The last few days notwithstanding, UK stocks still trade at lower valuations than their US counterparts. On top of this, they’re also trading at discounts to their own historic multiples.

As a result, I’m still looking for opportunities on this side of the Atlantic at the start of the new financial year. And there are a couple of stocks in particular I’ve been buying.

UK valuations

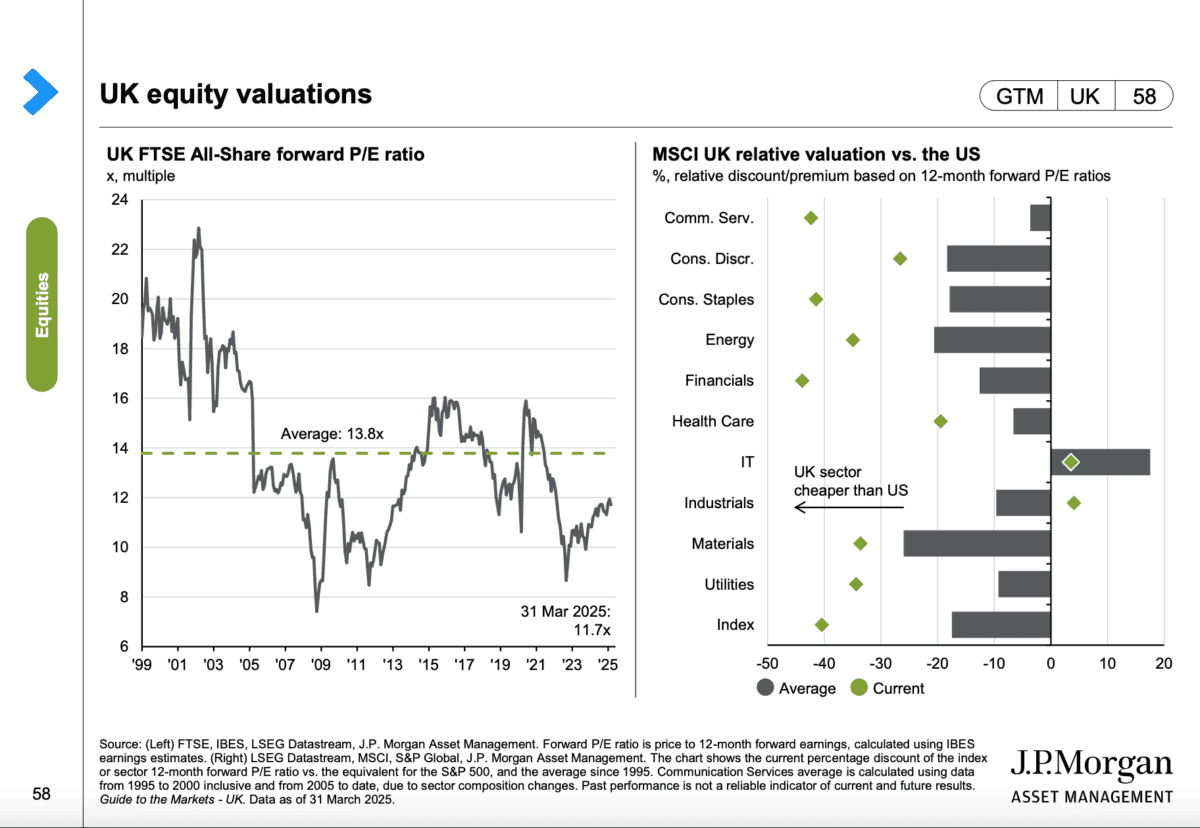

JP Morgan’s Guide to the Markets has some valuable insights. Despite the FTSE 100 starting 2025 strongly, UK shares are below their historical average in terms of multiples.

JP Morgan Q2 2025 Guide to the Markets (UK)

The FTSE All-Share – a pretty good measure of UK stocks as a group – trades at a forward price-to-earnings (P/E) ratio of just under 12. That’s below its historical average of almost 14.

UK shares also trade at an abnormally large discount to their US counterparts. Where they usually trade at lower multiples, the difference is greater than normal in almost every sector.

The exception is industrials, where UK stocks are unusually trading at higher multiples than US equities. But even in technology, the valuation gap’s wider than normal.

