A £10,000 investment in Greggs (LSE:GRG) shares a decade ago would now be worth around £25,773, based on the stock’s rise from 821p in February 2015 to 2,116p today. This translates to a 157% capital gain over 10 years, excluding dividends, which would add roughly £1,500–£2,000 to the total return.

While this long-term growth appears impressive, recent performance tells a more nuanced story.

The Greggs recipe for success

Greggs’ 10-year rally was fueled by strategic expansion and product diversification. The bakery chain added nearly 1,000 stores to over 2,500 locations, capitalising on demand for affordable, on-the-go food.

Innovations like vegan sausage rolls, extended evening hours, and partnerships with delivery platforms broadened its appeal beyond traditional lunchtime trade.

By 2024, Greggs achieved £2bn in annual sales, supported by operational efficiencies such as its new national distribution centre in Kettering.

Financial metrics underscore this growth. Annualised revenue increased by nearly 150% over the decade, while net profit margins improved over the period excluding a pandemic-era dip. Return on equity surged to 28.2%, reflecting stronger capital allocation.

Cracks in the pastry

However, momentum’s stalled recently. Shares have fallen 32% since August 2024 after the company warned of slowing sales growth, settling at a five-year return of -13%. CEO Roisin Currie attributed this to subdued consumer confidence, with Q4 2024 like-for-like sales growth decelerating to 2.5%.

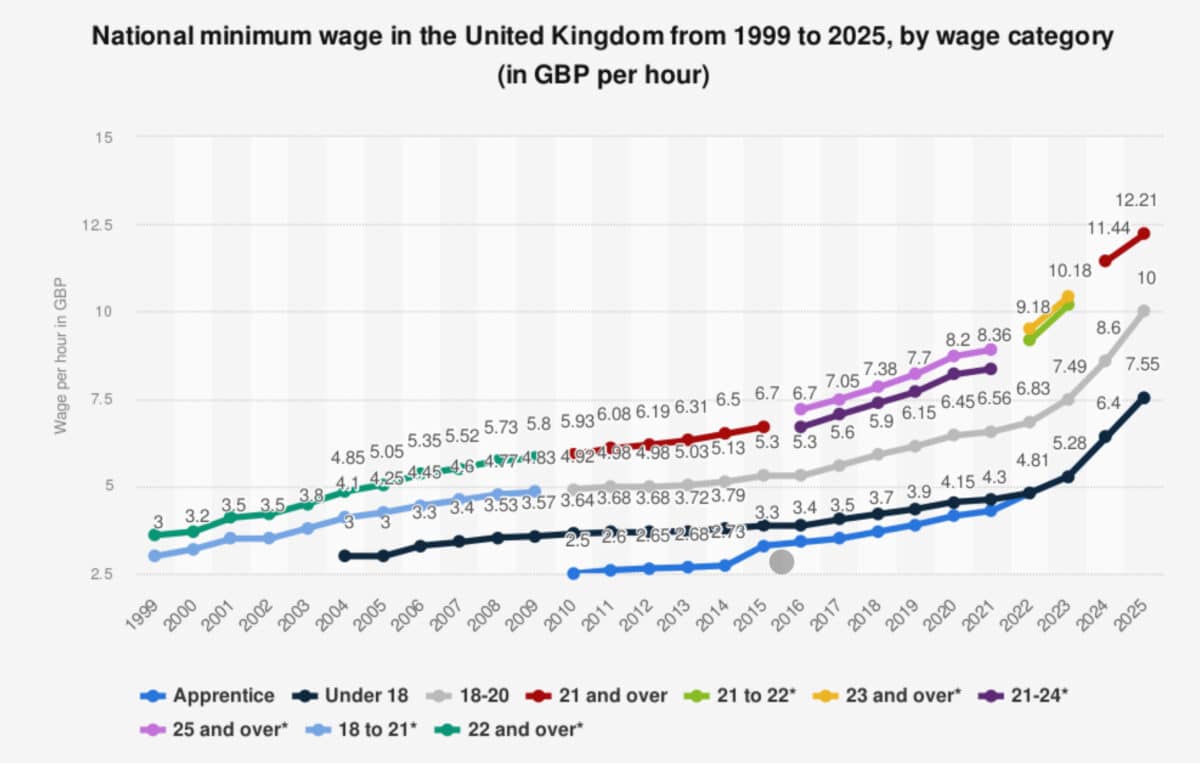

Rising costs — particularly the National Living Wage increase to £12.50 per hour — are like to add pressure to margins, despite Greggs’ efforts to maintain “value leadership” through price stability. Coupled with rising National Insurance contributions and high energy costs, management has its work cut out to maintain the level of growth that investors expect.

Moreover, while the company excelled during austerity and pandemic-era trading down, it now faces saturation risks in its UK-focused model and intensifying competition from supermarkets’ meal deals. What’s more, in the long run consumers should be trading up to healthier alternatives.

Institutional analysts remain divided: 10 rate the stock a Buy, citing its resilient brand and expansion potential, while two recommend selling due to valuation concerns.

Personally, I’m in the second camp. At 15.9 times forward earnings, the stock trades at a premium to the FTSE 250 average. With medium-term earnings growth projected at 7%, the price-to-earnings-to-growth (PEG) ratio stands around 2.2 — that’s well above the threshold of ‘1’ typically associated with undervalued stocks. Dividend-adjusted metrics suggest shares could be overvalued by up to 55%.

The bottom line

Greggs’ decade-long returns demonstrate the power of consistent execution in defensive sectors. Yet the stock’s current valuation appears to bake in overly optimistic assumptions about growth reaccelerating.

Is it one to consider? Maybe, but I believe the stock’s overvalued and I don’t have much faith for this part of the market. I believe investors might find better exposure to British consumer discretionary stocks elsewhere.