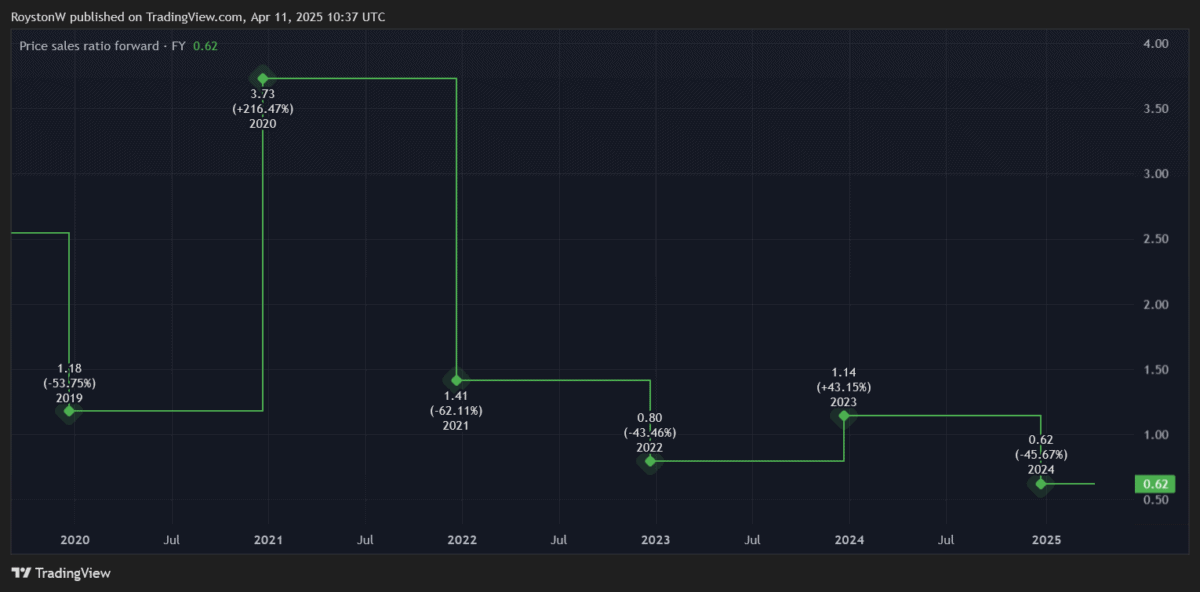

The price-to-book (P/B) multiple and price-to-earnings-to-growth (PEG) ratios, on the other hand, do. As you can see, both of these metrics fall well inside value territory of 1 and below:

However, it’s important to consider that Aston’s low valuation may reflect the level of risk it poses to investors. So what’s the story, and should invidividuals consider buying the business at today’s price?

Bumps in the road

Few carmakers on the planet have the lasting appeal that Aston Martin enjoys. Offering a tasty combination of luxury and speed, its products are among the hottest status symbols out there. And as the number of global millionaires rapidly grows, turnover could skyrocket if the company finds the right formula.

Yet while Aston’s products may glisten, the same can’t be said for the business itself. Supply and manufacturing issues, product development delays, a merry-go-round of CEOs, and high debt (net debt was £1.2bn in December) have left the Warwickshire firm in dire straits.

It’s also currently failing to reach customers in the highly competitive sports car market as effectively as other prestigious marques like Ferrari right now.

Worrying readacross

Aston’s task isn’t made any easier as the tough economic environment crushes demand for expensive cars. Competitor Porsche‘s first-quarter update on Tuesday (8 April) underlined the huge challenges that high-end manufacturers currently face.

This showed sales in Europe and Asia fall sharply in quarter one, with sales in China — a key market for Aston — down 42% year on year.

US sales rose 37%, but this reflected artifically low sales in Q1 2024 when units were held at US ports due to component issues. Even factoring this in, Porsche’s worldwide sales dropped 8% in the last quarter.

With the critical markets of China and the US embroiled in a fierce trade war, and the spectre of import taxes weighing on other regions, things could get worse for the carmakers before they get better. Aston’s own sales volumes dropped 9% in 2024, latest financials showed.

The threat of a 25% tariff on US auto imports presents a more specific risk for the company, too.

Longer-term threats

In another worrying omen for Aston Martin, Porsche announced a substantial pickup in electric vehicle (EV) sales in that first-quarter statement. Some 38.5% of all units that rolled out of showrooms were either fully electric or hybrid models.

This is significant because Aston has delayed the planned launch of its own EVs by three years, to 2030. By relying on combustion engine cars in the meantime, it risks losing relevance in an increasingly eco-conscious market.

And it is, in my opinion, another damning indictment of Aston’s turnaround strategy. While its cars still sparkle, I think investors should consider avoiding Aston Martin shares despite their current cheapness.