Jet2‘s (LSE:JET2) one of my favourite UK stocks at this moment in time. The airline and package holiday company is currently trading at 7.4 times forward earnings. But this figure falls to just 1.2 times when we account for net cash on the EV-to-EBITDA ratio.

In fact, the company’s half-year 2025 results showed that Jet2 had amassed a net cash position of £2.3bn. That’s a huge figure given the £3bn market-cap. And this cash position provides a firm foundation for increasing gross capex and repaying debt.

Interestingly, analysts believe this net cash position will continue to expand throughout the medium term. The current forecast suggests that Jet2 will have £2.7bn in net cash by 2027.

Could this be the catch?

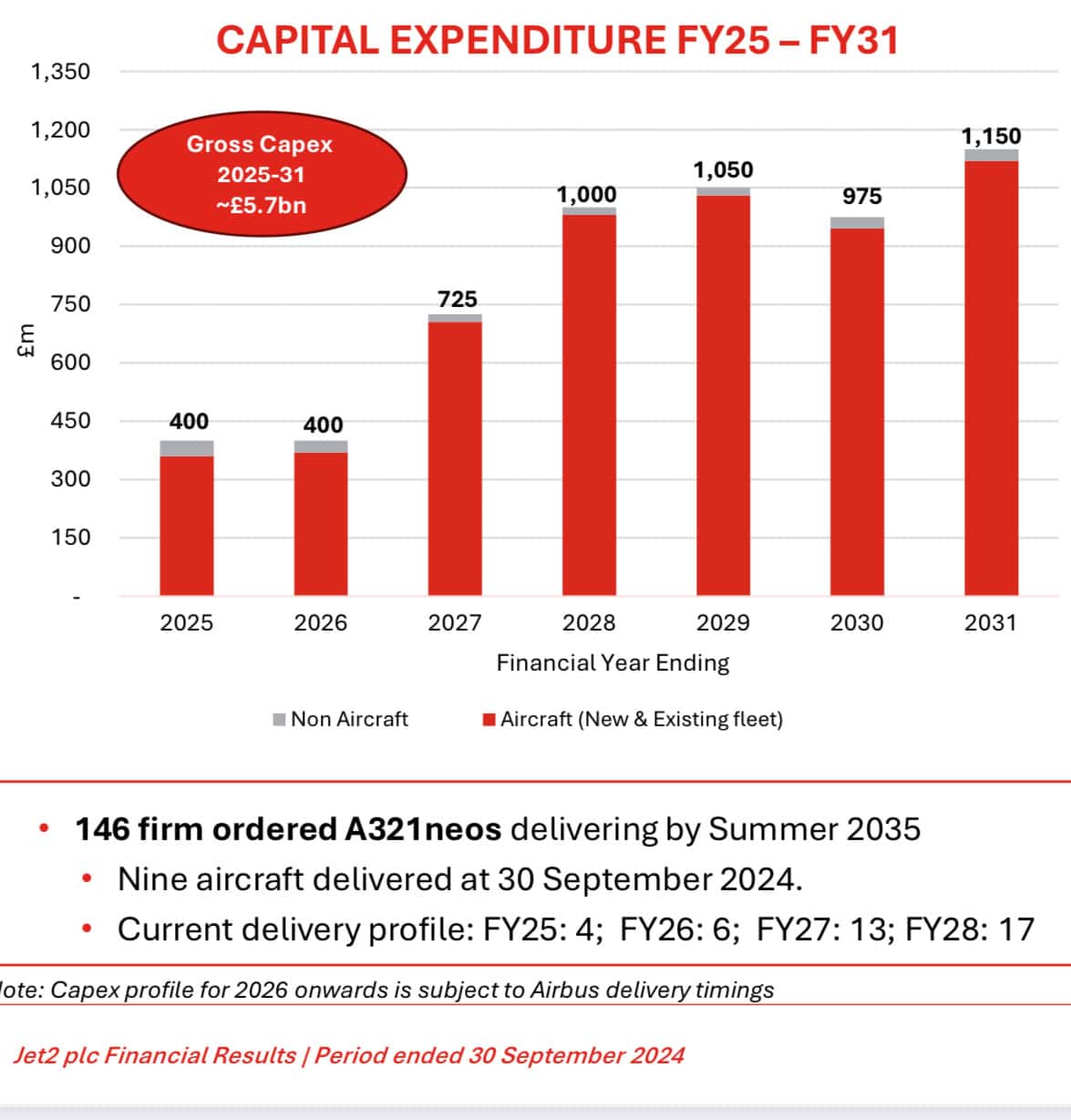

The data’s still excellent. But investors should recognise that Jet2 will be spending £5.7bn between 2025 and 2031 in order to upgrade and expand its fleet. The current Jet2 fleet’s actually a little older than some of its Western airline counterparts, but not by much. Nonetheless, there’s a transition ahead as the company aims to increase its fleet size from 135 to 163 by 2031 and tilts to a majority Airbus fleet. I do wonder if this could be weighing on the share price.

This is a considerable investment, but it’s also not unusual for the aviation industry. In fact, this figure equates to £833m annually. This broadly aligns with industry norms as airlines typically spend ~12% of revenue on capex.

Net sales for 2025 are projected to come in at £7.2bn, so this suggests the annualised capex figure represents just 11.4% of revenue. What’s more, revenue’s projected to increase to £8.6bn by 2027, further reducing this capex spend ratio.

As we can see, the net spend on new aircraft is actually weighted towards the far end of the forecasting period. The 146 A321neo aircraft ordered offer 20% lower fuel consumption per seat and 23% more capacity than older models, boosting operational efficiency.

Willing to overlook recent concerns

I like companies with momentum that are beating guidance. I’m willing to make an exception here because the valuation’s so good. However, Jet2 tumbled in February as it projected an 8-10% rise in full-year pre-tax profits to £560m-£570m but warned of material cost increases that could pressure margins. Rising wages, airport charges, and aircraft maintenance costs are key concerns. Higher National Insurance contributions will also weigh on growth.

Despite these concerns, Jet2’s strong market positioning — no.1 tour operator in UK — and strategic investments in new aircraft and bases position it well for long-term growth. The stock’s recent dip, driven by profit margin concerns, may offer an attractive entry point given its robust fundamentals and resilience in the leisure travel market.

And despite the cost warnings, the earnings projections are still very positive — earnings per share will grow from £1.83 in 2025 to £2.08 in 2027. Combined with a growing cash position, this forecast suggests it will be trading at 0.25 times EV-to-EBITDA for 2027. This suggests that the stock is vastly undervalued. The consensus forecasts infers a 50% undervaluation, but I believe it could be much greater.

In short, this is why I’ve recently added it to my portfolio.