The word ‘Rocky’ should be added to the end of Rolls-Royce (LSE: RR), given the mighty comeback the shares have staged since Covid.

In fact, this story has all the ingredients of a Hollywood film. Facing a mighty adversary in the form of a global pandemic, an iconic company is engulfed by spiralling debt and a loss of investor confidence, with its very survival on the line. Then a saviour in the form of a new leader arrives on the “burning platform”, rallies the troops and orchestrates an epic turnaround (and 750% rise in the share price).

However, Hollywood blockbusters normally have a sequel (or three), where the protagonist is struggling once again. In other words, another plot twist might be on the horizon for Rolls-Royce-Rocky.

Should I cash in my shares while the going is good?

Seemingly high valuation

To make up my mind, I’m going to consider a couple of things here. First, the valuation. Rolls-Royce stock is currently trading at 33 times forecast earnings for 2025 and 28 times for 2026.

At first glance, that appears high for a mature FTSE 100 stock. And if the firm was just selling engines for commercial aircraft, I might take my gains and move on. Especially as the income on offer from the restored dividend isn’t particularly high, with a yield under 1%.

However, the company has another division that looks set for high growth over the next five to 10 years.

Era of European rearmament

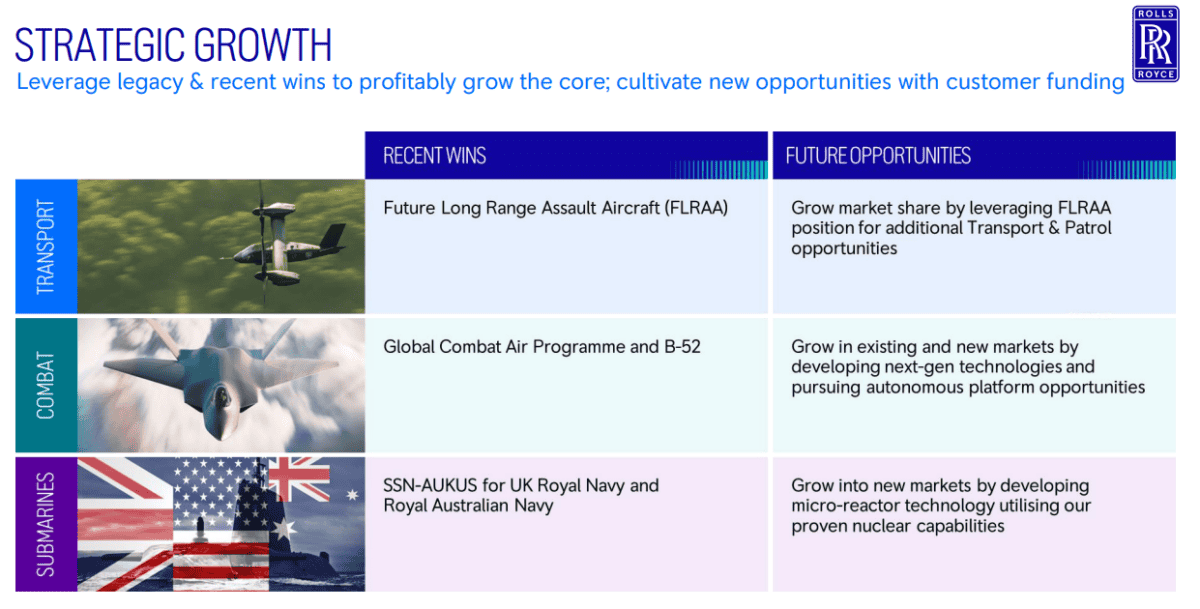

I’m speaking about defence, which makes up around 25% of the group’s total revenue. Rolls-Royce supplies advanced propulsion and power systems across air, sea, and land, with deep expertise in fighter jet engines, military transport, and nuclear power for submarines.

In January, the Ministry of Defence awarded the company a £9bn contract to design, manufacture, and support nuclear reactors for the Royal Navy’s submarine fleet over an eight-year period.

Yet this is unlikely to be the last contract it wins. That’s because European countries are now set to rearm rapidly, alarmed by Washington’s decision to suspend all military aid to Ukraine.

Due to this sudden uncertainty over US commitment to security, the EU is now proposing to spend at least €800bn on defence over four years. Earlier this month, the European Commission president said: “Europe is ready to massively boost its defence spending.”

Moreover, European asset managers are under pressure from some clients and politicians to increase their allocations to defence firms. In other words, loosen ESG considerations to get behind the continent’s rearmament efforts.

For example, the UK’s largest institutional investor, Legal & General, is now planning to increase exposure to the defence sector. UBS and Allianz are also reviewing their policies, while sustainable funds are even being encouraged to get on board.

Of course, we don’t know whether these asset managers will open or increase positions in Rolls-Royce specifically. But it’s a seismic shift.

My decision

Rolls-Royce keeps warning about supply chain issues in relation to engine parts and maintenance components. So this risk is worth considering. Meanwhile, the brewing global trade war could be inflationary, impacting travel and airline spending on new aircraft.

However, given that the company is highly likely to win more defence contracts in Europe in the coming years, I’m going to keep holding my shares.