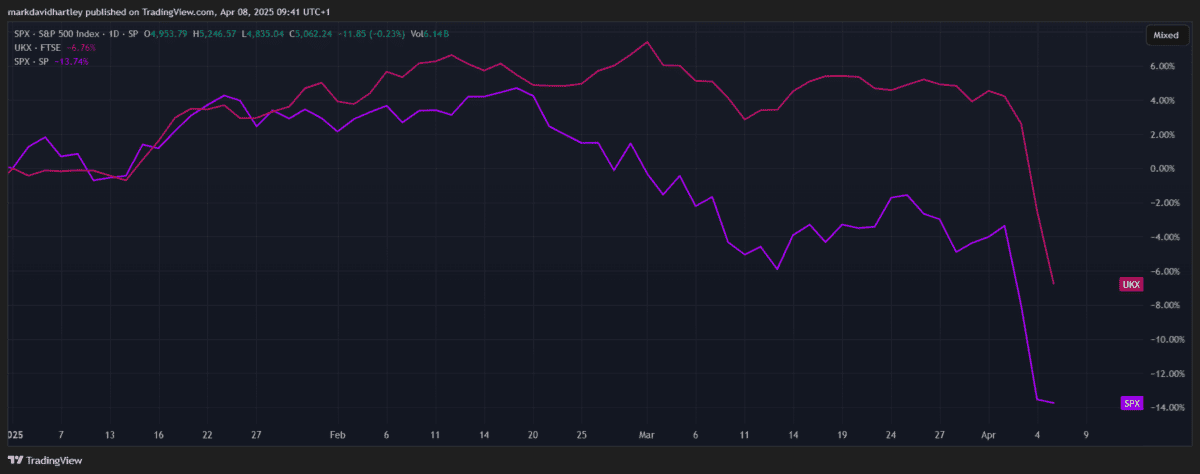

In an unusual twist of fate, the UK stock market could take a lead over the US this year. Already, the S&P 500‘s down almost 14% this year while the FTSE 100 has only dipped 6.7%.

Last month it was reported that fund managers are overweight on British stocks — marking only the second such occurrence since 2022. Statistics reveal investors are making strategic shifts away from US stocks and into UK equities.

This could lead to a much-needed revival for the FTSE 100 and other UK indexes. So what’s the play?

Here’s my plan.

Seeking value

The 10% trade tariffs placed on the UK last week hurt the domestic market but already things are improving. Now might be the perfect time to seek out some undervalued stocks. At the same time, it may be wise to avoid companies that rely heavily on sales in the US.

Here are three relatively insulated UK stocks that may be worth looking closely at for their defensive qualities.

Domestic insurance

As a leading UK insurer, Admiral Group focuses primarily on the domestic market. Insurance is a hugely competitive sector but the company has a decent 4.9% dividend yield and has demonstrated consistent performance, so it could be one to consider for investors seeking stability

Local hospitality

As the owner and operator of the Premier Inn hotel chain, Whitbread has a substantial UK footprint. The company’s implementing an Accelerating Growth Plan, converting underperforming food and beverage sites into higher-profit hotel rooms, which could enhance profitability so may be worth further research.

A food favourite

Tesco (LSE: TSCO) is the nation’s leading supermarket chain and a favourite among shoppers. It commands around 28% of the local market, with a significant presence both physically and online.

With a predominantly UK-based supply chain, it’s well-positioned to avoid the worst effects of US trade policy. It’s for this reason that I think analysts look favourably towards Tesco — due to its minimal reliance on imports, it seems to be less vulnerable to the tariff chaos.

But renewed competition from rival Asda has been weighing heavily on the stock. It’s down 12% in the past month, driven by news that Asda plans to undercut prices and steal back customers. If that happens, it could put pressure on Tesco’s already thin operating margins of only 4%.

It’s enjoyed several years of dividend growth, so I would hate to see it have to cut dividends to save money.

A history of resilience

While competition’s a risk, the retailer’s history suggests strong resilience in the face of such adversity. I’m optimistic it will once again develop a competitive strategy to meet and overcome this challenge.

It’s already announced cost-cutting measures to simplify operations and enhance efficiency. It also aims to ramp up its food waste reduction plans by offering items for free in the run-up to closing time.

For UK investors, domestically-focused companies like Tesco may help to provide a buffer against international trade uncertainties. And as things look to be improving, these companies are well-positioned to benefit from a UK stock market rally.