For me, leveraging a Stocks and Shares ISA and following a disciplined investment strategy is the very best way to try and achieve a £5,000 monthly passive income. The beauty of an ISA lies in its tax-free benefits, allowing investments to grow unhindered by capital gains or dividend taxes.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Stocks and Shares ISAs outperform savings accounts

Most Britons still rely on savings accounts, but with annualised returns typically below 3%, their money isn’t growing fast enough. By contrast, investing in stock markets has historically delivered significantly higher returns.

For instance, the FTSE 100 has averaged an annual return of 6.4% over the past 20 years, while the S&P 500 has averaged 10.5% since its inception. Even more impressively, the Nasdaq 100 has posted an average return of 19% over the last decade.

Stay with me…

To generate £5,000 monthly, or £60,000 annually, investors would typically need at least £1.2m in their ISA. This assumes a 5% withdrawal rate. And this can be achieved by investing in dividend-paying stocks or bonds within a Stocks and Shares ISA. And while this £1.2m figure might sound daunting, it’s very achievable. And remember, this is £5,000 a month, tax free. So it’s a goal worth aiming for.

Let’s say someone starts by investing £500 a month in a Stocks and Shares ISA. Over 30 years, assuming an average annual return of 10.5% (matching the S&P 500’s historical performance), these investments could grow to over £1.2m. Of course, the younger an investor starts, the more time they have to leverage the power of compounding.

Index trackers and other diversifiers

The problem however, is that many novice investors lose money. They invest poorly chasing big bucks and see the value of their investments collapse. This is why many advisors will recommend they buy index-tracking funds. These are funds that attempt to track the performance of indexes like the FTSE 100 or S&P 500 for a small fee.

While index-tracking funds are a solid choice, I prefer selecting individual stocks, trusts, and funds. This approach allows me to potentially outperform the market by focusing on high-quality dividend payers and growth stocks.

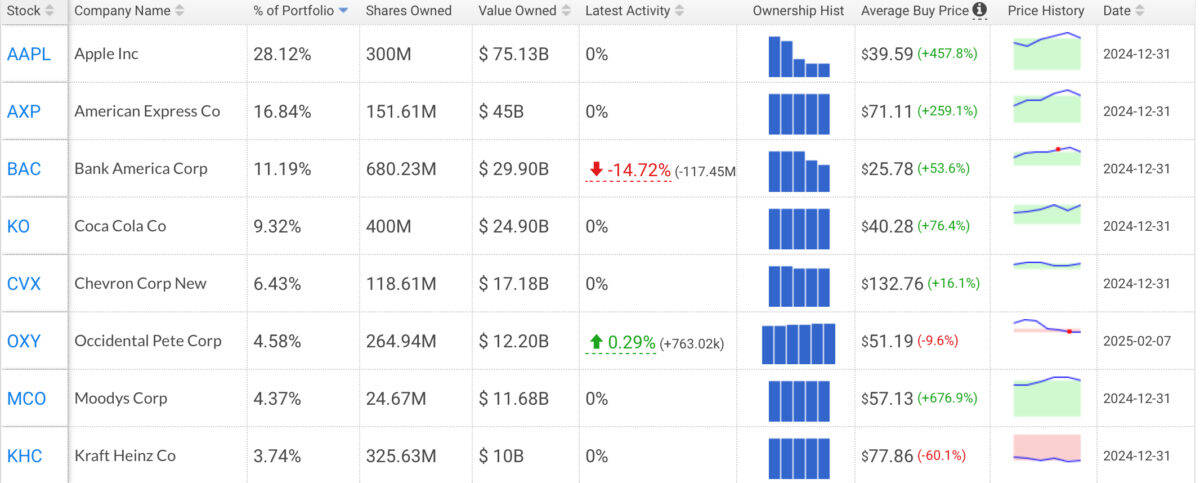

One place I’ve recently been putting my money is Berkshire Hathaway (NYSE:BRK.B). This Warren Buffett conglomerate has been making headlines over the past year for selling holdings and hoarding cash. And as market volatility picks up, investors are looking at Buffett’s strategy keenly and asking what he’s going to do with $334bn. While I don’t have a crystal ball, history shows us that Buffett has a great track record of making the right investment at the right time.

One risk of this investment is its US focus. Buffett invests in the backbone of the US economy, which has outperformed during his career, but there’s no guarantee this will continue. And it’s this concentration that arguably reflects one of the biggest risks of investing in Berkshire.

Nonetheless, I’d simply point to the conglomerate’s track record for outpacing index growth and delivering returns for shareholders over the long run. Buffett also isn’t limited to investing in the US. It’s simply been his preference. This could change if he sees better value elsewhere.