If I had £500,000 in my Stocks and Shares ISA, I believe I could comfortably earn £25,000 annually as a second income. That would be achieved by investing in bonds and dividend-focused stocks that give me an average yield of 5%. That’s about the equivalent of a £30,000 salary after tax. It’s not bad, but it might not be enough for some people.

How’s it done?

The maximum annual contribution to a Stocks and Shares ISA is £20,000. As such, it would take a while to build up to £500,000 through contributions alone. Of course, that excludes the main reason people invest… to make their money work and grow.

In short, there are lots of ways to turn an empty portfolio into £500,000. One way would be to invest £500 a month for 22.5 years — this assumes 10% annualised growth. The issue here is that a £25,000 second income wouldn’t go as far in 22 years, plus the return rate might end up being lower.

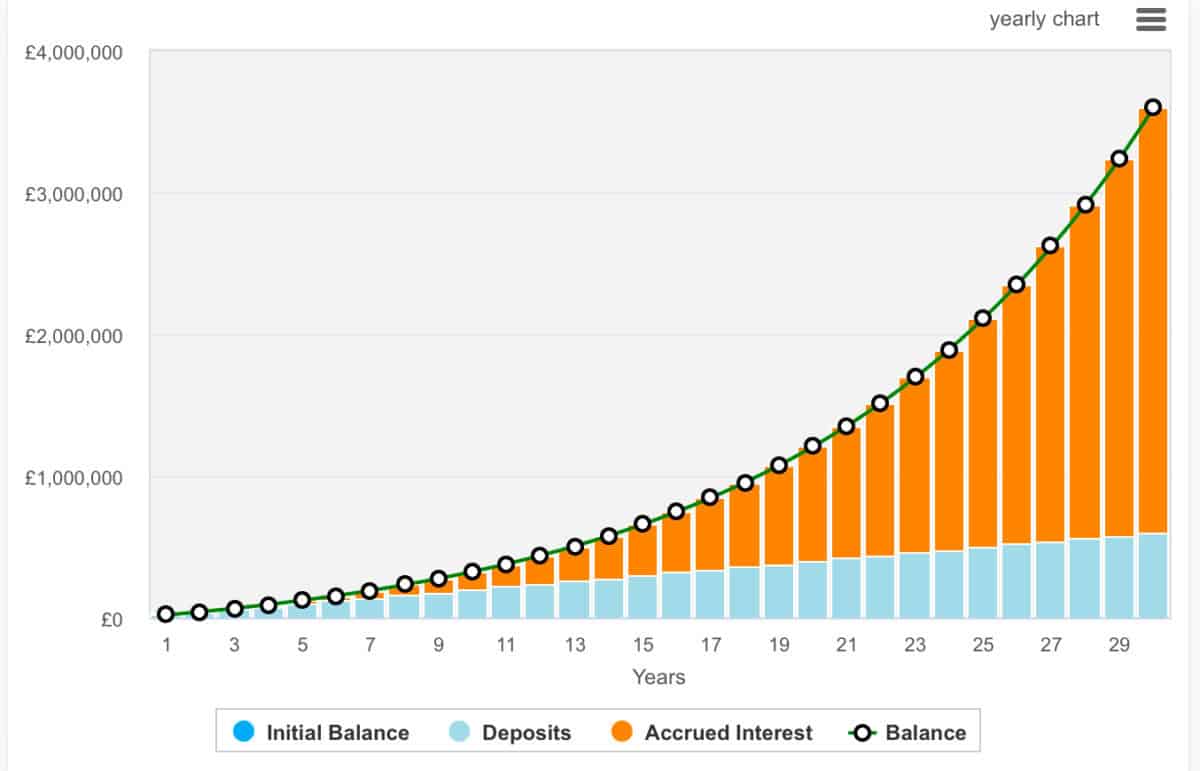

However, higher contributions could mean this £500,000 figure is achieved sooner. The below chart shows what could be achieved when an investor maxes out their ISA allowance. In such a case, and assuming a strong 10% annualised growth rate, this £500,000 would be achieved in just 13 years. But check out that compounding impact in the later years!

A reality check

There is, however, an issue. And that issue is that many novice investors lose money. They go chasing mega returns on risky investments and, more often than not, incur sizeable losses.

And this is why many advisors simply recommend investing in index-tracking funds. These are funds that aim to track the performance of an index like the FTSE 100. This also provides instant diversification.

Other options to consider

In addition to such funds, investors may want to consider trusts like Scottish Mortgage Investment Trust (LSE:SMT) to deliver diversification and exposure to growth-oriented stocks in tech.

Managed by Baillie Gifford, Scottish Mortgage focuses on high-growth companies, including both public and private firms. It has significant holdings in tech giants like SpaceX, Nvidia, Amazon, and Meta.

Many investors will also point to the trust’s excellent track record. From its first investments in Amazon in 2004, Scottish Mortgage often picks the next big winner before they’ve become household names.

However, it’s worth noting that the trust employs gearing (borrowing to invest), which can amplify gains but also increase losses, making it a higher-risk strategy. As of April 2024, gearing stood at 13%, down from 17% the previous year.

Despite this risk, I’ve recently topped up on Scottish Mortgage as the shares dipped. Personally, I believe its long-term growth potential, particularly with tailored investments in artificial intelligence (AI) and disruptive technologies, outweigh the short-term volatility.

Moreover, it does have investments in the luxury sector that provide a degree of shelter from the volatility of tech.