One FTSE 100 firm I keep a close eye on is Scottish Mortgage Investment Trust (LSE:SMT). As a shareholder, this is clearly in my best interests. But it’s also interesting to hear the managers’ talk about technology trends and company developments.

It’s noteworthy then that in the past few months the growth-focused investment trust has been dumping its shares in both Tesla (NASDAQ: TSLA) and Nvidia (NASDAQ: NVDA). These have long been large and important holdings, so it’s quite the turnaround.

But why? Let’s take a look.

Drastic reductions

At the end of September, both Tesla and Nvidia were in Scottish Mortgage’s top five holdings.

| Portfolio weighting (September 2024) | |

| MercadoLibre | 6.3% |

| Amazon | 5.9% |

| SpaceX | 4.6% |

| Tesla | 4.2% |

| Nvidia | 4.1% |

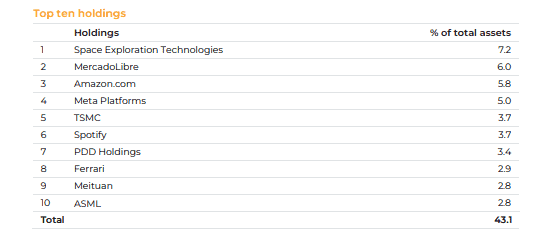

Just five months later at the end of February, neither were in the top 10. This means the trust’s been aggressively reducing these positions.

Nvidia had been cut to around 2.6% of the portfolio, while Tesla wasn’t even in the top 30.

Tesla

Reports say that Baillie Gifford, the asset manager that runs the trust, had cut its stake in the electric vehicle (EV) maker to just 0.06% of the company’s shares.

Again, this is some turnaround as Baillie Gifford had once been Tesla’s largest outside shareholder, second only to CEO Elon Musk.

Scottish Mortgage first invested in Tesla in 2013 and was widely derided for doing so. But in the 10 years to the end of 2024, the stock had returned 3,439%. This is an example of the asymmetric returns that the FTSE 100 trust searches for.

It recently wrote: “A recent surge in the stock’s price following the US presidential election prompted us to reassess its upside opportunity, and we reduced the holding into share price strength”.

So the official reasons are profit-taking and less potential for share price rises. There has been no mention about Musk’s polarising political views and potential Tesla brand damage. It should be noted that Scottish Mortgage retains its large holding in SpaceX, another Musk-run firm.

Nvidia

Similarly, Nvidia’s been a massive winner for the trust since it first took a stake in 2016. By the end of last year, it had gone up 10,188%!

Explaining the reduction, Scottish Mortgage said: “While maintaining conviction in the long-term growth potential of AI, we reduced the position throughout the year, as after extreme share price growth the future returns potential offers less of a positive skew”.

Again, the reason here appears to be the crystallisation of gains and less potential for massive returns. The managers have also said that Nvidia’s vast competitive lead in the AI training stage is “less assured in the inference stage“.

My takeway

I’m happy that AI king Nvidia has seemingly been retained, if only as a smaller holding.

I also think the massive reduction — or even possibly complete disposal — of Tesla is understandable, despite the huge potential of robotaxis and humanoids. Sales in its core EV business are under pressure, yet the stock’s still valued extremely highly.

For investors wanting broad AI exposure, I think Scottish Mortgage shares are worth considering. While the trust could underperform if the AI boom runs out of steam, its focus on disruptive innovation and high-growth companies sets it up well long term, in my view.