Greggs shares (LSE: GRG) have been a major let-down lately. In fact, investing in them has been like ordering a hot steak bake, only to bite in and realise it’s stone cold in the middle.

In other words, Greggs is not quite the hot growth stock expected, but merely a dividend stock.

So far in 2025, shares of the FTSE 250 bakery chain have dropped 35%. This means anyone who invested £15,000 in them back then would now have £9,750 on paper.

Thankfully, I didn’t have that much in Greggs. Yet I was still down 12% when I sold the stock last week (including dividends).

Here are five reasons I pulled the ripcord to get out.

Easing growth

In 2023, like-for-like (LFL) sales growth in Greggs’ company-managed shops jumped 13.7%. Last year, that eased to 5.5% versus the 6.3% that was expected. It was 2.5% in the Christmas quarter.

Then in the first nine weeks of 2025, LFL sales were up just 1.7%. Management blamed “challenging weather conditions” in January. To be fair, we did have Storm Éowyn, which shut 250 Greggs shops in Scotland and Northern Ireland.

The firm also said there was “improved trading” in February. However, this year is expected to be a slog. CEO Roisin Currie warned: “Looking ahead to 2025, the macroeconomic landscape remains tough. Inflation remains elevated, and many of our customers continue to worry about the cost of living.”

Gloomy economic outlook

This brings me to my second reason for selling: the UK economy.

Greggs has recently flirted with the idea of international expansion, and I think franchised locations would do well in British holiday hotspots like Spain. Of course, it would have to adapt the menu, but Greggs has proven to be a master of that in the past.

For now though, there’s just the UK. And according to Chancellor Rachel Reeves, the global tariff war will hit the UK: “We will be affected by slowing global trade, by a slower GDP growth, and by higher inflation than otherwise would be the case.”

Higher costs

Following the last UK budget, which increased employment costs, Greggs expects 6% cost inflation this year.

To mitigate this, it has implemented price increases and cost efficiencies. But it’s uncertain how much further these can be stretched to maintain profits. If Greggs keeps putting prices up, I fear it could lose its value reputation among consumers.

High street Armageddon

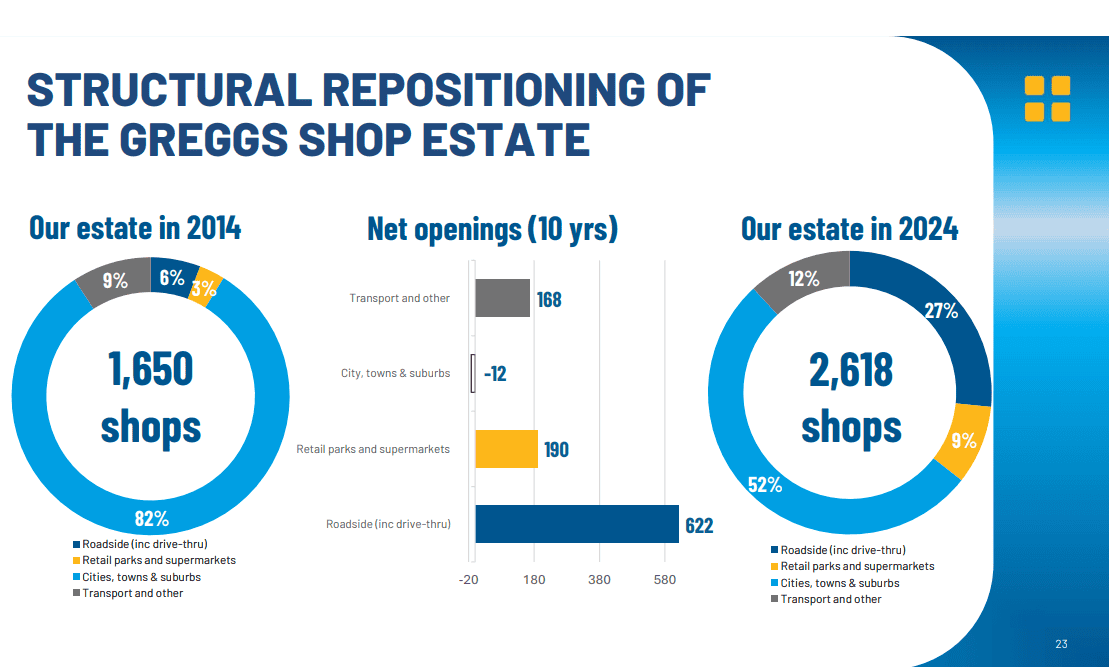

Next, due to high business rates and e-commerce, the UK high street is in terminal decline. And while Greggs is doing a splendid job of diversifying its shop estate and increasing digital channels, it still has over half its locations (52%) in cities, towns, and suburbs.

I fear that falling footfall on high streets could undermine decent growth elsewhere. Of course, this issue and the economic conditions are out of the company’s hands.

GLP-1 threat

Finally, we have a risk that isn’t yet part of the story but could be in future. That is the unstoppable rise of GLP-1 weight-loss drugs.

These treatments reduce cravings for the sugary and high-carb treats that Greggs is famous for. As of 2022/23, 64% of adults in England were classified as overweight or obese. So the potential market for these treatments is significant.