The time to buy shares is when they trade at discount prices. And with US tariffs shaking stocks on both sides of the Atlantic, I think there are some nice-looking opportunities for investors at the moment.

I’ve got an eye on two stocks in particular. The underlying businesses are very different but they have one important thing in common – the shares look like good value to me.

WH Smith

I thought I’d missed my chance on WH Smith (LSE:SMWH). I was looking at the stock with interest at the start of the year, but the share price jumped 14% at the end of January.

Since then though, the shares have fallen back and I’ve seized the opportunity to add the stock to my portfolio at what I think is a bargain price.

The thing with WH Smith is it’s actually two businesses – a high street division and a travel division. The first isn’t particularly attractive, but the second is.

WH Smith has announced plans to focus on its travel business. This is risky, as it’s much more vulnerable to a recession weighing on discretionary spending – like holidays.

But I think the decision is the right one. The travel ops generated £189m in profits last year and could alone be worth the current £1.4bn market cap.

If I’m right, investors might well have a margin of safety built into the current share price. And anything the company can get for its high street stores is a nice bonus.

Celebrus

Celebrus Technologies (LSE:CLBS) is much less of a household name. And it’s a very different type of investment – this one is about consistent growth going forward.

The stock is actually higher than it was at the start of February. But zoom out a bit and the share price is down 18% since the start of the year, so it’s trading at a discount to that level.

Celebrus is a software firm with a product that allows businesses to see what customers are doing on their website or app in real-time. And it has been growing very impressively.

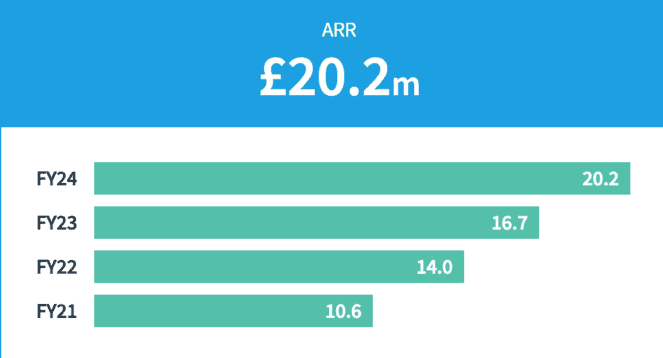

Source: Celebrus

The company operates on a subscription model and since 2021, annualised recurring revenues have been increasing by at least 20% per year. I think that’s impressive, but there are risks.

Celebrus has some significant competition and it gives away a lot in terms of size against some of its rivals. That’s something investors should keep in mind.

I think, however, this is reflected in a price-to-sales (P/S) ratio of below 3. Compared to CoStar Group (11), Guidewire Software (16), or Tyler Technologies (13), the multiple is incredibly low.

Same… but different

Both WH Smith and Celebrus shares trade at a price-to-earnings (P/E) ratio of 23. But that’s where the similarities end, from my perspective.

WH Smith is a well-known business, but I think there’s more to the stock than meets the eye. And Celebrus doesn’t get much attention, but I’ve been buying it for my portfolio.

Noise from the US and its tariff threats have created uncertainty in the stock market. As a result, I think this is a great time to be looking for potential opportunities.