The Prudential (LSE: PRU) share price looks likely to continue recovering after its full-year 2024 results were released last night (19 March).

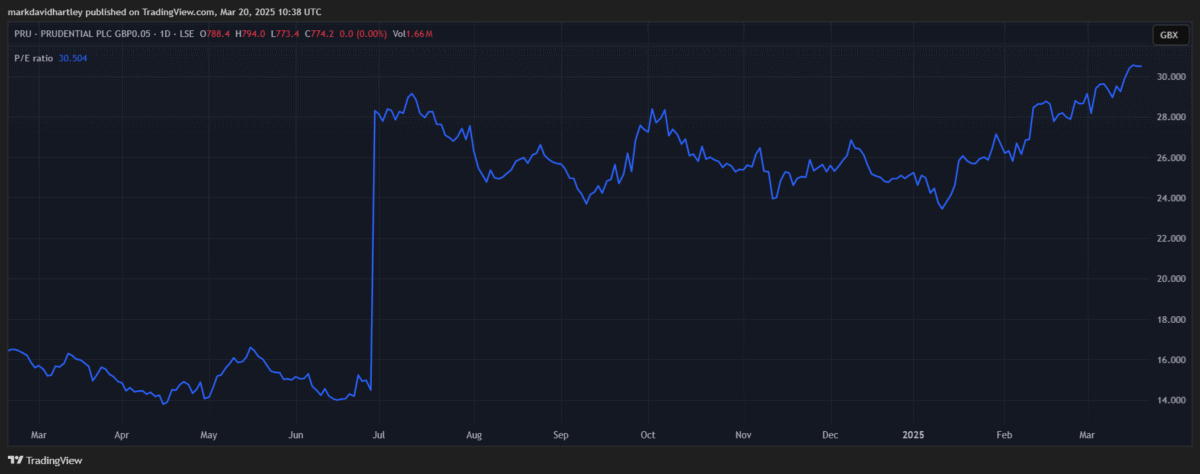

The stock has already made a spectacular 22% recovery this year after falling 56% throughout 2023 and 2024. Now, with revenue beating estimates for the first time in years, I suspect it will continue climbing.

Here’s why I think it’s a stock worth considering in 2025.

Full-year 2024 results

Adjusted operating profit before tax increased 10% to $3,13m, with adjusted operating profit after tax up 7% to $2,58m.

Earnings per share (EPS) came in at 89.7c, far surpassing estimates of 80c per share. Revenue followed a similar pattern, at $6.42bn — smashing estimates of $3.98bn. The company’s revenue has been on a steady decline for several years now, down from $44.67bn in 2018. This is the first time since 2018 that revenue came in ahead of estimates.

Promisingly, a final dividend of 16.29c was announced, raising the full-year dividend by 12.99% to 23.13c per share. This equates to a 2% yield on price with a sustainable payout ratio of 64.9%.

In addition, it completed over $1m in share buybacks, progressing its $2bn program announced in June 2024. The remaining buybacks are expected to be completed this year.

Focus on Asia

Prudential is a British multinational insurance and asset management company, headquartered in London and Hong Kong that relies heavily on the Chinese market. Recently, the firm has undergone a significant restructuring, including a demerger from UK and US operations. Now largely focused on Asia and Africa, there’s a risk this strategy may not pay off.

Slow growth in the region has been impacting its performance lately. Although it reported an 11% increase in new-business profit to $3bn, this is notably lower than the 45% rise achieved in 2023.

In today’s report, CEO Anil Wadhwani highlighted the significant opportunities Asia has to offer. It’s a region with low insurance penetration and a growing demand for long-term savings, wealth management and retirement planning. Yet despite these prospects, when accounting for changes in interest rates and exchange rates, new-business profit actually declined by 2% in 2024.

Restrained growth potential

Everyone loves a rising price but with it comes the increasing potential for a pullback. The stock’s price-to-earnings (P/E) ratio has now surpassed 30 — almost double the FTSE 100 average of 18. That could limit the number of new investors interested in buying the stock at such a high price. Even with earnings forecast to grow 23% in the coming year, there’s no guarantee this will pass on to the share price.

Any small hiccup could send things south.

Overall, the company appears to be operating well despite profits subdued by growth limitations in Asia. Analysts remain overwhelmingly optimistic about the stock, with 12 out of 17 maintaining a Strong Buy rating. The average 12-month price target is 1094p, a 41.3% rise from current levels.

I think the share price has a good chance of climbing between 20% and 25% this year – particularly as it edges ever closer to its 52-week high. After today’s results, it’s firmly on my watchlist for 2025.