Kainos Group (LSE: KNOS) is a FTSE 250 information technology company specialising in digital transformation services and Workday solutions.

Founded in 1986 in Northern Ireland, it’s grown to operate in 22 countries worldwide, employing over 2,900 people. It operates through three primary divisions: Digital Services, Workday Services, and Workday Products.

Among them, they cover the digitalisation of various clients in the public, commercial and healthcare sectors. Services include digital advisory, cloud systems, artificial intelligence (AI), user experience design and managed services.

But the key selling point is the company’s partnership with Workday, a US software system for Human Capital Management (HCM) and Financial Management. Kainos builds on Workday’s offerings by developing proprietary software that complements its functionality and enhances the user experience.

Years of problems

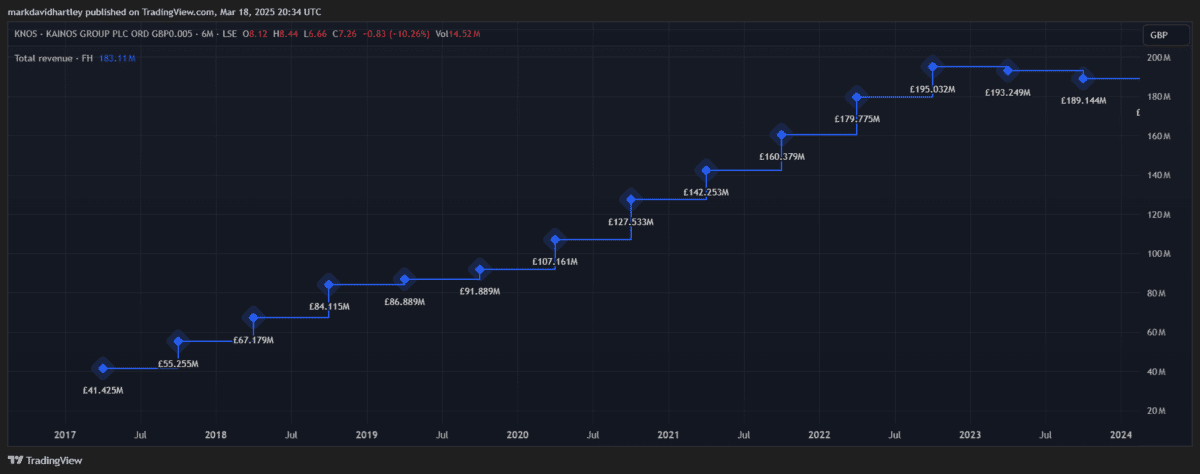

Despite consistent revenue growth over the past five years, a slew of issues have dragged down the company’s stock price. It’s currently hovering around £7.27, a 65% drop from its all-time high of £20.52 set in November 2021.

This suggests it’s undervalued, with a price-to-earnings ratio of 17.4 — below the industry average of 20.7.

Several factors have contributed to the decline, including a weak economy, a sudden leadership change and, most recently, the threat of US trade tariffs.

The issues have led to subdued revenue guidance for the year ending March, further impacting sentiment. The sudden and unexpected reappointment of ex-CEO Brendan Mooney brings a wealth of experience back in but has still irked investors. These issues may continue to limit price growth in the short term.

It also faces a barrage of competitors vying for a share of the growing digitisation market. This has led to more aggressive pricing among partners, putting pressure on its profit margins and market share.

Why I expect a recovery

Kainos has established itself as a leader in UK-based digital transformation and proprietary Workday services. Despite growing competition, it still commands a large section of the market across various sectors and has a solid pipeline of upcoming projects that promise long-term demand for its services.

It has overcome recent financial struggles and maintains a strong balance sheet with significant cash reserves. This financial stability positions it well to take advantage of expansion opportunities. It also supports its dedication to shareholder returns, with a 4% dividend yield and 68.5% payout ratio.

Its Workday Products division has enjoyed particularly impressive growth, accounting for 19% of total revenue. The strategic move is already proving profitable and could reduce reliance on service-based income.

A renewed growth strategy

With Mooney back at the helm, I think his experience and knowledge could reignite the business and reassure stakeholders.

His guidance will likely refocus the business on emerging technologies such as AI. This is critical to meet evolving client needs and capitalise on new market opportunities.

With a solid business and substantial cash reserves, Kainos has the flexibility to invest in growth initiatives, pursue strategic acquisitions, or simply satisfy shareholders.

It has all the trappings of a business ready to adapt (and thrive) in today’s rapidly evolving economic landscape. That’s why I’m stocking up on the shares while the price is good!