Earning passive income through investing is an achievable goal, especially when starting with £100,000 — enough for a large house deposit.

While this amount might not create instant passive income wealth, it serves as a strong foundation to build a steady income stream over time. The key lies in starting smart, staying consistent, and allowing time and compounding to work their magic.

With £100k, a variety of investment options can generate passive income. Dividend-paying stocks provide regular payouts, while bonds offer stable interest payments. Real estate investments, whether through rental properties or REITs, can deliver consistent cash flow. Index funds, with their low fees and steady growth, also present a reliable way to grow wealth.

The secret to success involves reinvesting earnings early on. By investing in growth, redirecting dividends, interest, or rental income back into the portfolio, growth accelerates. Over time, this compounding effect can transform £100k into a much larger sum, significantly increasing passive income potential.

Using an ISA to compound wealth

The Stocks and Shares ISA is an excellent vehicle for building wealth. That’s because income and gains from investments within the ISA are shielded from UK taxes, including income tax and capital gains tax. In other words, if an investors sells a stock that’s surged 100%, they keep all the profits. This allows investments to compound much faster.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

In short, £100,000 could compound into something much larger over the long run when invested wisely. Combined with £200 of monthly contributions and 10% annualised growth, £100,000 could become £2.4m in 30 years. Assuming a withdrawal rate around 5%, this pot could generate around £10,000 a month.

An investments for the job?

Investors favouring a more hands-off approach may turn to a trust for diversification, and The Monks Investment Trust‘s (LSE:MNKS) certainly an interesting prospect to consider with its focus on global equity investments aimed at delivering above-average long-term returns.

Managed by Baillie Gifford — which also runs the popular Scottish Mortgage Investment Trust — the trust employs a patient, active management strategy, targeting companies that address crises innovatively to reduce costs or improve service quality.

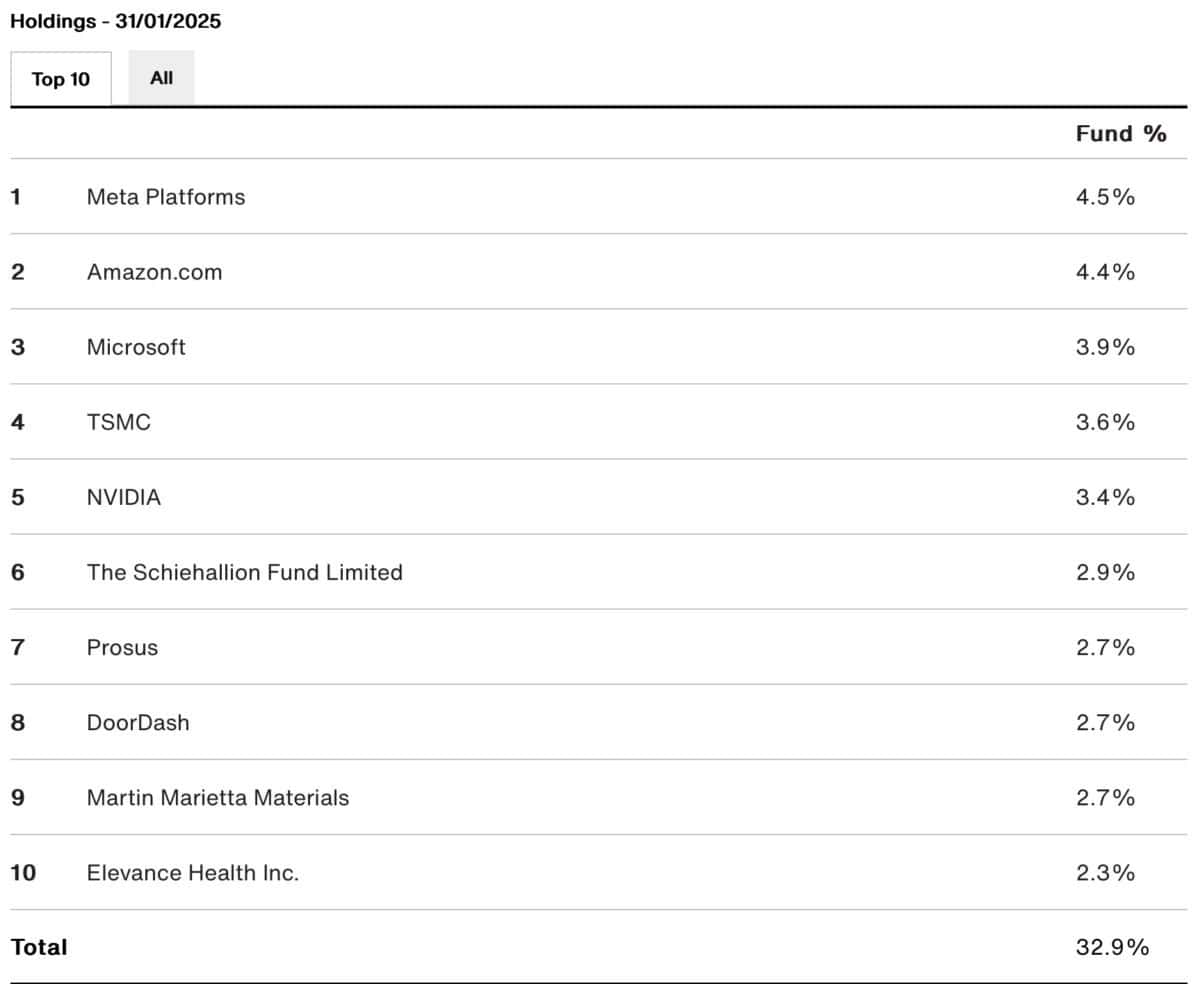

The trust’s portfolio is diversified across regions, including North America (62%), Europe (14.5%), and the UK (3.3%), and sectors such as technology, healthcare, and consumer goods. And with a low ongoing charge of 0.44% and no performance fees, it offers cost efficiency.

Over the past decade, Monks has delivered strong performance, with a 246.2% share price growth, reflecting its ability to weather market volatility while focusing on capital growth. This also reflects the strong performance of tech stocks over the period.

Understandably, some investors may be concerned about its weighting towards big tech, which has underperformed over the past month and has plenty of company-specific risk. Yet the trust’s portfolio is balanced, offering a low-maintenance option with a proven track record.