Scottish Mortgage Investment Trust (LSE: SMT) offers UK stock investors something different from the rest of the FTSE 100. The trust aims to invest in what it sees as the world’s most exceptional growth companies, regardless of where they’re located geographically.

Here are five reasons why an investor might consider loading up on Scottish Mortgage shares while they’re still under £10.

Solid track record

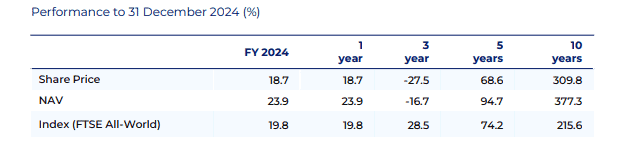

The first is performance, which is what an actively managed fund is ultimately judged on. Has it outperformed the market over meaningful time periods?

In the case of Scottish Mortgage, it’s delivered the goods. Over the 10 years to the end of 2024, the net asset value (NAV) had increased by 377%, versus 216% for the benchmark (the FTSE All-World index).

The trust has held three tech stocks for 10 years or more. These are Amazon, Tesla, and chip-making equipment giant ASML. All have done fantastically well over this time frame, though the trust has been selling down Tesla in recent months.

Another one worth mentioning is Nvidia, which it first bought in 2016. Due to the rapid rise of the chip maker, Scottish Mortgage has taken roughly £1.5bn of profit from an initial £64m investment. And it still has a decent-sized position in Nvidia left over!

Private investments

Second, roughly a quarter of the portfolio is in unlisted assets, which equates to 50 holdings. So the trust offers investors exposure to exciting growth companies not listed on the stock market.

While many are bite-sized, some holdings are very large. In fact, of the world’s 10 most valuable private firms, Scottish Mortgage owns half of them (SpaceX, ByteDance, Stripe, Databricks, and Epic Games).

With a 7.2% weighting in February, SpaceX is the largest holding in the portfolio. The space company’s valuation has ballooned to $350bn due to its dominance in the rocket launch market and fast-growing satellite internet business (Starlink).

Some of these firms could go public at very high valuations in the next couple of years, boosting Scottish Mortgage’s NAV in the process.

Low fees

The third reason to consider investing is the fee structure. According to the latest factsheet, the ongoing charge is just 0.35%. That’s low for a global equity fund that also offers exposure to unlisted firms like SpaceX. Many charge 0.75%–1%+.

Over time, lower fees can compound into significantly better net returns.

Deep AI exposure

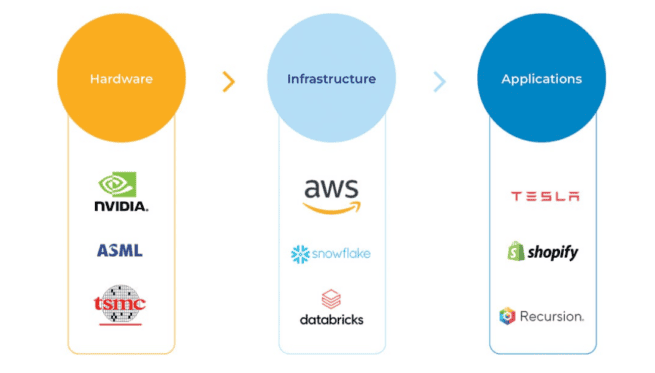

Next, the trust offers a straightforward and diversified way to invest in the ongoing artificial intelligence (AI) revolution.

In the past 12 months, the trust’s managers have been buying or adding to stocks that they think are perfectly positioned to benefit from the technology. These include Taiwan Semiconductor Manufacturing (TSMC), which is the leading manufacturer of AI chips, Shopify, and social media giant Meta Platforms.

This high exposure to AI is one risk I see here though. If the technology fails to deliver the efficiency gains expected, then investors might become disillusioned with AI. In this situation, the value of the trust could fall sharply.

10% discount

Finally, the shares are trading at a 10% discount to NAV. While there’s no guarantee this gap will narrow (it could even widen), it offers long-term investors a chance to consider buying below fair value.