Over the past year, National Grid (LSE: NG) has moved up 2% on the London stock exchange. The National Grid share price is within 6% of where it stood five years ago.

Things could be worse. At least the share price has moved in the right direction.

For some investors, the share price may be irrelevant. National Grid is popular for its dividend. Its position in the utility industry is perceived to provide stable cash flows that can help a dividend the firm aims to grow in line with inflation.

As an investor though, ought I to take that approach and consider just the dividends?

Why a share price matters

if I invest money in a share and the price falls, I do not lose anything – unless I sell. At that point, a paper loss crystallises into an actual one.

So even if I bought National Grid shares today and the price fell (it is down 13% since May 2022, for example) I would only lose money if I sold at that price.

However, most investors sooner or later will consider selling shares. Even long-term shareholders may change their financial objectives or view of a company, for example.

So a falling share price can be a concern if it looks unlikely to recover. Tying money up for years in shares that have a paper loss can also bring an opportunity cost as those funds cannot be used for other things.

How secure is the dividend?

So I would certainly pay attention to the National Grid share price even if I expected the dividends to keep coming.

But utilities are not as secure as some shareholders believe when it comes to maintaining their dividends, let alone growing them regularly.

Want an example? Look at SSE. Last year’s dividend was 60p per share. Back in 2020, it was 80p. In 2015, it was 88.4p. So much for utilities being reliable long-term dividend payers. No dividend is ever guaranteed.

Increasingly alarming debt levels

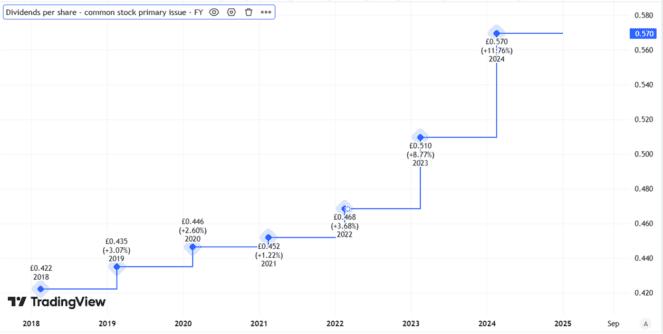

In fairness, National Grid has a good track record when it comes to annual dividend growth.

Created using TradingView

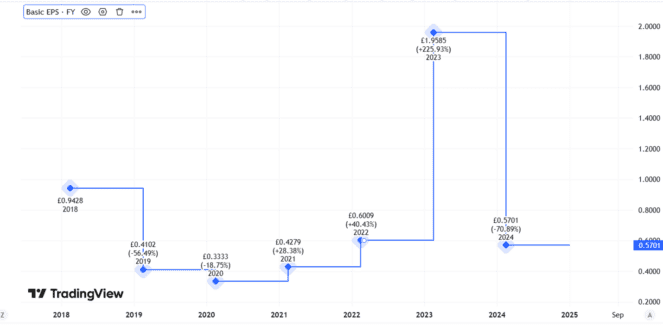

But look at the firm’s basic earnings per share.

Created using TradingView

They move around a lot – and do not always cover the dividend.

Owning and maintaining an energy network is costly business, especially now at a time when energy is being generated and where it is being consumed are in flux compared to historical norms.

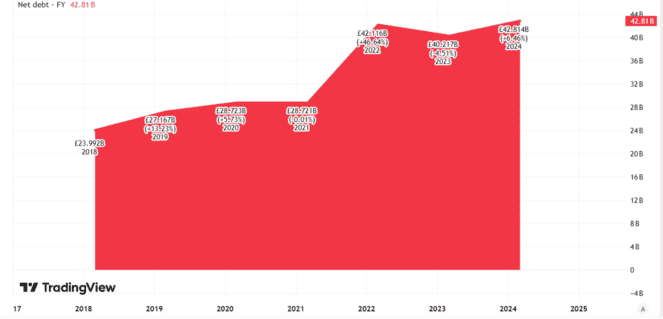

That means National Grid has to spend a lot to keep its business running. So its net debt has grown over time.

Created using TradingView

Last year saw a rights issue designed to help boost funds available for items including capital expenditure. That diluted shareholders.

I see a risk of a similar move in future if National Grid wants to deliver on its goal of keeping the dividend growing annually in line with inflation. An alternative, at some point, is for the company to reduce the payout like SSE has repeatedly done. If that happened, it could send the share price tumbling.

So although its unique network assets can help generate sizeable cash flows, I have no plans to add National Grid shares to my portfolio.