Size matters

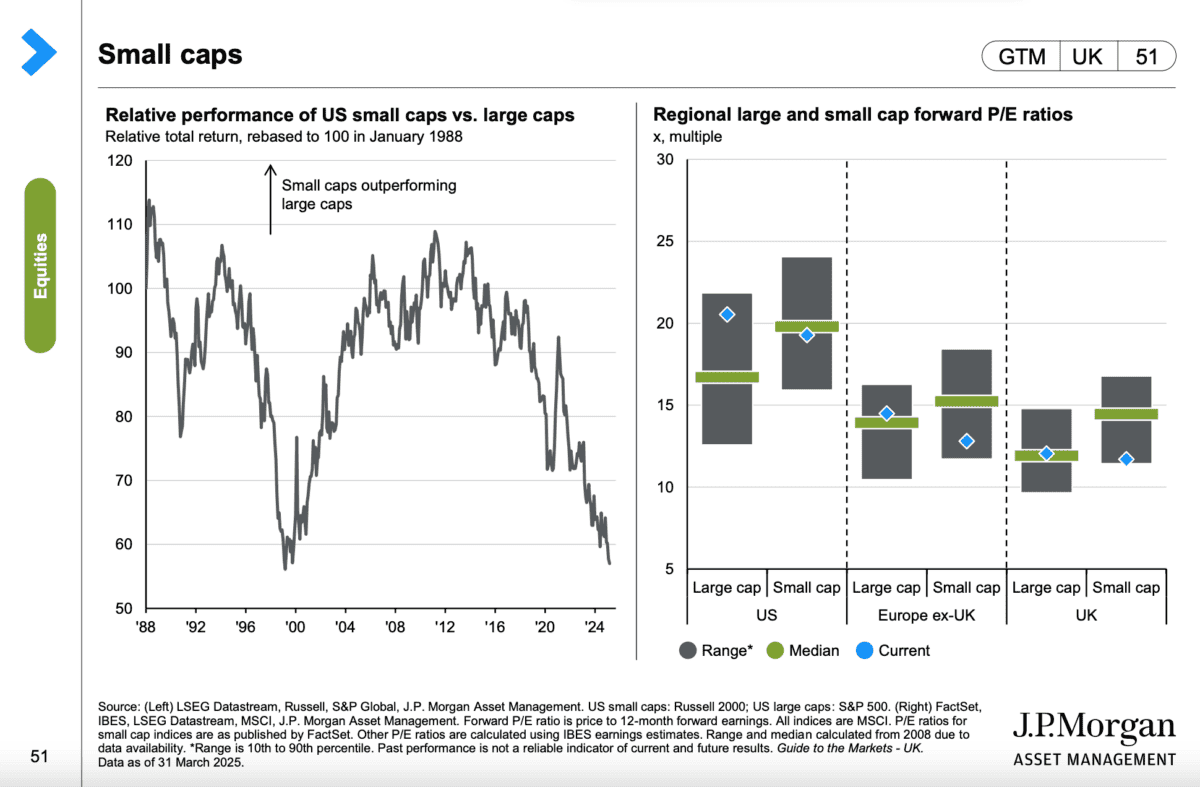

There’s another theme emerging on both sides of the Atlantic. In general, shares in smaller companies are trading further below their average multiples than their larger counterparts.

JP Morgan Q2 2025 Guide to the Markets (UK)

In the US, there isn’t much to get excited about. Shares in smaller companies are in line with their historic average multiples, but large-cap stocks are quite a bit higher.

The UK situation’s similar, but different in one key way. Shares in larger companies are level with their averages, small-caps are well below – towards the lowest they’ve ever been.

By itself, an unusually low P/E multiple doesn’t make a stock cheap. But it is a sign it’s out of favour with investors and this can create opportunities for investors to take advantage of.

A stock I’m buying

One stock I’ve been buying is Celebrus Technologies (LSE:CLBS). It’s a tech stock, which isn’t the sector showing the biggest discount to the US, but I think its P/E ratio is misleading.

The stock’s down almost 30% since the start of the year. And the big risk is that tariff-induced inflation could be a problem for a company with 78% of sales coming from the US.

In my view though, the current share price more than reflects this. Officially, the stock trades at a P/E ratio of just below 20, but the business has over 25% of its market value in net cash.

The company also has a number of non-cash and one-off costs that weigh on its net income. Factoring in all of this brings the P/E multiple down to around 12, which I think is a bargain.

Opportunity knocks

My plan for the new financial year was to focus on UK growth stocks. And I haven’t seen anything in the stock market’s response to the latest US tariffs that changes my outlook.

JP Morgan’s data suggests that UK shares typically trade at discounts to their US counterparts even after the latest sell-off. So I’m focusing on stocks like Celebrus at the moment.